UK pork imports rise, exports decline - AHDB

Growth and decline not reflected across all product categoriesBetween January and April of this year, the UK produced 306,400 tonnes of pig meat, according to Defra data. Despite lower slaughter throughputs in 2024, higher average carcase weights have resulted in production volumes growing 0.6% year on year, according to a recent market report from AHDB.

Global demand for pork appears to remain subdued with many economies still struggling with high inflation and consumers more wary around spending habits. Alongside this stands geopolitical uncertainly due to several imminent high-profile elections. Total pig meat exports (including offal) from the UK stood just short of 100,500 tonnes in the first four months of the year, a 3% decline compared to the same period last year. On the contrary, UK imports of pig meat (including offal) are up 3% year on year, despite weaker domestic consumption.

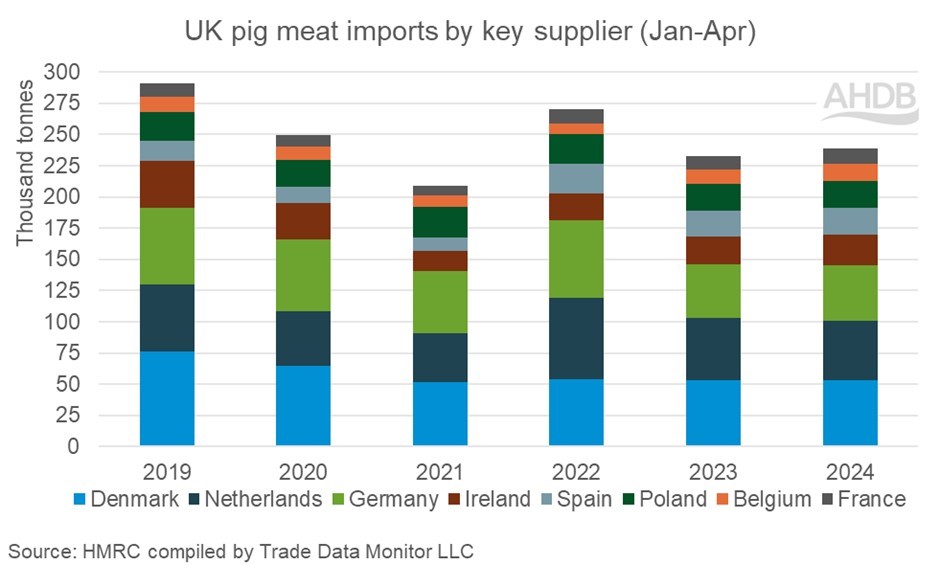

Imports

Although overall import volumes have increased to 251,500 tonnes so far this year, the growth has not been reflected across all product categories. Over 99% of UK imports are sourced from within the EU27. Fresh/frozen pork is the largest category, with 106,600 tonnes received from the EU27 for the year to date, up 4% on 2023. Denmark and Germany hold the largest market shares at 25% and 23%, respectively. Strong growth has also been recorded in sausage volume, up 7% on 2023, where Germany (28%) and Poland (18%) account for the largest shipments. Processed pig meat has seen volume decline since 2022, with Germany recording the largest loss in shipments. However, Poland and Ireland maintain their market share at 30% and 24%, respectively. Bacon imports have also been in decline for the last two years, but the largest shipments continue to be sourced from the Netherlands (57%) and Denmark (33%).

Exports

Similar to imports, the overall export volume change is not reflected in all product categories. The decline in UK pig meat exports is predominantly driven by a fall in shipments of fresh/frozen pork, although bacon volumes have also weakened year on year. The top four destinations for UK product remain the same year on year (EU27, China, Philippines and the USA), but an increase in shipped volume to South Africa has changed the fifth place, knocking South Korea down to sixth.