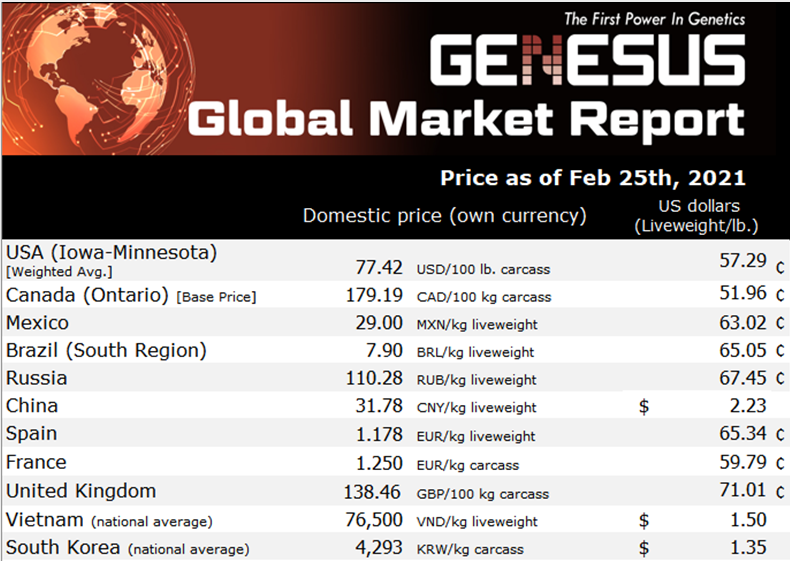

Genesus Global Market Report: Spain, February 2021

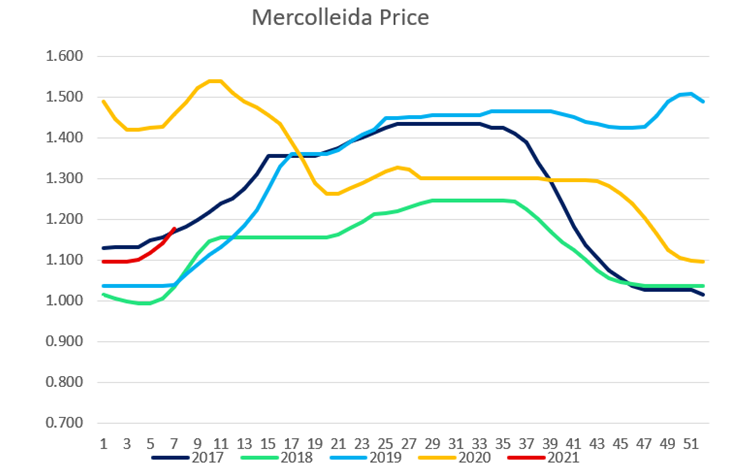

The Spanish market started 2021 with a high level of activity but in balance. After six months of falling prices, these last four weeks the price has been going up to €1.178/kg (65.34¢ US/lb.) live. We have had an unusual month of January. Although we are coming out of Christmas season with the usual high weights’ hogs and with higher supply, this has been absorbed earlier than usual and with better pricing because of continued high demand ever since October. Still, Spain is under total tension currently as we observe a supply/demand imbalance going on for a few weeks in Catalonia and Aragon. These areas are where 60% of the processing plants are located and affecting the entire Spanish Pork Market.

Overall, the European pork market seems to have already bottomed out, with Germany at the forefront which now sees rising prices for the first time since last spring, as slaughtering capacity is recovering, as do exports of live animals primarily to Italy. Germany is flooding the European market, including Spanish one, with meat and the difference from country to country on making a profit is whether they are approved or not to export in China.

This is the main factor that has set Spain apart from other European countries since October, following Germany’s ban to export pork to China. Spain is the European leading supplier of pork to China with ~100,000 tons per month representing 80% of Spanish exports. Exports are also strong to the Philippines, Vietnam, Japan, and Korea.

Spain’s live hog price despite still with well below 2020, in which we had an average of €1.45/kg (80.42¢ US/lb.) vs. €1.11/kg (53.81¢ US/lb.) average this year, is set above Germany €0.92/kg (51.03¢ US/lb.), France €1.09/kg (60.45¢ US/lb.) or the Netherlands €0.92/kg (51.03¢ US/lb.).

Live Hog Price (€/kg) |

SPAIN |

GERMANY |

FRANCE |

NETHERLANDS |

Average year 2020 |

1,34 |

1,23 |

1,23 |

1,19 |

Average 2020 (week 7) |

1,45 |

1,47 |

1,33 |

1,43 |

Average 2021 (week 7) |

1,11 |

0,92 |

1,09 |

0,92 |

Week 8 |

1,18 |

0,92 |

1,1 |

0,92 |

Cost of production in 2020 was around €1.08/kg (59.90¢ US/lb.) and the real selling price averaged €1.30/kg (72.10¢ US/lb.). With an average selling weight of 113.88 kg (251 lbs.), profit per hog was around €25 ($30.56). (Source SIP Colsultor) Despite the complication of the year, it has been a good year for the Spanish pork sector.

What to watch for in 2021:

- ASF: what will happen to Germany and the rest of the EU?

- Impact of ongoing worldwide pandemic on production costs and demand?

- Price of raw materials impact on cost of production. The current production price is close to €1.15/kg (63.78¢ US/lb.) compared to €1.08 (59.90¢ US/lb.) last year. What will happen in the second half of the year?

- Exports and the different European countries market disconnection based on approval to export to China or not.

PERTE Project in Spain

The Spanish livestock and meat sector, led by the pork sector, is working on the development of a new program that can be included under the European PERTE Project (Strategic Project for Economic Recovery and Transformation) and access part of the €3.5 billion Next Generation EU funds offered towards the development of a sustainable green and digital economy. This program would access 50% public and 50% private funding. Among the interprofessional that have promoted this project are INTERPORC (Interprofessional Association of White Hogs) and ASICI (Interprofessional Association of Iberian Pigs). In addition, it is led by important companies such as Grupo Fuertes, Vall Companys, Campofrío, Grupo Jorge, Uvesa, Coren, and Covap, which encompass all the stages of pork production. This union of companies has elected Manolo García (Vall Companys) as Chairman of the Executive Committee.