Genesus Global Market Report

Spain, March 2022When I wrote my last report, I sincerely believed that the European swine industry is going thru the worst possible scenario; but evidently, I was wrong. I ended previous report by stating how difficult it is to make forecasts for this year for several reasons: price of Mercolleida, price of raw materials, ASF, the pandemic, supply/demand, and exports. Never considered a war that is turning everything "upside-down". Apart from the moral crisis of not understanding/accepting events like this are still happening, this conflict is and will continue to have a massive impact for the agriculture sector.

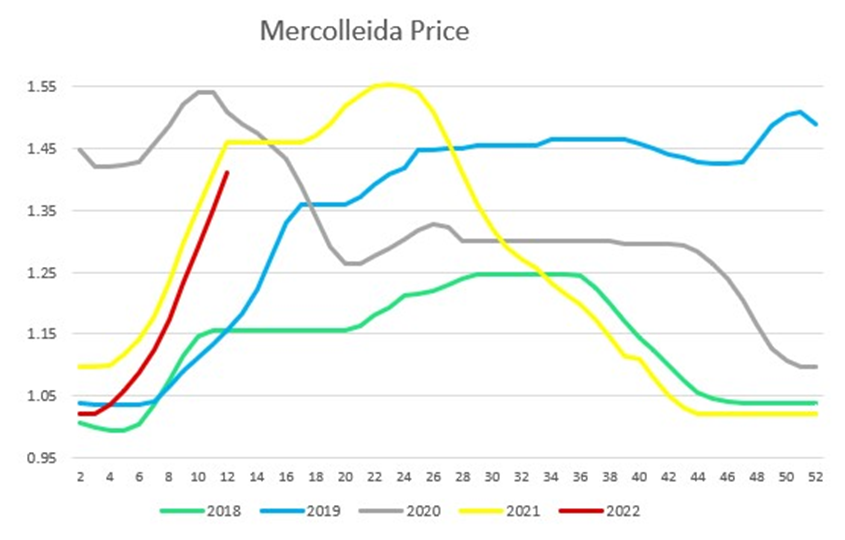

The price of Mercolleida

In the last four weeks, we witnessed a maximum allowed increase of 6 Eurocents per week. Since 2002 (entry into force of the €) this happened only nine times of which two times in March 2021 and four times now in March 2022.

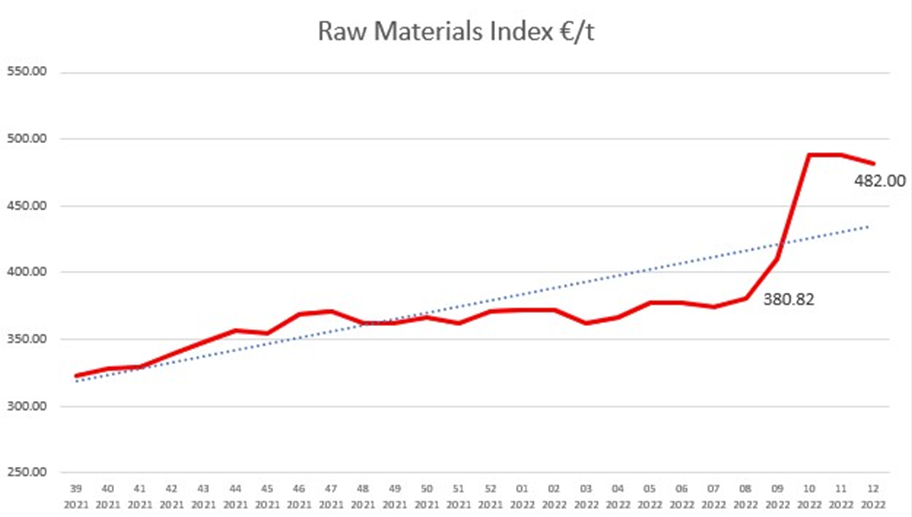

The price of raw materials

We saw continuous price increases for raw materials since the last quarter of 2021, but have since skyrocketed as the war in Ukraine continues. According to CESFAC (Spanish Confederation of Compound Food Manufacturers), Spain imports on average 15 million tons of cereals with 30% represented by corn imported from Ukraine, mostly in the first half of the year.

The following graph shows price evolution week by week.

In such a complicated market, it is literally impossible to know what is going to happen with prices in the short/medium term.

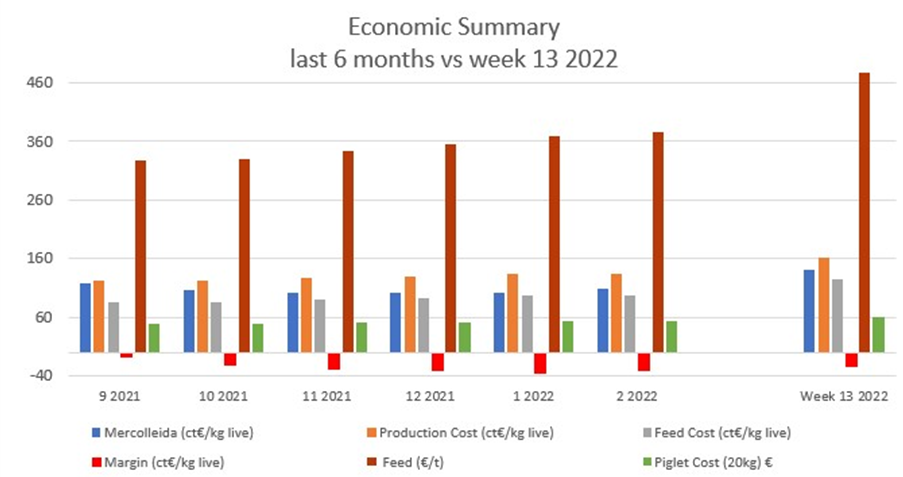

The following graph shows the actual market evolution for the last 6 months versus the forecast on the same parameters for this week.

Hog price

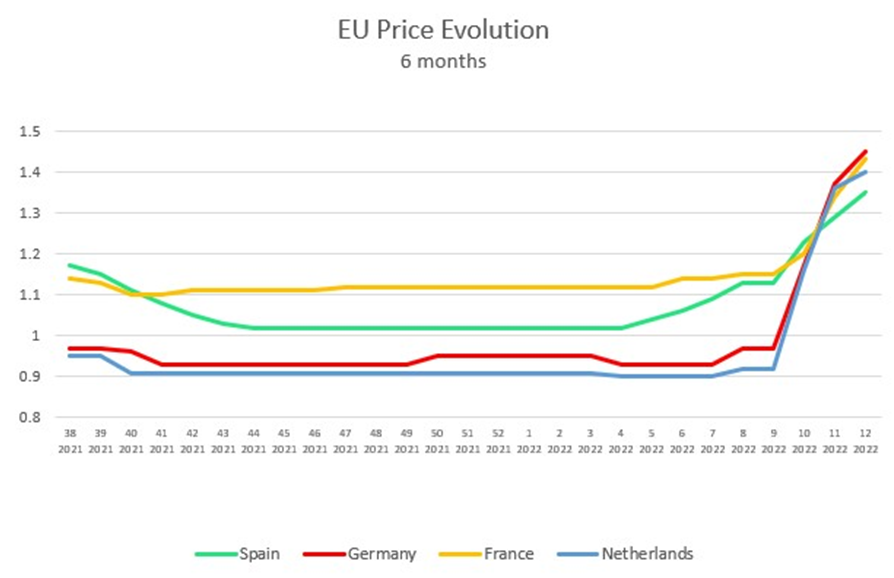

Germany from having the lowest price in the EU 1.20 €/kg carcass (0.94 €/kg live) 6 weeks ago, is now seeing the highest price in all EU, 1.92 € /kg carcass (1.50 €/live).

In Spain, market hog price has gone from 1.13 €/ kg live to 1.412 €/ kg live in the same 6 weeks and now has a competitive advantage in the EU against Germany.

Supply/demand - Shortage of hogs

The number of sows in northern Europe has clearly decreased. In Spain, for the moment, the sow inventory has not decreased, but a lot of piglets have been piled up, and supply is decreasing. The plants are already considering working only 4 days a week to reduce costs.

Production costs

- Raw materials prices - still not clear how they will evolve; it depends on the agreements that can be reached with the EU restrictions.

- Energy - its value continues to soar for the time being.

When and how much of this increase will it be possible to pass to the supermarket shelves? And where is the market going from here? No one can possibly know yet.