National Pork Industry Conference report

Jim Log's Pork CommentaryLast week we attended the National Pork Industry Conference (NPIC) in Wisconsin Dells, Wisconsin at the Kalahari Resort. Our Report:

- Attendance was around 900 with a cross-section of industry and producers.

- Genesus was a major sponsor. Sunday night Genesus hosted a reception attended by many.

- We had the honor to speak at the conference. Last week’s commentary covered the subjects we presented.

- NPIC was well organized as usual. The NPIC team does a professional conference in conjunction with Kalahari.

- Many people bring their families to Kalahari as it is a facility geared to family entertainment.

- One of the subjects well covered by several speakers was sustainability. It seems to be a new catchphrase for green, environment, carbons, etc. Have to say we aren’t sure what is the answer for this in the pig industry. To us, sustainability is making sure business is going forward.

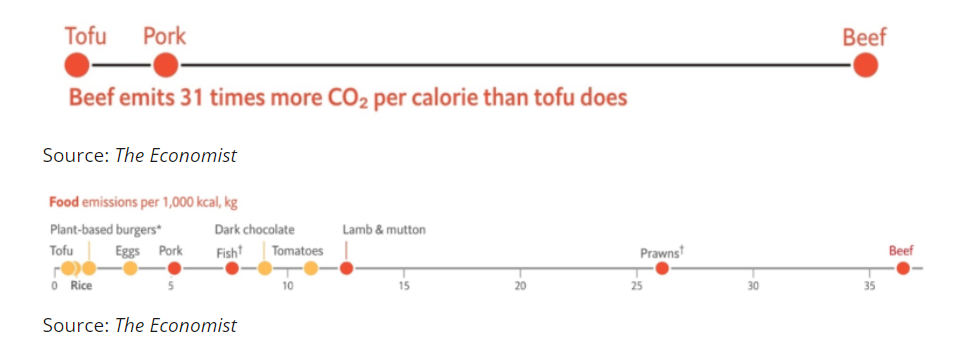

- One speaker highlighted – Beef has nearly 30 more times CO2 per calorie than pork. It seems we are significantly ahead of the beef industry in carbon emissions. A good step ahead on what is termed sustainable.

The speakers on the economics of the pork industry were generally optimistic about hog prices in the next coming months as the U.S. hog supply continues to be low. No concern near term of packing capacity. Exports are challenged by a stronger U.S. dollar making pork more expensive for importing countries. All speakers spoke of lower hog supply in China and the opportunities for pork exports in the future. Where feed prices are going can be described as a wildcard.

Last week in our presentation we discussed the recent survey analysis by Iowa State University on consumer acceptance of gene-edited foods. We had several people discuss it with us after.

- Survey was 2,000 people across the U.S.

- Quote from the survey “Around 60% of the women in the survey said they would be unwilling to eat and purposely avoid gene-edited food.”

- Iowa State is ag friendly

To be clear we support technology we aren’t against Gene-Editing as a science. Our concern is if 60% of women say they won’t eat, purchase or purposely avoid the product, what does that do to pork demand and pricing? We believe it will destroy our pricing and demand.

- It doesn’t take much to upend a market. Paylean (Ractopamine) was used across America and it was legal. No consumer had any concerns. Everyone was going merrily along with it with no issue. Then China said no to Ractopamine (Paylean). It effectively became banned as all the industry fell over itself to stop using it. One buyer (China), the product was gone.

What happens when a buyer says no to gene-edited? Whether it be a country or major retailer or food service?

- At a prior NPIC, a Vice President of McDonald’s told everyone there “Don’t expect us to explain Gene-Editing.” When the largest restaurant chain in the world and one certainly not with elitist clientele gives the warning, we should pay attention. Our point before we rush head first into a world of gene-editing, all of us genetic companies, packers, foodservice, retailers, and consumers need to look at this. Is this going to destroy demand and prices for the whole pork industry. Not much point in producing pork that 60% “of the women in the survey said they would be unwilling to eat and purposely avoid gene-edited food.”

It’s the elephant in the room which as an industry we seem to be approaching like an ostrich sticking our head in the sand.

- Anyone who reads the commentary regularly is aware of our disappointment with the NPPC for the lack of a fight to get the CFAP 1 top-up payments which was worth millions of dollars for our industry. One that every other major commodity got paid as promised, but swine producers didn’t. A promise was made but not kept. We had a premise that senior bureaucrats at NPPC needed to move on. We needed fresh blood to fight for producers. Recently there have been several senior bureaucrats leave from NPPC. Bryan Humphreys has been appointed the new CEO. Bryan spoke at NPIC and he gave in our opinion a blueprint of a new regime engaged to fight for and with producers. Afterward, we had the opportunity to speak with Bryan. It was a good conversation. As an American pork producer, we told Bryan we believe in the need for the NPPC. We appreciate the energy and new direction he is bringing to NPPC. As a pork producer, we will fight with him alongside other producers to move our industry forward.

China Update

In the first half of 2022, it is estimated that 14 Chinese publicly traded enterprises will lose more than 20 billion RMB ($3 billion U.S.). (These results do not include two of the biggest companies Wens and Zhengbang as they have not reported two-quarters financials yet). These losses in the first 6 months of 2022 of $3 billion are on top of the over $6 billion lost in 2021. Let’s assume these 14 companies represent 15% of Chinese hog production. Prorate the $9 billion lost by the 14 companies in 2021-2022 would lead to an estimated $60 billion lost in the whole industry. Any wonder the China hog prices have increased every week due to fewer hogs over the last three months? Hog financial losses lead to fewer hogs. Always have and always will.

We heard a report last week China has begun ordering pork from Canada and Europe. Not much from the USA, but any pork leaving North America – Europe to China is positive for all exporting countries and price support.

| China Prices | ||

| U.S. Dollar | ||

| Market Hogs – Liveweight lb. | 35 lb. Feeder Pigs | |

| March 18 | 85¢ | $59.60 |

| June 3 | $1.09 | $98.70 |

| July 8 | $1.50 | $115.60 |

| July 15 | $1.54 | $120.18 |

The relentless week upon week of China’s Price increase continues.

Our premise has been for the first time in history – China, Europe, and North America will be down in production at the same time, or about 75% plus of the world’s pork production. It appears the premise is true.