EU and Spanish Pork Markets November 2022

Genesus Global Market ReportAt the end of writing my last report on the market situation, one is left with the hope of being able, in the next one, to say that we can see the light at the end of the tunnel, but the truth is that it is not very clear. Let's go week by week.

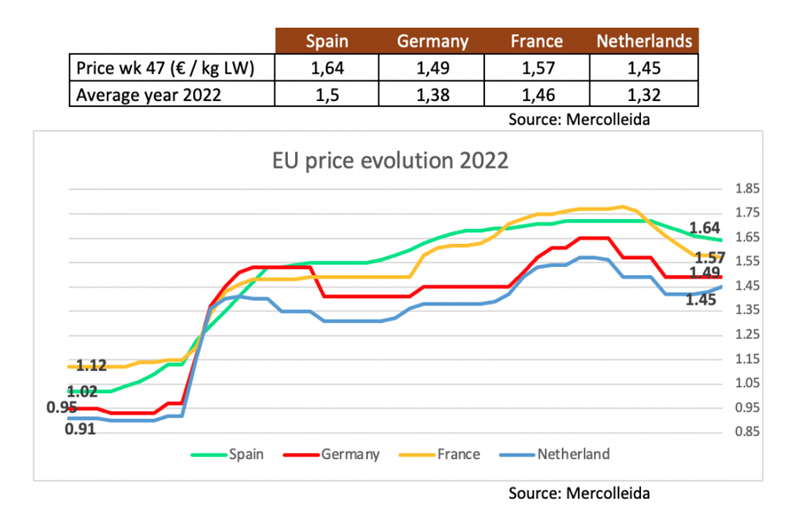

The price in Spain continues to have the highest value in the EU, 1.64 € /KPV with the highest annual average.

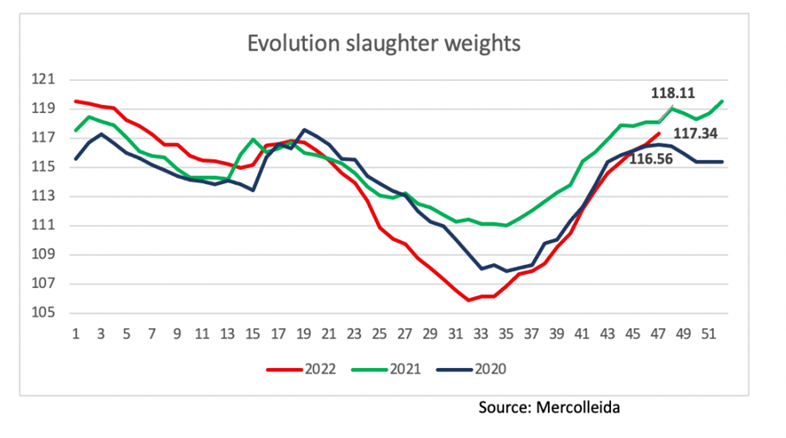

Weights have been increasing, although we are below a year ago, but we are still in a situation never seen before due to the long and hot summer, less supply of pigs due to sanitary issues and the high cost of raw materials.

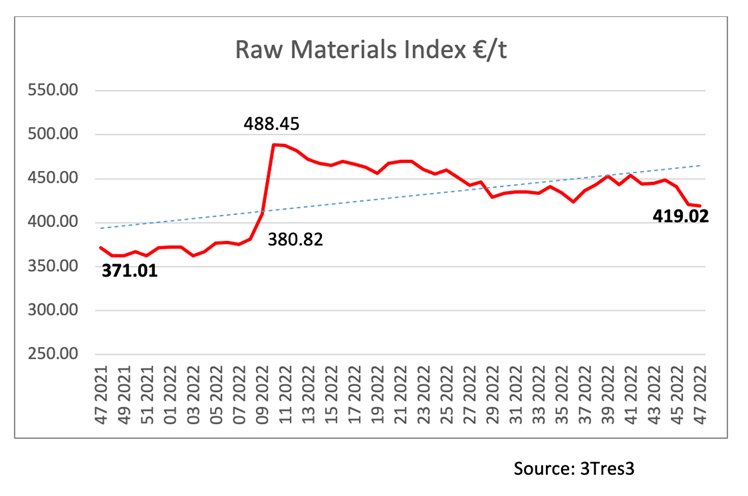

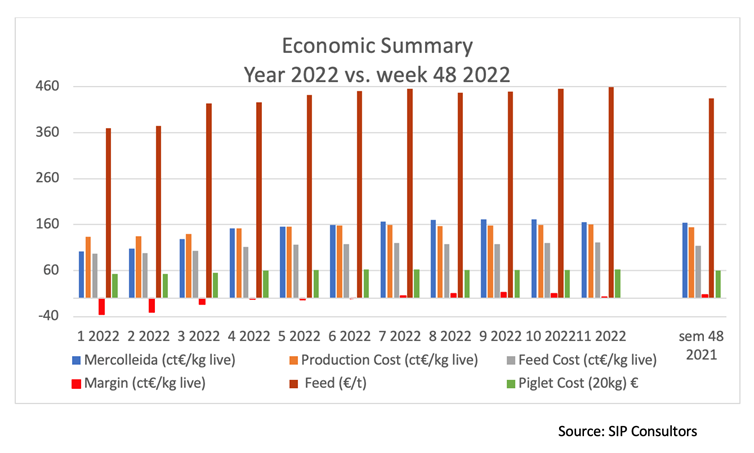

We still have very high production costs and although the selling price is still very high, we are not making a large profit, but we are not in the red.

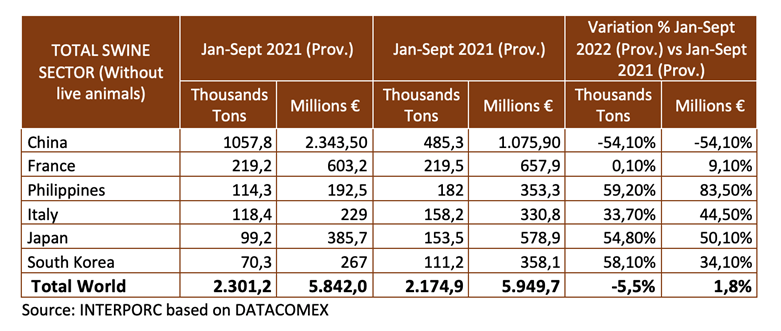

As for exports up to September (provisional data DATACOMEX) we can say that, although it has fallen in volume, it has risen in sales value. In the period January-September 2022, the Spanish pork sector exported to China 485.3 thousand tons compared to exports of 1,057.8 thousand tons in the same period of 2021, representing -54.1% in both volume and value. But the Spanish meat sector has been able to diversify by increasing exports in sales value and recover this decline in China, thanks to the Philippines, Japan and South Korea, which represented 12.3% in volume and 14.5% in value up to September 2021, becoming 20.5% in volume and 21.7% in the of the total value of exports in the of the same period of 2022.

Last week we had the opportunity to attend the XII AVPA (Association of Pig Veterinarians of Aragon) 2022 CONGRESS. It was very interesting, and of course, after the years we have spent with the pandemic, very nice to see how we are gradually getting together again in events like this.

But what I found most interesting is that there were a series of presentations on topics that are of great concern to the production sector right now, such as: "RESOLUTION OF INGUINAL HERNIAS IN SWINE", "CHANGES IN THE MANAGEMENT OF HYPERPROLIFIC SOWS: NOTHING IS THE SAME ANYMORE", "SOW DEATHS ", "FIELD EXPERIENCES WITHOUT ZINC", "QUALITY OF WELFARE AND WELL-BEING OF STAFF".

Topics such as these I believe help in that "change of glasses" that I talked about in my last report that the sector should be doing. We were able to hear about the cost of sow deaths ($1,000 per dead sow (cost of disposal, replacement and lost production), (https://www.swineweb.com/measuring-the-direct-and-indirect-costs-of-sow-mortality)); the importance of minimizing adoptions; the importance of piglet colostrum placement and the importance of the sow producing enough colostrum for her entire litter; staff motivation to move production forward; the challenge of pathologies in pigs and how to manage them,…

But what I found most interesting was the round table "THE GENETICS TO COME IN 2030: ARE WE PREPARED?" in which some genetics companies explained what they were doing or starting to do to face the current situation with its challenges. They talked about getting "robust" sows, meat quality, disease-resistant or transgenic pigs against PRRS, that they are not looking for more piglets born, but to reduce mortality; not to have more piglets than teats, uterine prolapses, sows resistant to stress, ...

After listening to all this, one reviews what we are doing in Genesus with an F1 sow that is able to get all her piglets forward because she has been selected among other things for her capacity of intake and milk production; that is able to farrow without the need of help her homogeneous litters and wean piglets at weights that help to resist the challenges (7 kg at 21 days with litters over 13 weaned piglets), that has been working for more than 20 years in meat quality at competitive costs, ... In the end, I conclude that GENESUS IS PREPARED AND WILL CONTINUE TO PREPARE FOR THE CHALLENGES TO COME IN 2030.