Jim Long pork commentary: new lean hog contract highs!

US lean hog futures reached new contract highs on 28 May.Lean Hog Futures June, July, August and October reached new contract highs last Friday.

- June - $117

- July - $119

- August - $116

- October - $94

Long ways from the prediction of the Chicken Little economists who expounded last August with 2021 summer futures in $75 range that there was little chance of higher prices in 2021. Its over $80 per head difference.

Current Iowa/Minnesota slaughter weights are below the 5-year average weights

At first of this year they were 7 lbs heavier than the 5-year average (286 – 293); now 2 lbs below; a year ago, right now they were 11 lbs over 5-year average. Tells us hog supply is very current. The 5-year average Iowa/Minnesota slaughter weight shows a low of 277 lbs. in the first part of August. We expect to see similar weights this year but probably before August.

US pork cut-outs closed Friday at $126.59 higher yet again

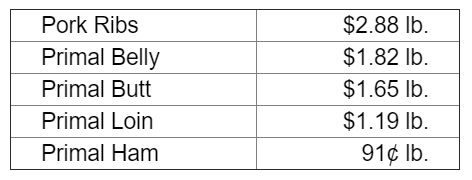

Choice beef cut-outs were $3.3097. The huge range between pork and beef in our opinion is a great support for high pork price sustainability. It also continues us to question why beef is so much more than pork. pork cut-outs tell us something very obvious.

All pork cuts leading in pricing have marbling (taste). The push to too lean pigs has devalued Loins and Hams. Consumers vote with their money (Loins and Hams are about 50% of carcass). The joke is some think a pretend Duroc is the answer. Using Durocs with little marbling ends up the same crap just with a different name.

Exports

Despite the high pork cut-outs relative to history, exports stay strong. Pork sales to Mexico were 20,780 metric tonnes a week ago. Our farmer arithmetic tells us that’s equivalent to over 200,000 market hogs. Mexico hog market is on fire at 47 pesos/kg or $1.07 US/lb liveweight. We expect continued massive US pork sales to Mexico to fill the hole of liquidation and disease. For Mexican producers they were benefiting from the high prices and we expect that to continue.

World mega producer

The last three years, Genesus and National Hog Farmer worked together to produce the Global Mega Producer list. It was the idea and concept of Steve May at National Hog Farmer. At the first of this year the National Hog Farmer stopped after several decades publishing their monthly magazine.

At Genesus we believe the Mega Producer project is worth continuing. Consequently, our team of Genesus World Regional General Managers have worked to update in detail the Mega Producers (over 100,000 sows) in their areas.

Next week at the World Pork Expo the World Mega Producer list will be unveiled while simultaneously it will be sent to World Media outlets. We invite you to visit the Genesus tent to see the detailed list and pick up a copy of the World Mega Producers 2021.

New barn survey

Last week we asked our readers to send in any details of new sow barns under construction.

Quotes from different readers

- “10,000 sow barn getting built in South Dakota this year. This one definitely breaking ground this year or already has hole dug replacing some old batch farrow farms but for the most part this will be new sows on feed.”

- “Heard of new sows in South Dakota two 6,000 and one 9,000 sows – this was chatter from a construction crew in Iowa.”

- “You did not hear from me, Jim, but heard from a construction firm that a certain vet clinic was planning a something like 4 or 5 10k sow units…”

- “6,000 in Illinois burnt down… being worked on right now.

- "10,000 sow new in South Dakota… in bidding"

- "6,000 sow new in Indiana… in bidding”

- “10,000 sow barn being built in South Dakota this year, 3,000 sow barn being built in SW Minnesota and next year in 2022 and 5,000 – 10,000 barn being built in South Dakota next year 2022? Not official”

This is what we got. Seems the only sow barn that is actually being built at this time with any confidence is the 6,000-sow barn that burnt down. The others are varying degree of planning it appears. If you talk to builders or equipment people, lots of sow barns get quoted but for whatever reason they don’t get built. High feed prices are measured building costs have moved break evens up.

Generally, the vet clinics put little of their own money in projects, they search for investors. In our opinion today there is little bullish optimism in our industry for the future. Producers realize prices are good today but high feed prices dampen the long-term view. It’s like everyone is ready for a rock coming from nowhere to land on their head. Hello coronavirus.

We believe October and December lean hogs are undervalued. We decided to look at Iowa – South Minnesota prices over the last ten years 2010 – 2019 (excluding 2020 pandemic). Last week May Iowa/South Minnesota price was $1.12; October Futures 93¢; December 83¢. The price difference May to October 19¢ lb; May to December 29¢.

To put in context, the 10-year average Iowa/South Minnesota May-October spread is 7.7¢ lb (largest year 21¢); May to December spread 12.3¢ (largest year 22¢ lb). Currently October and December Lean futures are both near or beyond the widest 10-year spread.

If we take October 7.7¢ lb 10-year average May to October spread from current Iowa/S Minnesota 1.12 – 7.7¢ lb, October is 1.04 lb (current future 93¢); same arithmetic on December-May $1.12 less 12.3 = 99¢ lb (current futures 83.5).

Seems to us not overly a reach to believe both October and December lean hog futures are below where Iowa/South Minnesota lean hog prices will be in both months. Upside to market in our opinion.