Genesus Global Market Report Canada, January 2021: No relief (yet) with a tight race

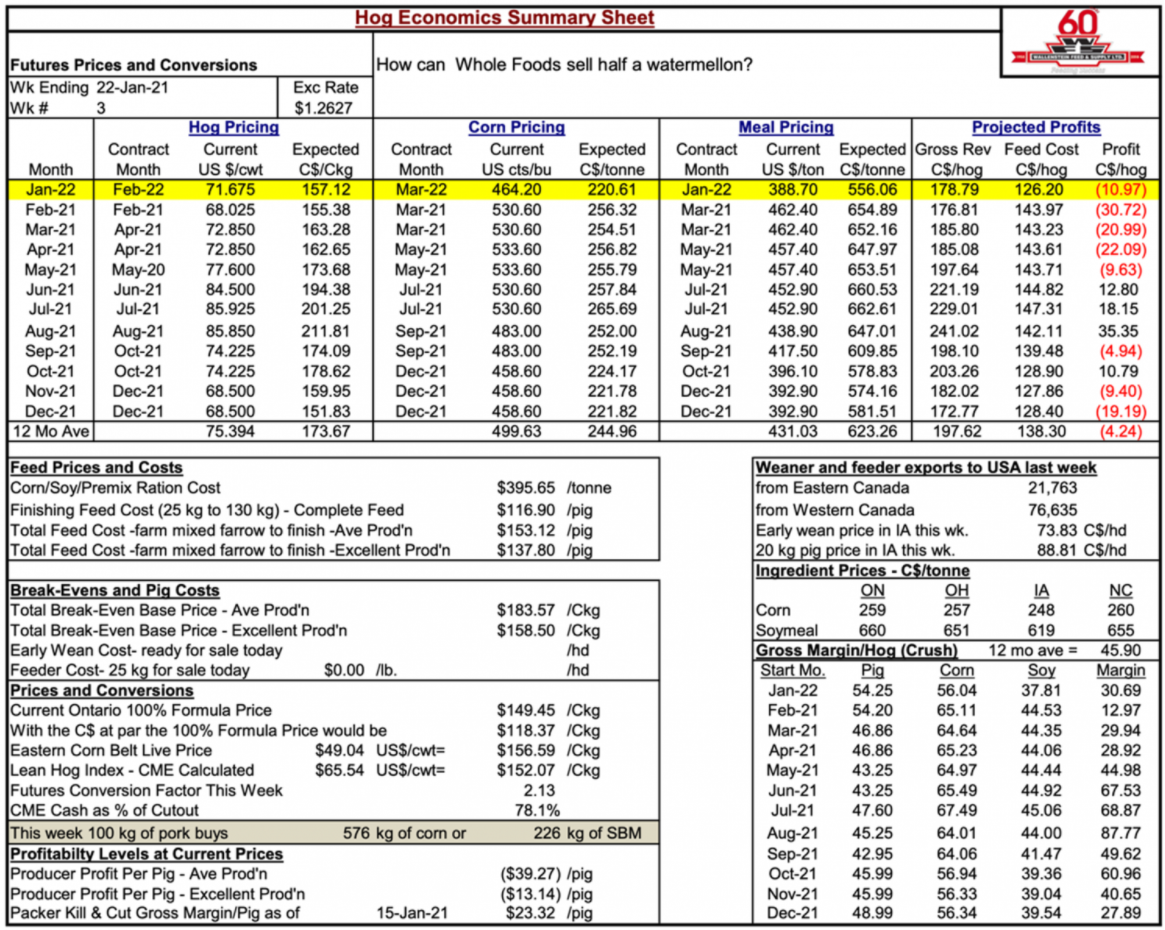

From November 30, 2020 - Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet showed profitability per pig with average production loss of (-$15.45). Then with the next twelve-month projection moving of $5.39. Not wonderful but at least positive numbers.

Now from January 22, 2021- Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet showed profitability (loss) per pig with average production more than doubling to (-$39.27). Then with the next twelve-month projection moving also to a loss of (-$4.24).

Ontario 100% Formula Price eroded from $158.14 to $149.45 but it was Total Feed Cost – farm mixed farrow to finish – Ave Prod’n moving from $139.13 to $153.12 that really crunched margins. Coming from corn moving from $221/tonne to $259/tonne and soybean meal moving from $628/tonne to $660/tonne in the course of eight weeks.

If in fact, we’re in a “commodity supercycle” we need it to come stronger to pork because right now grains are outrunning it.

So, the big question for the year becomes even if pork prices improve which futures are already showing a strong possibility can those prices out run surging corn and soybean prices. Presently it doesn’t look promising. Once again highlights the strength of many Ontario producer’s integration to land. That plugs at least some of your feed cost in at cost of production. Not perfect but does help to fight another day.

In addition, we have here the seemingly ever rising value of land. I had a recent conversation with a farm realtor who indicated had a farm listed with land, house, older baffed out barns that if sold for asking, which he expected, would work out to $35K per acre. Appreciating you can’t eat equity, certainly provides some considerable ballast.

Therefore, starting off the year we’re witnessing a tight race, but pork price is going to have to run a lot harder to provide a profitable year.