Genesus Global Market Report: Mexico, July 2021

Mexico’s hog industry has had an unusual start to 2021, with expectations of greater growth in production, which in the end have turned to the opposite, due to different factors. Rising herd health challenges, higher feed costs, and domestic demand uncertainty due to ongoing pandemic disruption have pressured production and herd expansion, as Rabobank has recently reported.

Health Status

The challenges of disease in the Mexican pig industry have added more uncertainty to both commercial pig production and the expansion of the national herd. Diseases like PRRS and PEDv are impacting the number of hogs produced in Mexico adding more pressure on the supply chain over the last few months, and subsequently resulting in sharply higher prices.

Grains

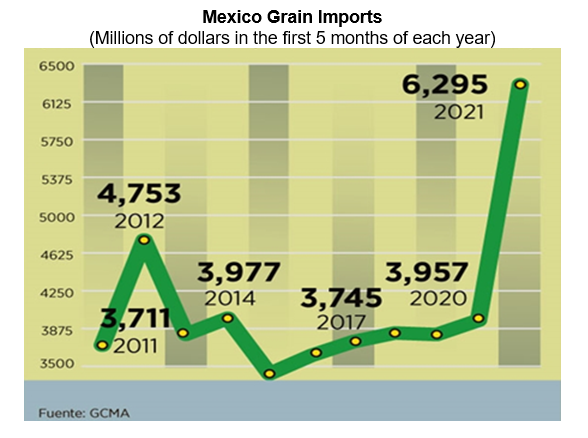

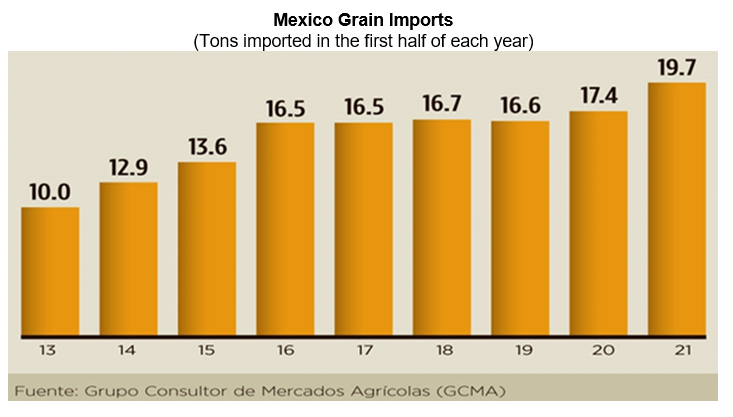

Countries like Mexico that rely on imported feed have more exposure to global shortfalls and price volatility. The price of feed and feed ingredients has jumped 35% higher year over year on average. Because of extreme drought, Mexico’s grain and oilseed imports in the first half of 2021 hit a record of 19.7 million tons, which represents an increase of 14% against the 17.36 million that were imported in the same period of 2020.

The commercial value of grain and oilseed imports accumulated in the first semester of 2021, increases by 64.2% compared to the same period of 2020, with a total that amounts to 7,611.3 million dollars.

Confronted with the Guarantee Prices program that is still far from guaranteeing the country's food security, Mexico closed the first half of 2021 beating its record in the purchase of grains and oilseeds abroad, according to estimations from Agricultural Markets Consultant Group (GCMA).

Mexican Pork Industry Status

The Mexican hog production sector remains cautious. With ongoing supply challenges and limited visibility around demand, the industry has responded by almost no growth and in some cases, contracting supply.

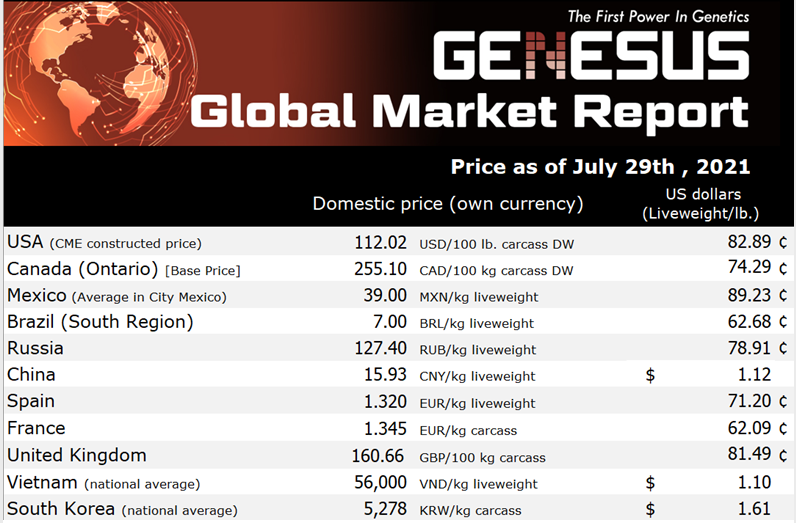

Pork prices

The above prices are from the State of Jalisco, which produces 30% of the total pork in Mexico. The price is around 39 Mexican pesos (approx. US $ 0.89 / lb liveweight). Regarding the market in my latest reports which were 37.28 pesos / kg (US 82.62 / lb) in April and 48 pesos / kg (US 1.09 / lb) in May, we can appreciate a little bit the roller-coaster that prices have experienced in the last 4 months.

Everything seems to indicate that due to a new pandemic peak caused by the Delta variant of the coronavirus, the consumption of pork has started a decline again, as fewer tourists are arriving on Mexican beaches.

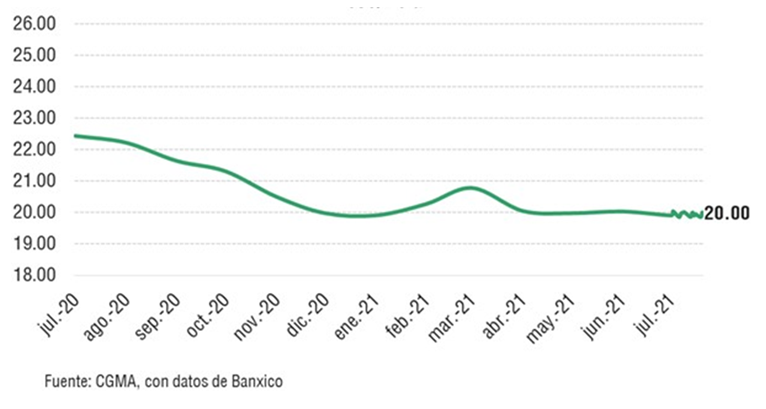

Exchange Rate

Something positive that we must highlight is the downward trend of the US dollar against the Mexican peso during the last year, which has somewhat cushioned high prices of grain imports to the country. Currently, the FIX exchange rate is at 20 pesos/dollar; the average in the current month is 19.93 Pesos vs. The 20.03 pesos that it averaged in June and is 2.50 pesos below the level reached in July 2020.