Where are the market hogs?

Last week the US marketed 2,327,000 market hogs, a year ago same week 2,559,000. That’s close to 10% less!In the last five weeks numbers have been close to 10% lower. Anyone keeping hogs because they think the price will go higher? We don’t think so, and weights holding at 277 – 278 lbs. over that time tells us we are keeping hogs moving.

Year to date US total marketing’s 1.1% less than a year ago. Remember the Chicken Little Economists and followers who campaigned to tell us the US was going to have more hogs in 2021 and the lean hog prices would not be profitable. These wise guys of course never owned hogs and never will. They had no clue how bad 2020 was for producers financially. As if losing $50 a head makes more hogs. The same “experts” work hand and hand with the NPPC executives that don’t seem to care why producers are not getting CFAP 1 top-ups promised by the government. Cattle and grain producers got billions in the CFAP 1 top-ups. As if they were the only ones damaged by COVID-19 debacle. The Washington-based NPPC crowd kept getting their big paycheques while accomplishing next to nothing for producers.

This past week NPPC big accomplishment, they applauded new measures on imported dogs that USDA put in place. How about CFAP 1 top-up? Let’s hope the swamp gets drained in Washington and NPPC directors can find new dynamic leadership.

Every producer needs to contact their Congressman and Senators. Ask where CFAP 1 top-up promised to hog producers is? Why haven’t we got it? Pork is an important part of America’s Food Chain and we need to be treated fairly.

Other observations

US pork export to China

China bought 18,000 tonnes of Pork from USA last week. A significant purchase. Why does China need to buy Pork if they have lots?

Fewer hogs year-over-year

The 10% decrease in Market Hogs in the last few weeks, we believe, is a combination of liquidation, disease, and high temperatures. Financial losses last year devastated the industry, sow herds inventories were not maintained, we believe PRRS issues are hurting the industry big time.

Talked to a producer last week hit with PRRS. Expects 30% decline in weaned pigs over the next 12 months from previous year and a 20% increase in wean to finish mortality. That’s a 50% decline in market hogs.

Weights have held at 278 lbs over the last few weeks, there is chance hogs backed up some due to the fact that weight didn’t drop lower.

We expect fewer hogs year-over-year for the next several months.

Cost of sow mortality

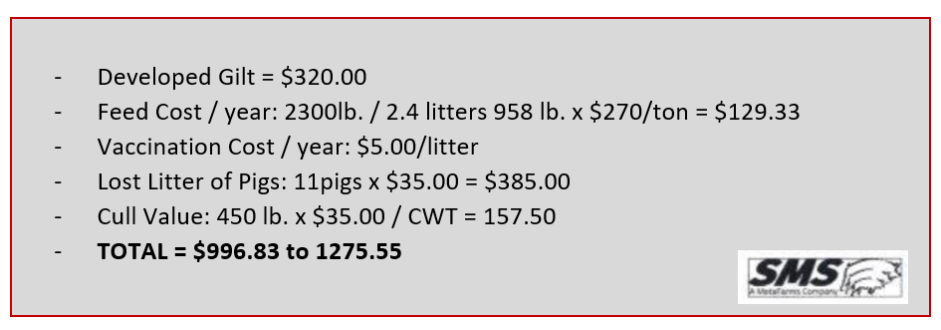

We have written about ever-increasing sow mortality in our industry, jumping 6% over the last few years to last year’s 13.9% average on PigCHAMP data system. Ron Ketchum, with Swine Management System, a well-known expert and founding partner of the database, recently spoke to the value of a dead sow. Mr. Ketchum estimates a range of $996 - $1275.

At calculation midpoint, big economic difference, with our farmer's math estimating every 1% change is 45¢ a pig. A 5% sow mortality change makes $2.25 a pig. We have talked to producers that used to have 7-8% sow mortality they now are pushing 20%. We have asked what changed? Barn? Penning? Density? Health? Answer was, nothing but sows don’t hold up and have prolapses that didn’t have before. Ask yourself same questions.

Huge economic cost to sow mortality. 5% change on a 2,500 sow unit is $135,000 a year, using a $40 sew price you need to produce an extra 3,375 pigs per year to cover the loss of 5% sows in a 2,500 sow unit.

If your sows prolapse, cripple, need toe clipping, poor sow salvage value, maybe you need different genetics. It’s your money.