Hog markets go sideways

Jim Long Pork CommentaryThis past week we saw continued lackluster movement in Cash Hogs and Pork Cut-Outs.

Observations

Packers buying hogs are losing money. This is tempering their desire to be further aggressors for slaughter numbers.

We understand pork demand is historically soft just before Easter. Easter is over in a week.

We had a bullish March Hogs and Pigs Report confirming there are less hogs year over year in the foreseeable future. Despite this verification, Lean Hog Futures declined in the $5 range. Go figure, Chicago = Las Vegas with no rules. Same sharpies had June Lean Hogs in the 80’s last fall. We expect Lean Hogs to rebound into the 120s, every packer is short hogs going forward. We will see plants with dark days. No point running shackles with no hogs in them.

In the recent April USDA Supply and Use Report the USDA is projecting 2022 Pork Production.

Year | Million lbs. |

2022 (projected) | 27.090 |

2021 (actual) | 27.668 |

2020 (actual) | 28.318 |

A drop in U.S. production of 1.2 million lbs. from 2020. No wonder the hog price is going to be higher.

April USDA projected Red Meat (Beef-Pork) plus Poultry for 2022

Year | Million lbs. |

2022 (projected) | 105.783 |

2021 (actual) | 106.410 |

2020 (actual) | 106.172 |

No doubt less Protein for an ever-increasing domestic and global market.

Like all projections, things can be fast-changing, the USDA is projecting this past week eggs at $1.57/dozen for 2022. Large eggs have gone from $1.40/dozen to $2.60 in a week as millions of birds have been exterminated for Avian Flu.

As of this past Saturday, 24 million chickens and turkeys have been lost to Avian Flu. If it ever gets into the breeder flocks, already high chicken, turkey, and egg prices will explode higher. In the U.S. producers who get Avian Flu receive financial compensation when the birds are eradicated.

As we wrote earlier, bullish Hogs and Pigs Report and Lean Hog Futures decline. The USDA came out with what is termed a bearish Corn Report and futures went higher! We understand the issue of Ukraine's limited ability to export and plant questions. What we wonder is where is the corn demand coming from, certainly not from increased global poultry and livestock production. Everywhere we look whether it be Europe, North America, or Asia we see less production either here now or on the horizon.

In China, the preliminary first-quarter financial results are coming out for the publicly traded swine companies. It appears billions of dollars further losses in the first quarter of 2022. The losses China’s producers are having are leading to sow herd liquidation. We expect not if but when China’s hog prices takeoff when the results of the liquidation lead to significantly smaller hog numbers. This will lead to China looking for pork imports but less imports of corn-soybeans. You don’t feed what you don’t have.

Sow Mortality

PigCHAMP is a Globally recognized swine database system based in the USA. This database reflects the issue of sow mortality in our industry. Let’s look at the trend for 2021 PigCHAMP Average of 292 farms.

USA Sow Mortality Mean | Canada Sow Mortality Mean | |

2021 | 14.86% | 9.61% |

2018 | 11.68% | 9.87% |

2015 | 8.94% | 7.11% |

It’s not hard to see the big jump in sow mortality in the U.S. over the last few years. The prolapse problems of the leading supplier of Genetics in the U.S. cannot be underestimated in the mortality increase. In Canada, mortality is significantly lower. The major genetic supplier in the USA has a much smaller percentage of sales in Canada. Genesus is based in Canada.

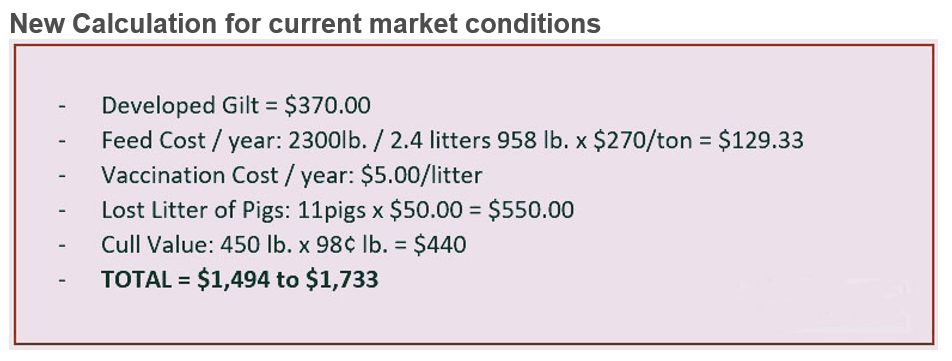

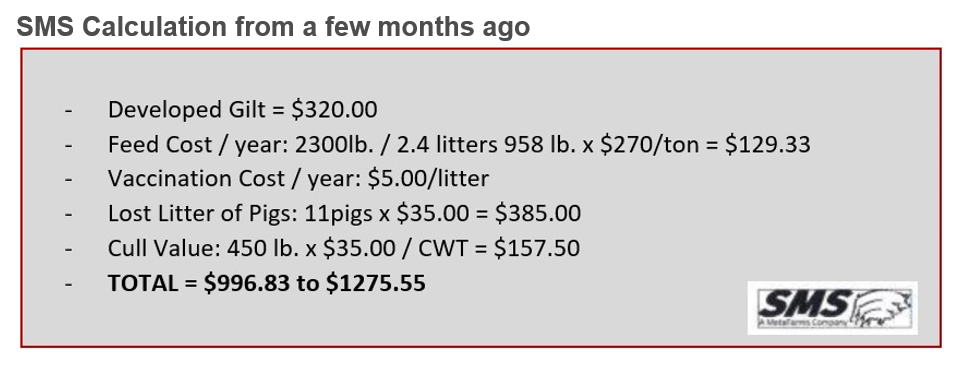

What is the cost of a dead sow? A few months ago, the SMS part of MetaFarms put out their calculation of loss per sow as you can see below. We thought it is interesting to update to current market conditions.

SMS Calculation from a few months ago

New Calculation for current market conditions

Big money at $1,500 per dead sow. On a 2500 sow unit a 1% change in annual mortality is 25 x $1,500 = $37,500, 5% is $187,500. It’s Simple Farmer Arithmetic but it is real money. With the U.S. average at 14.86% sow mortality, means half is over that. We have seen no results from the main genetic supplier that they have many herds under 15%. How long will producers tolerate the financial burden of dead sows? Business is about choices. Dead Sows Cost Real Money.

Big money at $1,500 per dead sow. On a 2500 sow unit a 1% change in annual mortality is 25 x $1,500 = $37,500, 5% is $187,500. It’s Simple Farmer Arithmetic but it is real money. With the U.S. average at 14.86% sow mortality, means half is over that. We have seen no results from the main genetic supplier that they have many herds under 15%. How long will producers tolerate the financial burden of dead sows? Business is about choices. Dead Sows Cost Real Money.