UK inflation hinders dine-out recovery - AHDB

Rising costs, labour shortages, supply chain issues continue to impact foodserviceFor foodservice, recovering post pandemic was already daunting enough but rising costs, labour shortages and supply chain issues are just a few of the economic factors putting inflationary pressure on an already struggling market, according to a recent market report from AHDB.

According to the ONS, consumer price inflation (CPI) in restaurants and cafes hit 7.5% by July 2022. With consumers being stung in all areas of spending (overall CPI at 10.1%) it is not surprising that 52% are planning to spend less than usual over the next three months, on visiting pubs and restaurants (Two Ears One Mouth, Aug 2022). So, what has been the impact on the market so far and what does it mean for the meat category going forward?

In the 12 w/e 12 June 2022, spending on foodservice was higher than the same period last year, when dining out and food-to-go options were restricted by COVID. However, when compared to a more ‘normal’ year, prior to COVID in 2019, spend in 2022 was still 5% up.

However, while spending increased, the number of trips this year dropped 15% compared to 2019. This shows the stark impact of inflationary pressure, with the growth in value driven purely by price. Looking month-on-month, as financial pressures intensify, trip recovery is slowing, spend growth is softening, and penetration has been declining since May.

This performance is being driven by two areas; eat-in and particularly food-to-go, as takeaway and delivery occasions are still over double what they were pre-pandemic.

Looking at just dine-out (eat-in and food-to-go), breakfast and lunch now make up fewer trips compared to 2019, being the fastest declining day parts versus pre-pandemic. These meals are more likely to be food-to-go and are therefore easier to substitute with carry-out options such as lunchboxes and leftovers. That being said, the need for food-to-go isn’t redundant and consumers appear to be turning to cheaper channels such as supermarkets at the expense of bakery and sandwich shops, which are typically a higher priced on-the-go option.

While evening meals are still down versus pre-pandemic, they have gained share as, according to Kantar, enjoyment and treat-led needs have gained greater importance, at the expense of routine. This means that dine-out channels gaining share over the last three years lend themselves to treat-based evening occasions, such as independents, full-service restaurants and pubs/bars, despite these being higher priced establishments.

This shows a tale of two halves, with consumers prioritising value during the cost-of-living crisis, but also still using the out-of-home market to treat themselves, albeit less often.

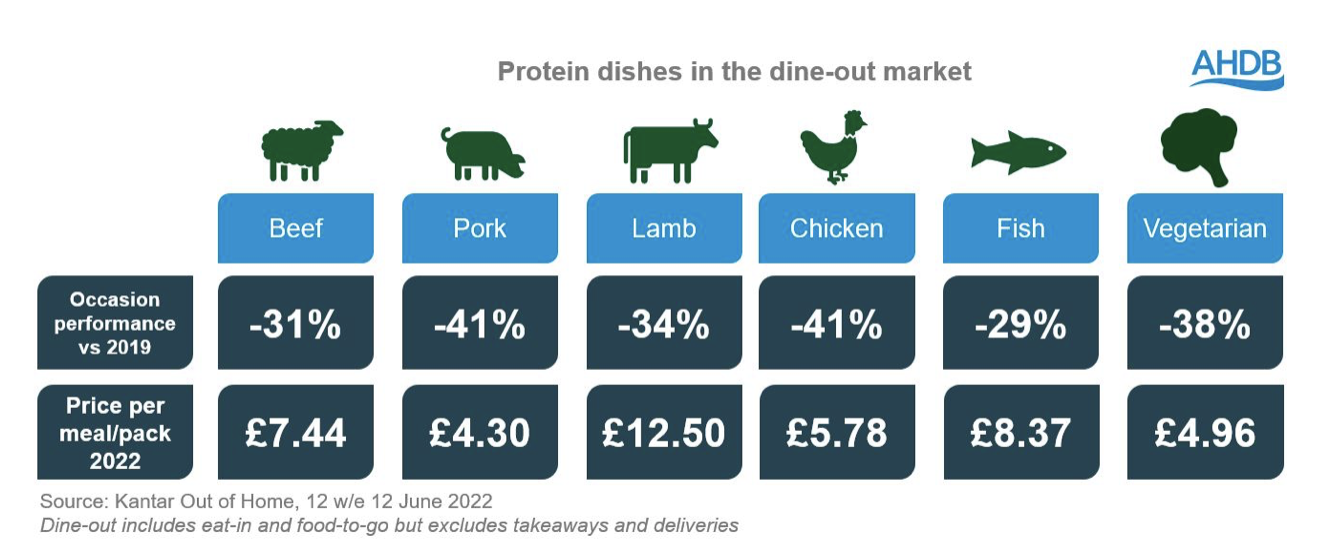

Protein and vegetarian dishes suffer regardless of price point

With consumers dining out less than 2019, it is unsurprising that all proteins are being impacted. Despite the lower price point of vegetarian meals, vegetarian eating-out occasions are declining faster than both beef and lamb, with their recovery slowing.

Beef in the dine-out market caters to both eat-in and food-to-go options with lower priced dishes such as burgers, as well as higher priced dishes like steak and roasts. However, this does not mean it isn’t suffering, with a double-digit decline in occasions. Just under a third of beef dine-out occasions are through quick service restaurants, compared to only 8% for total food, and therefore pushing this protein beyond takeaway and delivery is key for beef demand. Full-service restaurants and pubs account for 36% of beef occasions, compared to only 10% for total food. These channels gaining share is obviously a positive for beef, but they are still losing trips overall. Focusing on how the varying price points of tasty beef dishes can cater to different budget needs will encourage consumers through the doors.

Despite being the lowest priced protein in the dine-out market, pork is seeing the fastest decline in dine-out occasions (alongside chicken) when compared to 2019. With food-to-go being the biggest loss area, pork is the most impacted protein due to its over reliance on this part of the market. AHDB predict that 50% of pigmeat volumes in foodservice during 2019 went through food-to-goversus beef at only 23% and lamb at 5%. In the 12 w/e 12 June 2022, 37% of pork dine-out occasions were through bakery, sandwich shops and coffee shops (versus only 16% for total food), therefore the declining share of these channels is impacting processed dishes such as sausage rolls and sandwiches. Processed pork needs to play on its price point and convenience as a quick dine-out option, while an opportunity for primary lies in utilising this cheaper protein in innovative evening dishes which suit the treat-led occasion.

The need for establishments to offer different deals to value-seeking customers will be heightened as financial pressures worsen. Meal deals are the essence of value, particularly to encourage consumers back to the food-to-go market. On the flip side of this, when consumers do eat-in, they will do so for a treat. Therefore, indulgent meat dishes which cannot be replicated at home will stand out on menu.

To understand more about the opportunities in the foodservice market please see AHDB’s latest Foodservice Recovery Report which covers trends such as digitalisation, provenance and escapism.