China is importing less US pork

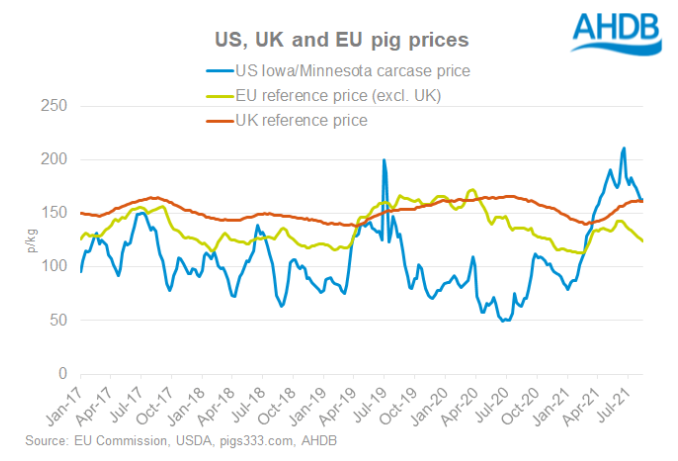

Recent market analysis finds that US pork exports are facing headwinds from China as domestic prices continue to rise.Recently, US processors have found the price of pigs much higher than normal. Pig prices in the US had been strengthening since January, and according to the USDA, processor margins had been narrowing. Low margins at the start of July may have prompted processors to buy fewer pigs, reduce slaughter levels, and rely more on their own company supplies. These actions reduced pig prices and supported both wholesale pork prices and processor margins.

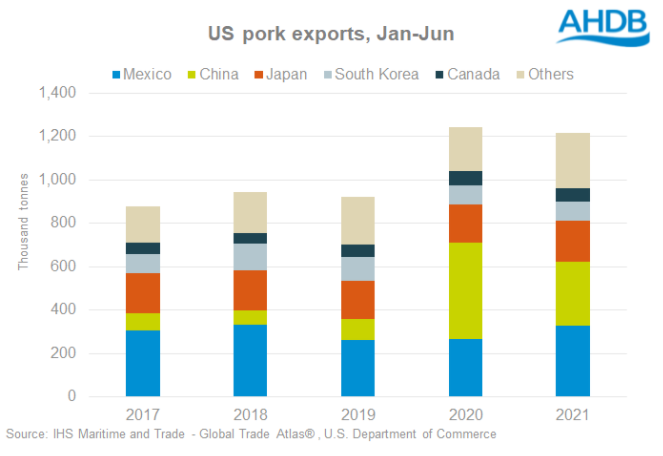

US prices may still be too high to stimulate demand overseas. One important market that the EU and US have in common is China. US fresh/frozen pork exports to that market have fallen by around a third in the year to date. Although, this is perhaps as much to do with Chinese pork production rebounding from African swine fever (ASF), as it is to do with high pig prices in the US. Nonetheless, the EU has increased its fresh/frozen pork exports to China by around a fifth in the year so far.

High prices, and tariffs into China, are expected to impinge further on US competitiveness as China’s demand for imported pork continues to fall. US export volumes are therefore expected to go to markets both elsewhere in Asia and closer to home (such as Mexico) to offset declines to China.

The USDA has recently revised down its forecast for total US pork exports for 2021 by 65,000 tonnes, to 3.4 million tonnes. This would be a 1.8% increase over 2020 export volumes. Export volumes in 2022 are expected to decline by 1.5% compared to 2021.

Words: Duncan Wyatt