UK pork exports fall in June despite increased production

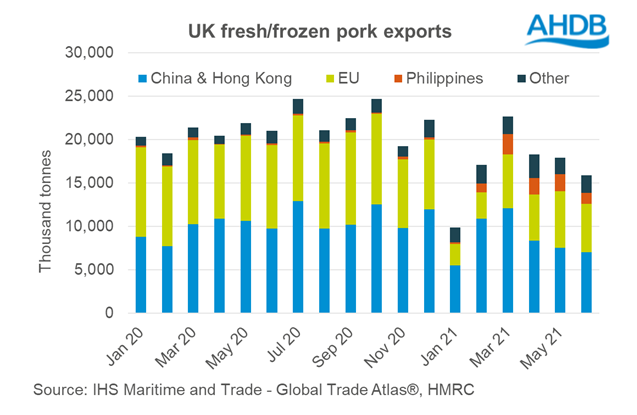

Despite improving pork production figures in the UK, export volumes fell in June 2021 when compared to May 2021 and June 2020 - Duncan Wyatt from AHDB explains why.UK exports of fresh/frozen pork fell in June, compared with volumes in both May, and June a year ago. This is despite UK production having been higher, and could reflect a combination of factors. An oversupplied EU market, continued logistical difficulties in the supply chain, and challenges further afield will all have played a role. The UK exported 15,900 tonnes of fresh/frozen pork in June, 24% less than a year ago, and 11% less than in May.

In the year to date, the UK has exported 102,000 tonnes, 18% less than a year ago. However, due to an 11% rise in the average price, the value of these exports has only fallen by 8% year on year to £189m.

Offal exports on the other hand, which are so important for the sector, increased year on year in June by 41%, to nearly 11,000 tonnes. Volumes to China alone increased by a third to 5,700 tonnes. The value of offal exports in the year to date has increased by a half, to £81m.

Imports of fresh/frozen pork were also lower year on year, by nearly 8% at 27,400 tonnes in June. While Germany maintained its traded volumes, other important suppliers, Denmark, Spain, and Ireland all reduced exports to the UK. Imports of most pig meat products were behind 2020 levels in June, the exception being bacon, which recorded an annual growth of 4% to total 13,500 tonnes.

Looking at all pig meat products, in the year to date, the UK has imported 335,300 tonnes, 13% less than at the same time a year ago.

It wasn’t really until the end of June when EU pig prices started to fall quickly. In the latest week, ending 8 August, the EU average price was 126.5p/kg, 35p lower than its equivalent in the UK. These lower prices, combined with the continued gradual reopening of the foodservice market here, suggest increases in future imported volumes could be on the cards. This increase in trade could show in July and August trade data, so look out for further trade updates.

Words: Duncan Wyatt