One year on from the first ASF outbreak, where is China's pork industry heading?

On 3 August 2018, the first case of African swine fever (ASF) was detected in Liaoning Province of north-eastern China. Over the past year, it has spread rapidly nationwide and up to the end of August 2019 a total of 156 separate outbreaks have been confirmed, covering 107 cities across 31 provinces. In other words, all provinces in mainland China, together with Hong Kong, have now reported instances of the virus.Part of Series:

< Previous Article in Series Next Article in Series >

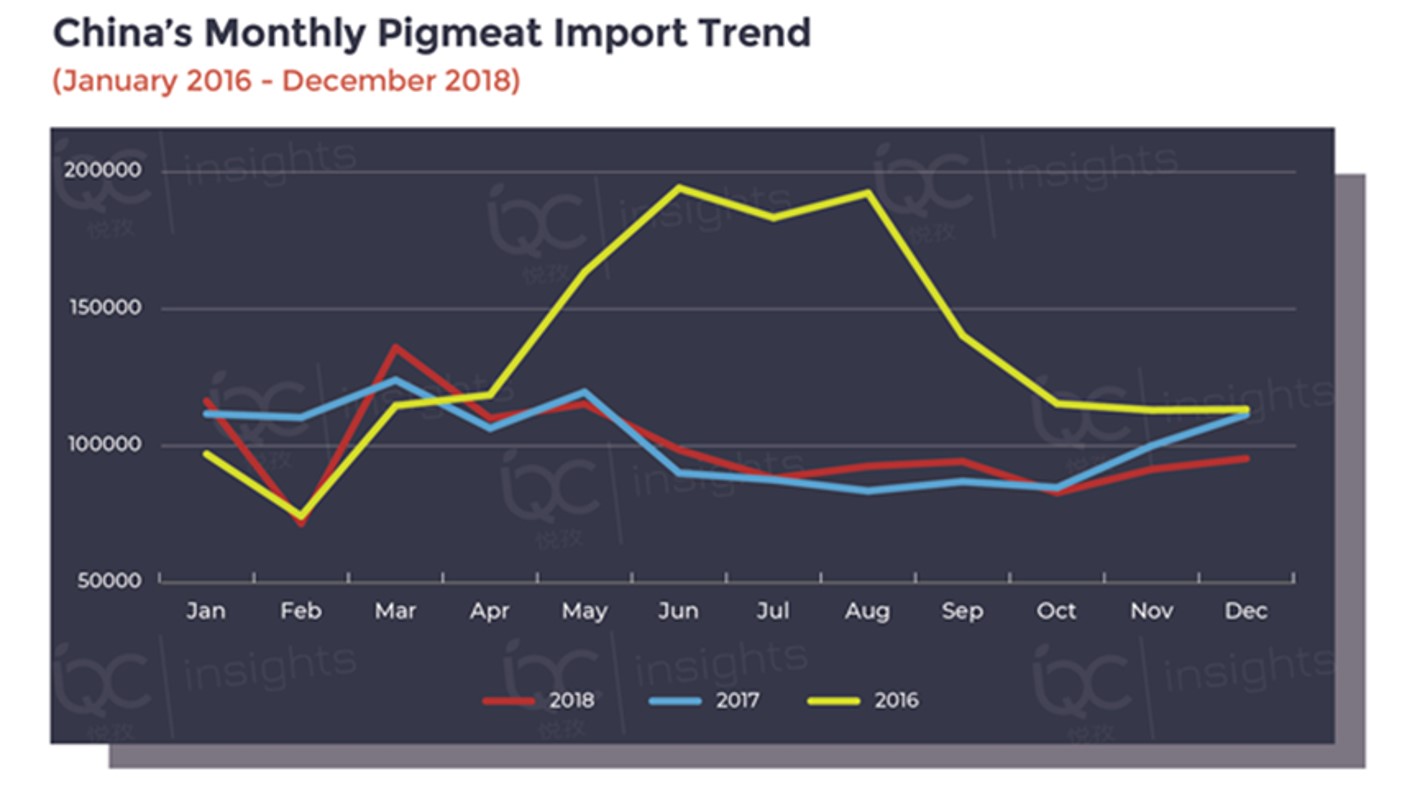

As predicted in a previous report (see “What does 2019 hold for China’s pork import market”, published on 15 March 2019), the domestic pork price has shown an upward tendency in the past few months.

China’s slumping hog inventories vs soaring pork prices

The domestic live pig price sharply rose by 25.1 percent to CNY 26.4 per kilo on a month-on-month comparison, and 67.2 percent year-on-year by the end of August 2019, breaking the price record in China over the past 20 years. In contrast, China’s live-pig inventory has fallen to fresh historic lows since 2000. Its accumulated decrease rate has reached 33.9 percent in the first seven months of 2019.

© IQC Insights

In China, July and August are traditionally an off-season period for meat consumption, but this year is obviously an exception. The booming pork price has been mainly driven by the slumping live-pig inventory, instead of the domestic consumption demand for pork, which is currently still weak. For this July alone, China’s live-pig inventory declined by 9.4 percent month-on-month and 32.2 percent year-on-year, leading to a severe imbalance of pork supply and demand.

However, when examining what’s causing the short pork supply, the outbreak and fast spread of ASF in China are not the only culprits. Due to the strict implementation of new environmental protection law across China since 2015, many small pig-breeding farms that fell below the standards were closed, and – more importantly – large-scale farms were also prompted to move from the south to the north, and from the east to the west. After ASF broke out nationwide, these trends were compounded by the subsequent ban on transporting live pigs between infected and non-infected provinces – as a result, the liquidation in pork-production areas was accelerated and the imbalanced supply-demand situation has worsened.

To fill the large gap for domestic pork supply, there are two major channels: one is imported pork; the other is alternative meat, such as chicken, duck, beef, mutton and even plant-based meat substitutes.

Growing imported pork vs diversified alternative meat categories

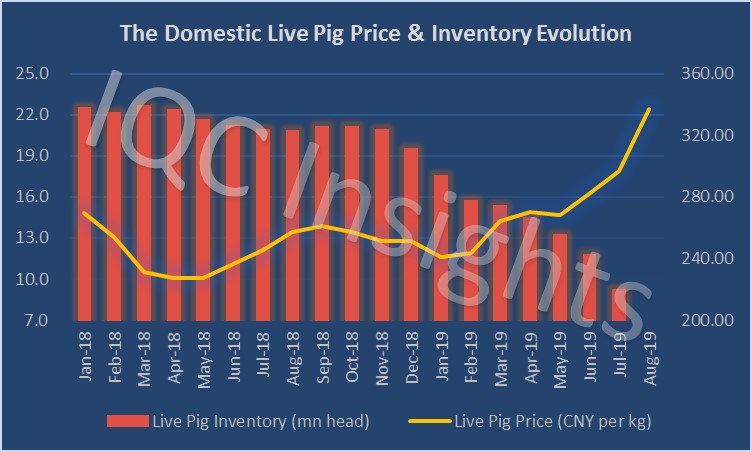

China’s total pigmeat and offal import volume reached 1,000,930 and 589,997 tonnes in the first seven months of this year, representing an increase of 36 percent in pigmeat year-on-year, but a decreasing of 0.5 percent in offal. For July 2019 alone, which was mostly influenced by the soaring domestic pork price from May onwards, the import volume jumped by 106.7 percent to 182,227 tonnes for pigmeat, and by 37.8 percent to 97,375 tonnes for offal.

As shown in the chart below, the monthly pork import volume has risen to an even higher level than 2016, a bullish year for pork, for most of 2019 so far, and such a positive trend is expected to continue in the forthcoming months.

© IQC Insights

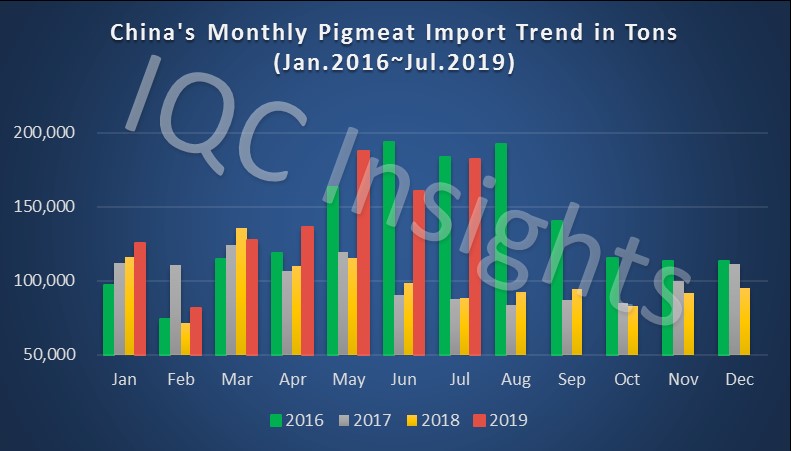

However, when comparing pork with the import volume of other major meat categories, we find that beef and chicken have performed much better than pork in China’s meat import market. This is particularly the case with beef, whose total import volume reached 865,991 tonnes with a year-on-year growth rate of 56.5 percent – nearly triple that of pork.

In addition, as announced by China’s Ministry of Commerce, due to the boom in imports of Australian beef in 2019, the quota for Australian beef – as stipulated by the China-Australia Free Trade Agreement of 2015 – was automatically triggered in mid-August. Consequently, tariffs on eight categories of Australian imported beef resumed, set to the “most-favoured nation” rates, from 17 August until the end of 2019. Nevertheless, considering the upcoming cold weather and peak season for meat consumption from September onwards, the negative impacts of such tariff change would be quite limited.

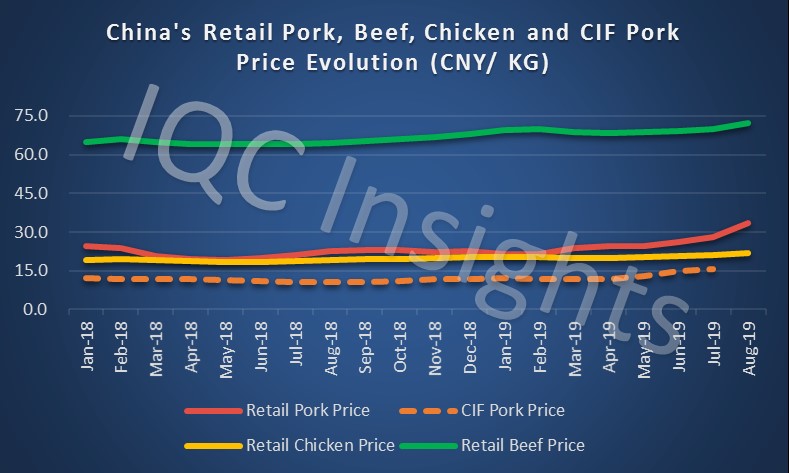

The strong ascending trend for beef and chicken imports can be mainly attributed to the equally bullish domestic prices in recent several months. Compared with those of last August, China’s retail chicken price has grown by 15.8 percent to CNY 22.0 per kilo, and the retail beef price also increased by 12.1 percent to CNY 72.2 per kilo by the end of August.

In assessing the impacts of soaring domestic pork prices on other meat categories, one important point to note is that it generally takes some time for the price transmission to appear among pork, beef and chicken. Therefore, it can be expected that the price increases in chicken and beef will intensify in the remaining months of this year.

© IQC Insights

Meanwhile, the soaring domestic pork price is also pushing up import prices. The pork import market experienced two peak periods in 2019: one in mid-April, the other in August.

The average CIF pork price has increased by 31.6 percent since February (2019) (after China’s Spring Festival). Heads with ears and without tongues, bellies bone-in rind on outshone other products in the pig meat and offal categories, increasing in demand by over 60 percent between February and August 2019. The pork belly is high in demand, its spot price reaching CNY 38,500 per tonne in August, surpassing the peak price of CNY30,000 per tonne in the last bullish year of 2016. The major reason for this increase is that the domestic end market prefers fresh/chilled pork; imported frozen bellies can replace fresh cuts and can be sold to local supermarkets more easily than other pork products.

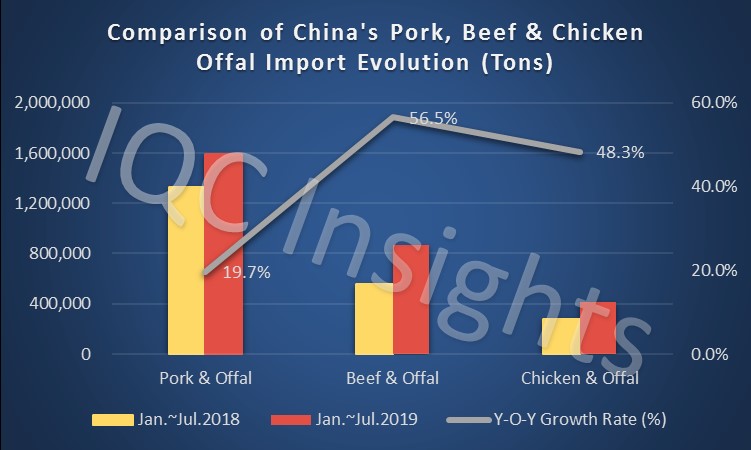

The CPI pushed up by the pork price vs constant stream of new policies

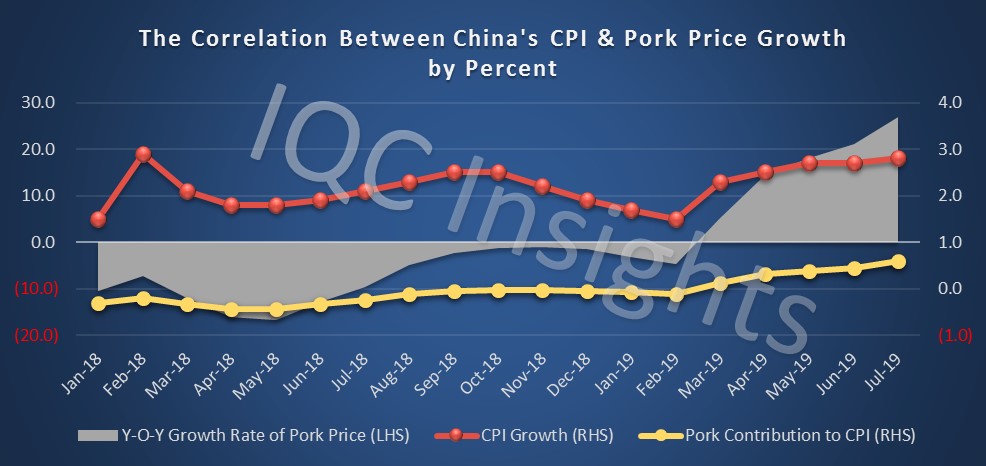

China’s consumer price index (CPI) is sometimes jokingly called the “china pork index”, which helps illustrate the importance of pork in the daily life of Chinese consumers. According to the latest data from China’s National Bureau of Statistics, China’s consumer inflation increased by 2.8 percent in July 2019 compared to the same month in 2018. The increase in July was also up 2.7 percent compared to June 2019. Meanwhile, the domestic pork price jumped by 27 percent year-on-year, and contributed to 0.59 percent of the CPI growth.

As shown in the following chart, the correlation between China’s CPI and changes in the price of pork was weak throughout all of 2018 – especially in April 2018, when it was at -0.43 percent. However, after the outbreak of African swine fever and large-scale destocking of hogs, the tight supply of domestic pork has not only stimulated the rapid pork-price increase, but has also intensified its contribution to the CPI growth, especially from March 2019 onwards.

© IQC Insights

To stabilise the pork price and curb domestic inflation, various government departments have published policies and regulations to ensure an abundant pork supply and stable price. These policies are as follows:

The Ministry of Agriculture and Rural Affairs and the Ministry of Finance

These two departments jointly issued a notice on 4 September 2019 that the central government would provide more subsidies and loans as well as sums insured to help the pig-breeding industry to recover.

The Ministry of Commerce

Its spokesman stated on 29 August that it would closely monitor pork-market developments, and if necessary the government would release emergency pork reserves to increase the pork supply. In addition, the government may continue to encourage the increase of pork imports.

The State Council

The State Council issued five countermeasures to stabilise China’s pork production on 21 August: the more timely dispensing of subsidies to farms to help pork production to recover; the lifting of strict bans and limits on hog breeding; developing and supporting large-scale pig raising; enhancing the capabilities of animal disease prevention and control; ensuring stable pork supply and increasing local pork reserves.

Ministry of Transport

A notice was issued on 2 September that it would resume the “Green Channel ”policy to facilitate the transport of piglets and fresh chilled pork. Furthermore, it regulates that, between 1 September 2019 and 30 June 2020, tolls will be waived for vehicles transporting sows and frozen pork.

In the short term, the release of pork reserves and resumption of “Green Channel” policy could help to stabilise the pork supply and mitigate the unbalanced supply-demand situation among different provinces. In the long term, the financial support (subsidies and loans) from the government, and other measures, could relieve the cash-flow stress on domestic farms.

© IQC Insights

Forecast

There is no doubt that the domestic pork production is likely to sharply decline this year. The domestic sow and live-hog inventories have decreased by 31.9 percent and 32.2 percent by the end of July 2019 compared with a year ago. Since the live-hog inventory reflects the current pork supply level while the sow inventory indicates the future supply 6 to 11 months later, it can be predicted that the national pork supply could be reduced by 20 to 30 percent from H2 2019 to H1 2020.

However, this does not simply indicate that the domestic supply-demand gap would be around 10 million or even 15 million tonnes in the forthcoming months. One major reason is that the domestic demand for pork consumption is also falling quickly. Local consumers are eating less pork, partly because of the negative impacts of African swine fever. But more importantly, the unprecedented high price is also discouraging them to purchase pork. The increased beef and chicken prices verify that more and more consumers are replacing pork with other meat. Furthermore, as one of the alternative meat categories with prices closer to pork, the breeding cycle for chicken is only 30 to 40 days – much shorter than the 10 months of pork. Therefore, considering the greatly reduced demand for pork consumption, in real terms the supply-demand gap might not be so large. Although the pork price is expected to continue to follow the upward trend, we can be confident that it will find its ceiling, especially when the countermeasures from the government are taken into account.