CME: USDA Significantly Increases 2017 Pork Production Outlook

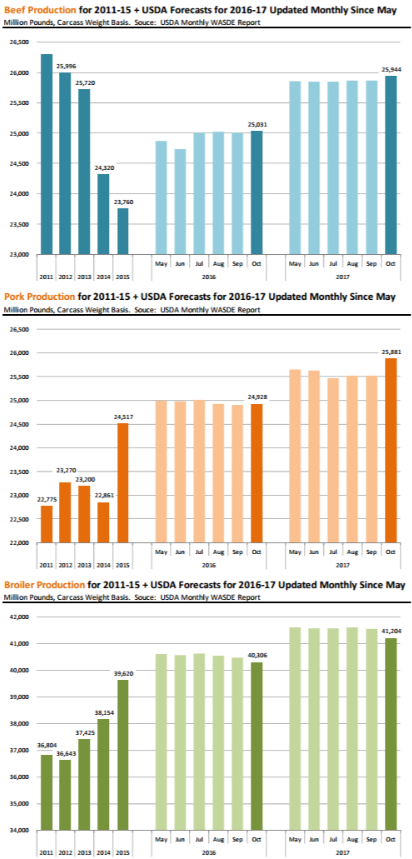

US - The monthly USDA WASDE report provides an opportunity to regularly step back and take stock of the supply situation not just next week but many months down the road. Often market participants get caught up in the day to day market movements, daily slaughter schedules and price reports and lose sight of the bigger picture, write Steve Meyer and Len Steiner.The monthly USDA WASDE report once a month offers the opportunity to review the broader context for key agricultural commodities. The charts below are meant to illustrate the dramatic expansion in US meat supplies and expectations for further increases in 2017.

Consider that for the three year period 2011‐2013 US beef, pork and chicken production averaged around 86 billion pounds. Supplies were fairly stable and producers put a lid on expansion due to a combination of adverse weather events and high feed costs. Production declined in 2014, mostly because beef production dropped an astounding 1.4 billion pounds (‐5.4 per cent) and pork production declined 400 million pounds (1.5 per cent). More chicken helped alleviate some of the protein shortage but overall production of the three main species at 85.335 billion pounds was down around a billion pounds from the previous year. Fast forward to 2016 and the turnaround in production has been quite astounding.

USDA reported that 2016 beef production is now forecast at 25.031 billion pounds, 1.271 billion pounds larger than it was a year ago. By next year, beef production is expected to reach 25.944 billion pounds, up another 913 million from 2016 levels and 2.2 billion pounds higher than 2015.

Fed cattle prices have reacted quite violently to the increase in supplies. Futures peaked at around $170/cwt in late 2014 but today are priced about $70 under that level. Keep in mind, however, that fed cattle futures gained around $50/cwt between June 2013 and October 2014 as markets sought to both ration out available supplies and provide a strong enough incentive for producers to rapidly bring more product to market. The challenge of course is that as beef supplies increase prices at retail tend to be sticky and, in the short term, cattle and wholesale values may decline even more than long run price/supply models indicate.

In the case of pork and chicken we see a similar trend towards larger supplies coming to market.

USDA currently forecasts 2016 pork production at 24.9 billion pounds, about 400 million pounds more than a year ago (+1.7 per cent) but almost 2 billion pounds more (+8.3 per cent) than what was available on average during 2011‐14. USDA also reacted to the latest Hogs and Pigs report by significantly increasing pork production outlook for 2017.

Current forecast calls for 2017 pork output at 25.881 billion pounds, 953 million pounds (+3.8 per cent) more than in 2016 and 2.8 billion pounds (+12.4 per cent) more than what we saw on average during 2011‐14. The point is that while current prices may appear quite low compared to what we saw a couple of years ago, one needs to consider how dramatic the increase in total production has been and will be in the next 12 months.

Chicken production for instance averaged around 37 billion pounds during 2011‐13 as high corn prices forced producers to cut back. Supplies then started to slowly increase in 2014 and 2015. Next year USDA pegs US broiler production at 41.2 billion pounds, about 4.3 billion pounds (+11.5 per cent) more than 2011‐13 levels. We have said it before and continue to repeat: exports are a key factor for prices going forward. We absolutely need other markets to absorb some of this increase in supply.

Domestic channels are well saturated and the structural changes that happened during short years will take time to resolve.