China drives Brazilian export growth

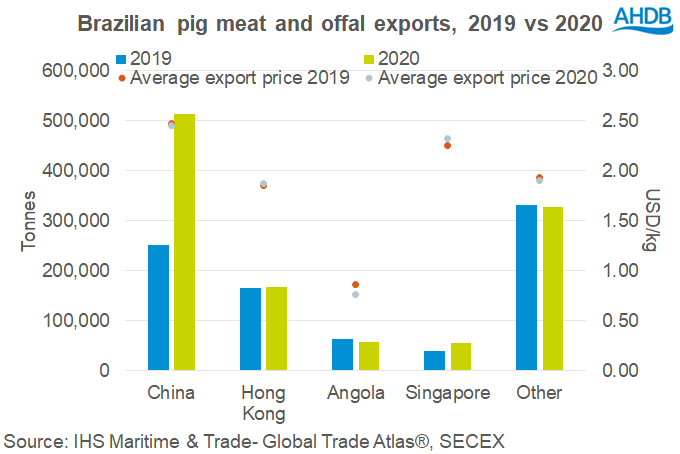

Brazil and China see growth in pig meat exports in 2020Demand from China was sustained due to the shortage of domestic pork while their herd is still recovering from African Swine Fever.

The Brazilian real weakened significantly against the US dollar in the middle of last year, attributed to the economic impact of the coronavirus pandemic. As such, while pork export prices have risen significantly in domestic currency, in US dollar terms, things have been more stable. This has helped enable large export volumes onto the global market. For 2020 overall, the value of Brazilian pig meat and offal exports was 81% up on the year, as prices rose by nearly 40%. In US dollar terms, value was 38% higher than in 2019, as prices were just 5% higher year-on-year.

Interestingly, this momentum does not seem to have been sustained into early 2021. There was a 5% drop in Brazilian pig meat exports during January, compared to year earlier levels. This was because shipments to Hong Kong were about half of the 2020 volume.

Overall, the USDA is still expecting growth in exports this year as increasing production outpaces recovering domestic demand. With Chinese demand expected to fall back, other markets may need to be explored, unless Brazil can capture more market share.

The shape of domestic demand will be dependent on Covid-19 developments in the country. Most Brazilian pork production is consumed domestically. If this market suffers, incentives to expand may be dampened, limiting supply, even if in the shorter-term exportable volumes are boosted. The weakness of the real will have also increased costs for imported products associated with pig production. Feed costs are also rising too, with strong export demand for feed ingredients, especially from China as producers there strive to rebuild the pig herd. Pig prices have risen to accommodate these changes, but unless there is robust demand on both the domestic and export markets, producers may find the market increasingly tricky.