Genesus Global Market Report: Spain, December 2021

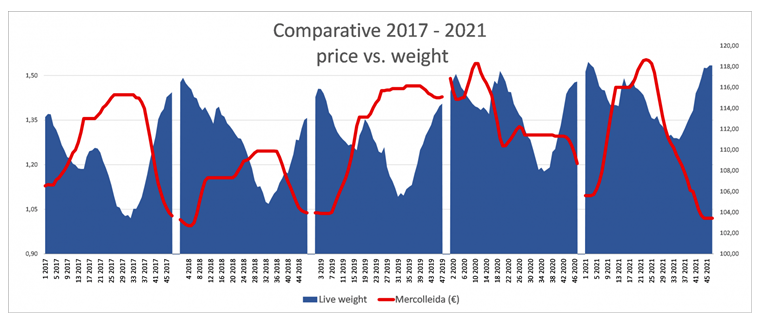

It’s the last month of 2021 and Mercolleida price in Spain is expected to stay at 1.020 € / kg, as established 4 weeks ago, for the rest of the year.

In 2020 production cost averaged 1.08 €/kg with a market hog selling price of

1.30 €/kg; and an average weight of 113.88 kg - profit was about 25 €/ head

according to a SIP Consultor

For 2021 so far, according to data provided by the same source, the average

cost is at €1.17/kg, with a market hog selling price of €1.25/kg and an average

weight of 114.84 kg. After everything that went in 2021, we could say this

ended to be a little better year than we would expect. Even so, the success is

derailed by the ever-increasing feed price. On September 20th, the cost of feed

was 272 €/MT, on October 21st, jumped to 333 €/MT and still going up.

With these figures, according to SIP Consultor, current cost is 1,227 €/kg – the last two months of this year will register big losses. We are at the lowest selling value in the last 5 years and by far the highest production cost.

Feed represents about 70% of production cost so obviously eyes are focused on that, but there are several other factors that worry producers as well.

Like the Spanish National Plan against Antibiotic Resistance (PRAN) or piglet tail docking, In 2016 the European Commission's recommendation on measures to decrease the need to practice tail docking was published, from next year (2022) it will be incorporated in the SIGE within the animal welfare action plan of RD 306/2020. This in addition to the decision to forbid the use of veterinary drugs that contain zinc oxide which was used to ease the weaning process and manage post-weaning diarrhea.

These implemented measures so far have had their consequences and have led to increased mortality in nursery and finisher pigs. From an average mortality rate of 3.2% in 2014 to 5% in 20/21 for feeders; and from 3.6% to 4.3% in finishers (Source: SIP Consultant)

Sow mortality has increased as well - in 2014, according to SIP data, mortality rate averaged 7.5% (with a variation between 4 - 11%). In 20/21 average is at 11.9%, with a high and low between 6.8 and 17.1%.

We were able to hear and feel firsthand all these concerns last week at the VII ANAVEPOR CONGRESS (National Association of Swine Veterinarians). There were over 600 industry professionals present there.

In the two-day congress, some interesting topics were presented such as "Adding efforts: Key points in front of the challenge of the withdrawal of the Zinc oxide in 2022" by Miguel Ángel Higuera, or "Increasing consumption of pork meat, unattainable objective?", by Ignacio Arranz, and not least, a presentation by Pep Font, on "Costs of pig production after the reduction of antimicrobials".

Observing the current situation in the sector and considering available data, it is easy to reflect as to where we are heading as an industry.

At Genesus, more than 20 years ago a decision was made, as to what type of selection to bet on. Although for many years this has not been very well understood by our industry, the right direction was taken, to select for a prolific, high-appetite, robust sow that could raise her own piglets - pigs with a high feed intake and excellent quality pork. As a result, Genesus today has a hog that is significantly different from all others. Genesus pigs are stronger, can cope better with disease, and respond well to environmental and space challenges. Genesus sows can produce more kilograms of saleable (and tasty) meat over their productive life than any of the alternatives.

For 2022, I can only wish for the industry to face these new challenges well prepared and with good standing production results so we can maintain the good work of our sector.