Inflation hits value meat tiers, impacting struggling UK shoppers - AHDB

Inflation reached 9.4% in June 2022Research from Kantar suggests those who feel they are struggling financially jumped 5 percentage points in the last year to 22% of UK households, according to a special report from the UK's Agriculture and Horticulture Development Board (AHDB).

To combat this increase in prices, buying less volume is currently the most effective coping strategy for shoppers according to Kantar (4 w/e 12 June 2022) contributing to a 5.3% fall in average price followed by shoppers choosing cheaper products (-4.9%). Changing to a cheaper store is used by a small minority and not giving much of a saving (-0.33%). Choosing products which are on promotion will save money compared to the previous price, but sometimes increases costs as shoppers may trade up into more expensive brands or products.

In the last 4 weeks we have seen an acceleration in the decline of branded products, losing £43m. While some shoppers have switched to value ranges, most of the brand losses have gone to standard own label products, benefitting these products by £27m (Kantar, 4 w/e 12 June 2022)

Only 2% of shoppers buy the majority of their groceries from value ranges, so even those who are struggling tend to buy a range of product tiers. However, those who are struggling are more likely to buy the cheaper ranges than someone who is better off.

Research from the ONS based on web-scraped supermarket data for 30 everyday grocery items, showed that the lowest-priced items have increased in cost in line with average food and non-alcoholic drinks prices (with both rising around 6% to 7% over the 12 months to April 2022). Although it did suggest there was a large variation between the top and bottom of the 30 items.

Beef mince was one of the products which saw the biggest increase while cheese saw a drop in price, according to the ONS. We have looked in more detail using our data sources to see how inflation is impacting other value cuts.

How is meat impacted?

There is a mixed picture (dependent on protein) on whether value own label products are being hardest hit by price rises. The values for average price are based on actual price paid by shoppers, so can be impacted by product mix and promotions, and are not like for like product comparisons, but do provide some indication of relative price changes.

Currently, value products are only a small proportion of primary and processed red meat sales at only 7% of volumes. Standard tier private label take the lion’s share of volumes at 74% (Kantar, 12 w/e 12 June 2022). This does differ across proteins.

Primary beef has seen the highest average price increases for value products, up by 17% and on average costing an extra £0.95/kg (Kantar, 12 w/e 12 June 2022) compared to only 8% for standard tier and 5% for premium tier. Fish also sees price increasing faster for value range products, up 4% but in actual terms this is lower than other ranges at only £0.25/kg. Primary pork is the protein where value ranges are the least impacted by price rises, up by less than 1%. This is the equivalent of an average increase of £0.03/kg.

We have seen a drop in the number of products within value ranges. Some retailers have scaled back on their value propositions and moved the products in to the standard range, which is having an impact on the average price.

It could also be that these products have the lowest margins for processors and retailers and therefore price rises in the supply chain have to be passed on to consumers more quickly.

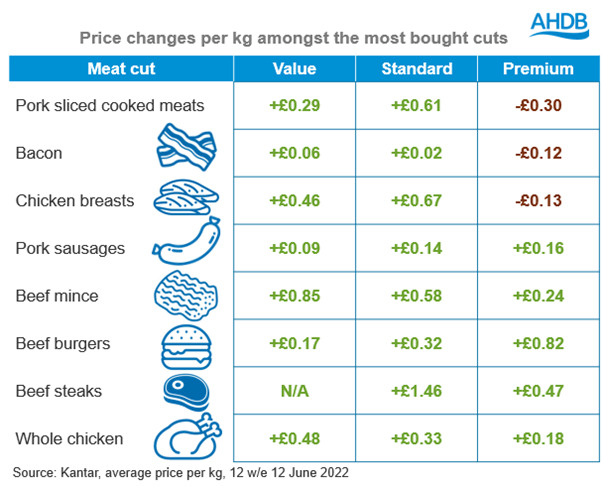

While looking at total proteins gives an idea, if we look at the top eight cuts which people actually buy, we see that on average premium cuts have seen shallower price rises than standard and value. In some cases, we have even seen prices decline for premium products. Beef burgers and pork sausages are the exceptions where we see price differences increasing most for premium tier products.

This shows that those who do buy value products will see their shopping spend increase the most. All shoppers have been impacted by price rises however, more affluent shoppers are able to trade down or reduce the amount they buy to mitigate price rises. The least affluent shoppers have not been able to do this. They also may be sticking to a stricter weekly budget, so may not be able to buy in to the cheaper per kilogram but larger pack products. Those of the lowest social grade have spent £4.15 more over the last three months than they did last year but on only 95% of the volumes (Kantar, Social Class E, 12 w/e 12 June 2022). All other shopper groups have actually reduced their spend on meat through retail.