Chinese pork imports are slowing

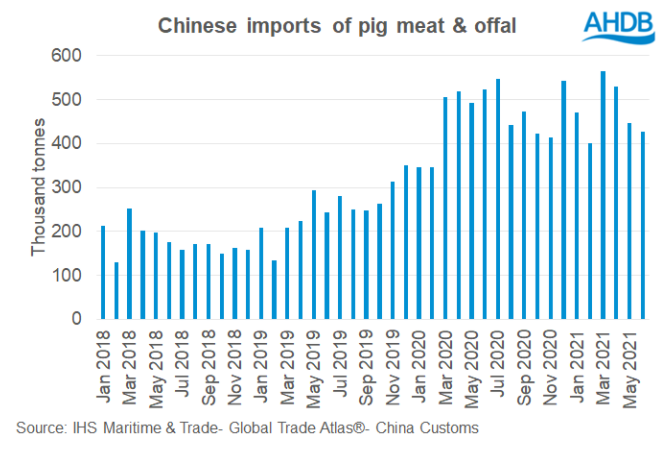

New analysis from Bethan Wilkins from AHDB finds that China's imports of pork meat are no longer growing, suggesting that the driving force behind the international pork market could be changing.China’s strong demand for imported pork has been the key driver of global pork markets in recent years. After African swine fever (ASF) was first detected in the pig herd in 2018, culling and direct losses from the disease led to a protein shortage. Pig meat imports were particularly large in 2020 and totalled 5.6 million tonnes, 85% more than in 2019.

Nonetheless, in the first half of this year, we have not seen much further increase in Chinese pork import requirements. Volumes totalled 2.8 million tonnes, just 4% above last year. In quarter two alone, volumes were actually 9% lower than in 2020, at 1.4 million tonnes.

Shipments in Q2 last year did receive an extra boost due to difficulties supplying the market in Q1, because of COVID-19. However, this is not the only reason imports have been behind last year’s levels recently; Chinese demand for imported pig meat does seem to be falling.

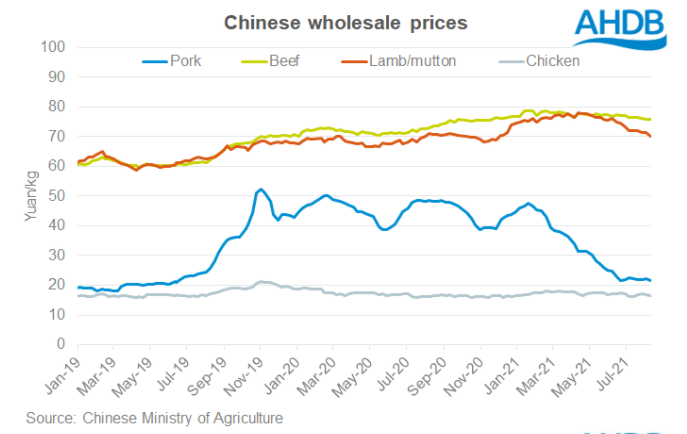

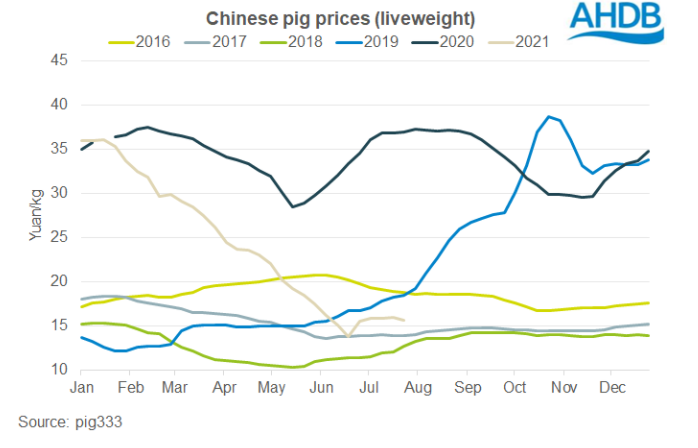

Inside China, both live pig prices and pork wholesale prices have been falling. This makes imported pork less competitive.

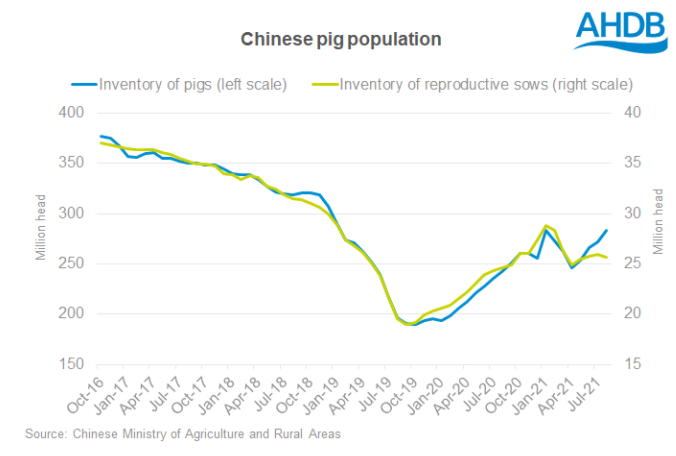

Prices have fallen in response to increasing pork production in China. Some herd recovery is now underway, which ought to mean we have passed the peak of import demand, and so volumes could be expected to generally ease back from here. However, the road to recovery is a long one, and unlikely to be smooth; we can already see volatility developing in recent production trends.

Reports indicate there has recently been a particular short-term spike in pork production in China. Some resurgence in ASF outbreaks earlier this year encouraged higher slaughter levels, and some destocking from farms that are no longer profitable, as prices have come down. This is expected to lead to particularly poor import demand in Q3. Some subsequent recovery in both pork prices and import demand would be expected after the influence of this phase eases. Official statistics show that the number of breeding sows in China fell again at the start of this year, and has not yet recovered to late 2020 levels.

The EU is particularly reliant on China as an export market, so any weakening of import demand is likely to have particular influence on the market there. With the UK market so closely linked to the EU, this will also have implications here. We can already see EU prices starting to weaken. Chinese imports from the US have already been falling so far this year (-21%), influenced by unattractively high US prices. This at least moderates the international competition UK/EU exporters face on the Chinese market at the moment, although US prices have dropped back from a peak in June more recently.

It is also interesting to note that China has been increasing its imports of live breeding pigs again this year. Total imports for the first half of 2021 were more than double last year at 1.2 million head. About half of these were supplied by the US, with the other half coming from Europe, including some from the UK (46,000 head).

Words: Bethan Wilkins