Looking back on 2019: what does 2019 hold for China's pork import market?

Next in the rundown of top stories this year: assessing the resilience of China's pork industry and predicting import trends for 2019.Part of Series:

< Previous Article in Series Next Article in Series >

The year 2019 has been regarded by many as the Year of the Pig - both in reference to the zodiac animal, and to the tumultuous period of change that the global pig industry has faced.

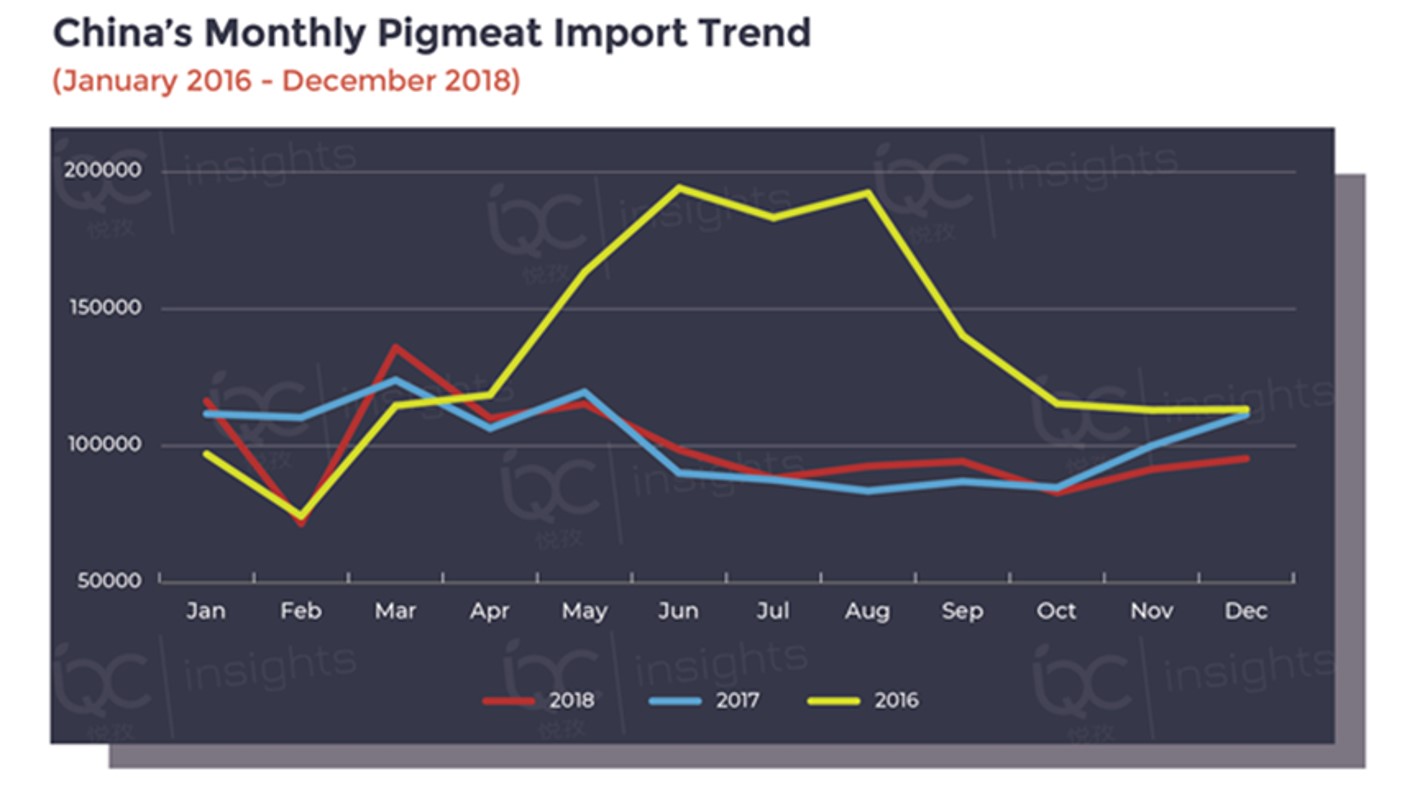

Back in March, Angela Zhang, IQC Insights, provided her assessment of the pork market situation in China based on 2018 figures. She took a deep dive into China's imports in 2018 and investigated the impacts of African swine fever on the current and future markets, following with her predictions for the rest of 2019.

Despite the immediate impacts of African swine fever in China, many domestic players and overseas suppliers in the pork industry were optimistic about the future market and predicted gradual price increases. But what actually happened this year?

© IQC Insights

Reviewing her predictions, Angela confirmed that pork prices did indeed increase in 2019 in her last pork market update. The domestic live pig price sharply rose by 25.1 percent to CNY 26.4 per kilo on a month-on-month comparison, and 67.2 percent year-on-year by the end of August 2019, breaking the price record in China over the past 20 years. In contrast, China’s live-pig inventory has fallen to historic lows.

Access the full article, What does 2019 hold for China's pork market?