US hog farmers rebound from 2023 losses - AFBF

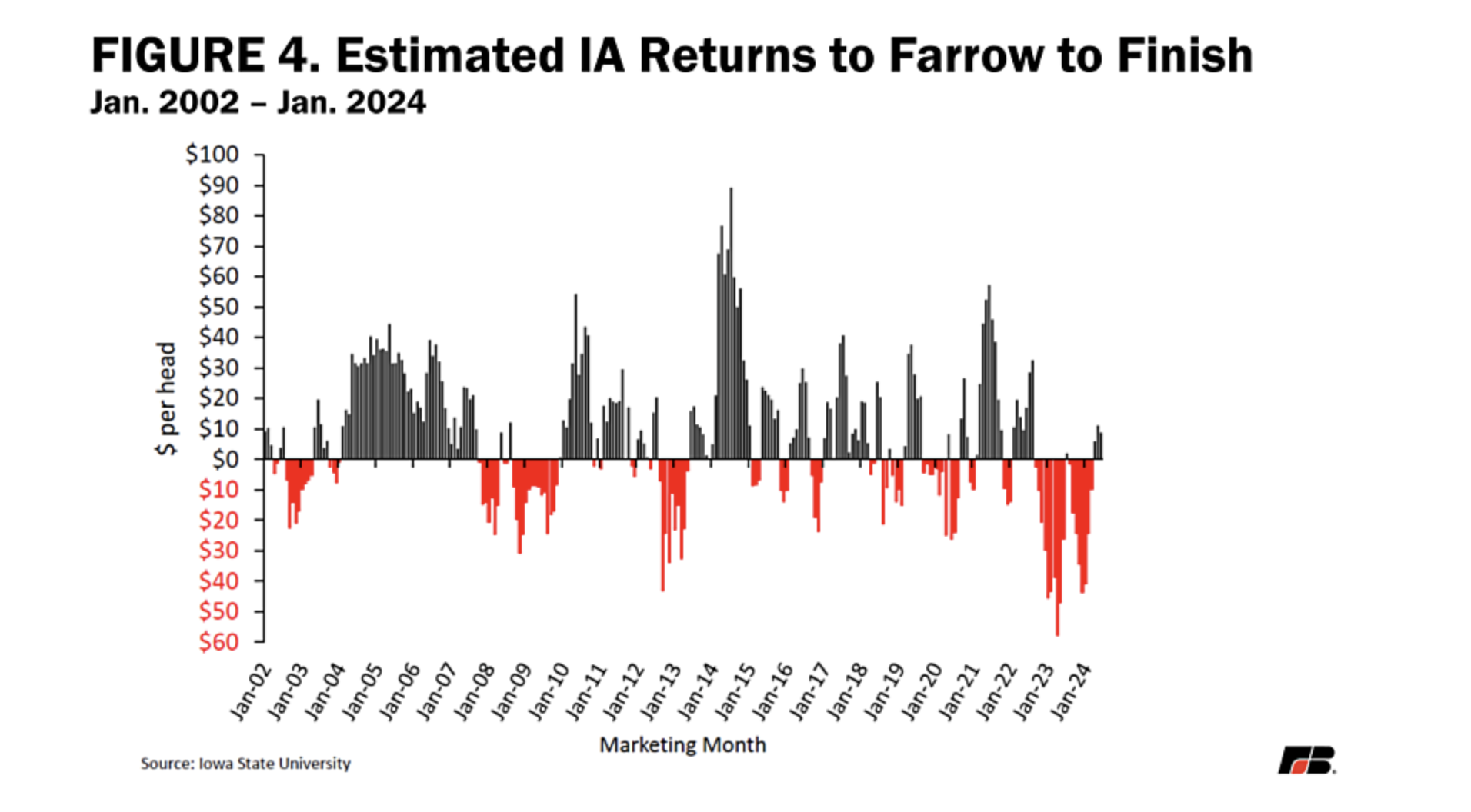

Farrow to finish returns expected to climb 133% over last yearUS hog farmers faced devastating average losses of about $31 per head in 2023, according to a recent market report from Bernt Nelson at the American Farm Bureau Federation.

Elevated input costs, particularly from feeds and inflated fixed costs, were responsible for losses. Iowa State University’s June 2024 estimate for returns to farrow to finish operations shows a profit of $8.82 per hog, up 133% from -$26.18 in the same time period in 2023.

The majority of this difference comes from the 25%, or $31 per head, drop in the cost of feed from June 2023. Despite the much-needed boost from lower feed costs, the cost of fixed inputs such as fuel and utilities remain elevated from inflation. This will continue to be an obstacle to profitability while pork struggles to find demand.

In its July World Agricultural Supply and Demand Estimates report, USDA estimates the annual US per capita demand for pork is 51 pounds per person. This is up 0.4 pounds per person from June projections and up 0.8 pounds from last year’s per capita demand.

While current domestic demand is just not enough to bump prices up, export demand has been extremely supportive for hogs. As of July 18, total pork export sales were 967.2 thousand metric tons, up 6.7% from 2023. Mexico has been an essential trade partner, purchasing 369.1 thousand metric tons year to date, up just slightly from last year but 278% higher than the second-largest importer of US pork, Japan.

Hog slaughter for the week ending July 26 was 2.44 million head, the highest weekly slaughter since April. This means there is more product available in the short run as products like hams hit their highest prices of the year. Since Mexico has been such a big player in the US ham market, these higher prices may slow export demand from Mexico, ultimately putting downward pressure on prices, especially in the short run.

The latest CME lean hog index has been in an upward trend since early July. The index was $91.85/cwt on July 29, while the national average cash price picked up $1.94, bringing the price to $84.07/cwt. Currently daily slaughter numbers are elevated. Slaughter hog supplies are expected to grow as we move closer to fall and winter months, which may lead to falling cash prices.