Alberta Pork Annual General Meeting

Jim Long Pork CommentaryLast week we were honored to be invited to speak at the Alberta Pork Annual General Meeting. Alberta Pork is the pork producer organization for the province. Our observations:

- The Annual General Meeting was well attended with 350 people present and well organized. Thank you to Darcy Fitzgerald, Executive Director of Alberta Pork, his staff, and the Alberta Pork board of directors for their excellent hospitality.

The province of Alberta is in the western part of Canada. The inventory of sows is 123,000 in 2022. About 40% of this production is done by Hutterite Colonies with a balance of independent – producer groups. This sow herd has been stable in numbers over the last few years.

In our opinion, some of the best producers in the world are in Alberta. We define this by the large number of producers pushing 30 pigs per sow with low wean to finish mortality. With many of Alberta’s producer customers of Genesus we see their production numbers are able to compare with other areas and countries we do business.

- Alberta like most of Canada exports approximately 70% of its pork production. This makes the world pork market dynamics a big factor in the industry.

- In the past year, China decreased pork imports. This has made other countries I.E. Japan, Korea, and the Philippines battleground for global pork exporting countries. This has led to a challenging situation for not only Alberta but all Canadian Pork Producing and Packers dependent on importing countries. In our opinion, the effects have been negative for all Canadian Packers with some losing significant money. Producers need strong packers to continually upgrade facilities and fund domestic and export markets.

- Alberta like most of the world has suffered from high feed costs driving up the cost of production. We observe 2022 has been a good year for producers that grow their own grain. The whole farm income has been good with the business model, grow feed, manure on land, feed pigs, and own appreciating land. Many producers in Alberta have this scenario. In North America, we expect 80% of pig production is buying feed.

- Also last week Maple Leaf Foods – Lethbridge, Alberta plant had its annual producer meeting. The Lethbridge facility focuses on high-quality pork for premium export and domestic markets (Lethbridge Heritage brand). High-quality pork with the best eating attributes. Maple Leaf Foods Lethbridge is unique in an award program recognizing producers who deliver pigs that have quality. We believe it’s the only plant that does this in North America. As all readers of this commentary are aware we believe that our industry should produce better-tasting pork to grow demand. Genesus Genetics program is to do just that. The Lethbridge plant is supplied by a high percentage of Genesus – Jersey Red Duroc hogs. Obviously, we were pleased when the Quality awards were presented to the top 3 herds. All Genesus full genetic program Jersey Red Duroc x Genesus Female. We congratulate Neu Muehl colony, Rock Lake colony, and Elmspring colony. All herds push 30 pigs per sow. Production and Quality are a necessity for competitiveness.

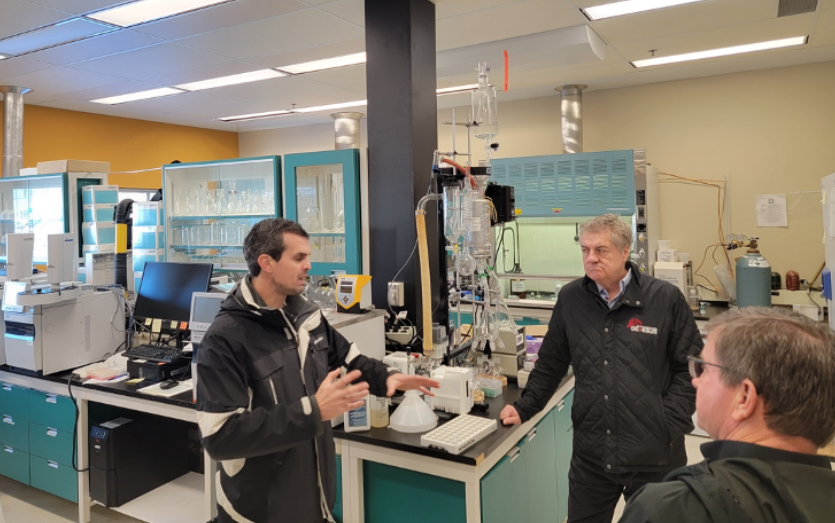

- Also, this past week we toured the Lacombe Research Facility in Lacombe, Alberta. Lacombe is the Canadian government’s meat research centre for Beef and Pork. They raise Beef cattle and have a farrow to finish unit stocked with Genesus Genetics. At Lacombe, they undertake research on farm in on site abattoir and with various meat quality measuring protocols with world-class equipment. Genesus is collaborating on several projects with Lacombe with the goal to produce ever-better pork. As the only Canadian-owned swine genetic company it is appreciated our opportunity to work with Lacombe and their world-class facility.

Other Observations

- U.S. sow slaughter in October was 266,000, a year ago 246,000, a 20,000 increase. A year ago, the U.S. breeding herd decreased by 65,000 September 1 – November 30. We expect the U.S. breeding herd is decreasing this quarter. Less Sows = Less Pigs = Higher Prices.

- At a recent NSIF Conference Mike Tokach a recognized global expert on swine production gave a presentation of Iowa State research. The study determined that a 1% change in wean to finish mortality is worth 82¢ to $1.20 a pig. With the U.S. wean to finish mortality records indicating an average of 9-10% the economic effects are huge. Using a wean to finish average value of $1.00 per head a 3% improvement would be $3.00 per head. 10,000 head = $30,000. Real money.

- Let’s assume the U.S. sow herd is lower so is the market hog inventory. We believe lean hog futures for the summer circling $1.05 lb. are undervalued. We expect lean hogs at $1.20 in the summer of 2023 will be a reality.