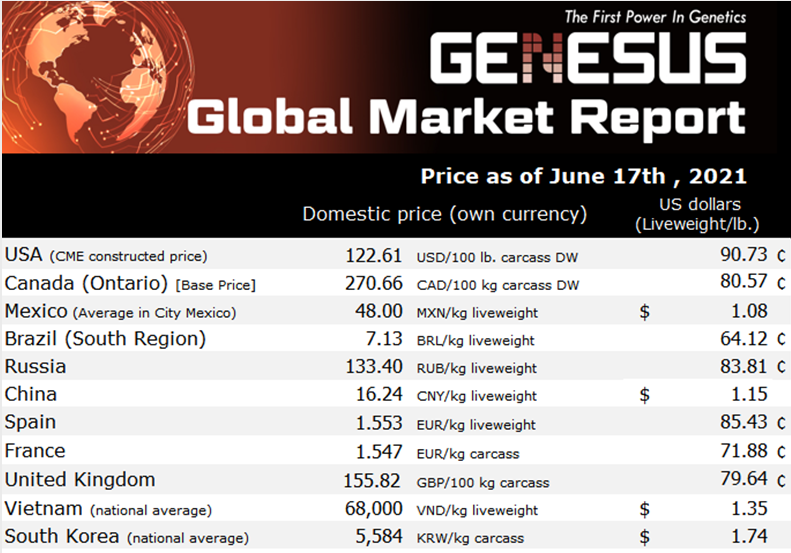

Genesus Global Market Report: Europe and Spain, June 2021

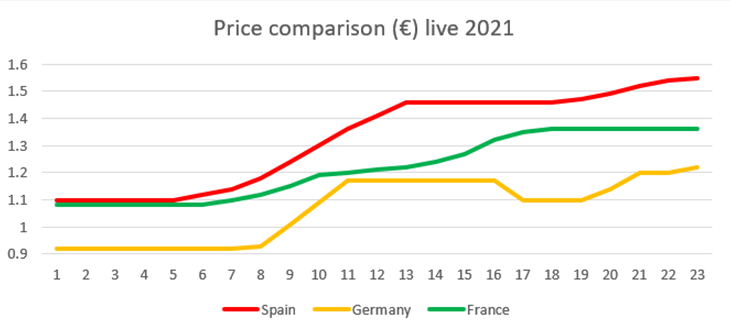

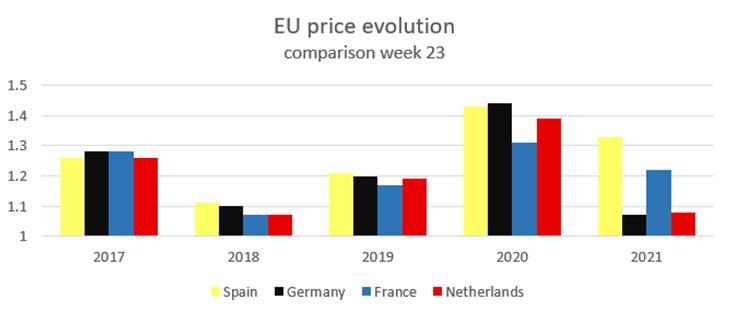

Until now in Europe the market was divided -there were those who could export to China - Spain, and those who could not - Germany. This has made the price depending on whether you were in one area or another.

Germany with its ASF issue, despite the increases, is currently at 1.22 €/kg while Spain is at 1.55 €/kg live. We started the year with 0.92 €/kg in Germany and 1.10 €/kg in Spain. We were at 18 cents cents difference, now we are at 33 cents.

Germany, not being able to export, had to place its meat on the European domestic market. Spain has exported everything China demanded, reaching record figures that a few years ago would have been unthinkable. Spain was the origin of 31% of all Chinese imports in the first quarter of the year, followed by the USA with 15%.

And all these are the reasons why Spain and Germany have the price they have. China continues to “set the pace” for pork markets worldwide.

Now we are in the moment when contracts must be renegotiated and the situation for Spain is overly complicated in order to have competitive prices for China.

If we analyze the supply/demand balance that we have in Spain:

- Producers do not want the price to go down because in addition to having fewer hogs, with the increase in packing plants capacity, there is more demand than supply.

- According to SIP Consultors, the production costs are close to 1.20€/kg for the month of June; with an overall average feed price in May of 316€/tonne (288€/tonne sow feed, 497€/tonne nursery feed and 304€/tonne fattening feed).

- The average cost of production so far for 2021 1.16€/kg compared with same period in 2020 when it was 1.083€/kg; the year 2020 closed at 1.082€/kg.

- The average weight is dropping very slowly, although it is still the highest in the last 5 years and a little higher than in 2020. Current weight 114.6 kg with 2021 average of 116 kg versus 2020 which was at 115.4 kg at the same date and an average of 115.5kg.

- Processed pork exported to China is priced above domestic market.The industry cannot transfer same price to the domestic market because, due to the pandemic, the average purchasing power has decreased, and distribution wants to maintain its market share by offering cheap products.

- At these prices it does not seem to be profitable to freeze the pork meat.

- So, we ask ourselves - What is going to happen with China? Is it going to continue importing as it has been doing so far? At what prices? And perhaps the million-dollar question - How long will this production structure be supported by continuing to make a "commodity" pork? We know our competitors USA and Canda are using more and more registered Durocs to improve their carcass quality. Shouldn’t Spain look to compete on a market that is willing to pay more for a better product?

In summary we can only say, we started the year with uncertainty that continues to loom on the Spanish and Europe pork market.