Genesus Global Market Report: Russia, October 2020

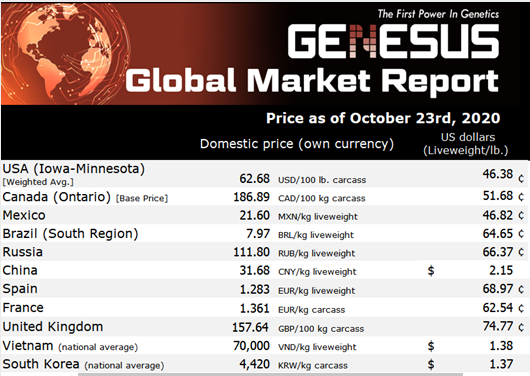

Pig price in Russia is 111.8 Roubles ($1.46) per kg live (with VAT). Covid and ASF, which has been causing havoc markets globally, is today having minimal effect on the Russian market.

Over the past couple of months, I have been managing to do some international travel. Once busy hub airports are virtually empty, many retail outlets closed, airport hotels empty and very different Covid rules country by country. It seems the real economic effect of the way Covid has been managed has not yet been seen!

Russia does continue to develop export markets for pig meat, although in percentage terms of total production exports are at a relatively low level. Russia also continues to build and stock new pig farms. This means more and more pork is going to be produced. We have recently seen in global markets what local oversupply (regardless of cause) does to farm gate pig prices.

In Russia nearly all of the focus on increasing sales is developing export markets. I do not see significant efforts on growing the domestic market. There are about 145,000,000 Russians. Just a 1kg per capita increase in Pork consumption is the production from about 60,000 sows.

Per capita pork consumption in Russia has been rather static over the past few years. This is in comparison to Chicken which has and continues to increase significantly. The same pattern that we have seen globally. Pig producers can blame the economy and spending power of consumers for lack of growth, but chicken consumption has grown in the same economy.

Maybe the pig industry needs to look at itself and ask why, not just in Russia, but globally, why consumption is not increasing at the same rate as for chicken. All sorts of ideas have been used to drive consumption including high welfare, ecological pork, antibiotic-free. None of these have had a real impact on total sales. They all miss the reasons people buy meat.

Price and taste are the two drivers of meat consumption. They are the two things that really matter to the housewife when doing the weekly shop, or the customer choosing what to eat from a restaurant menu. A bad eating experience is the best way to make sure the consumer does not repeat the purchase.

There are rumors around the Russian industry of plants with high levels of PSE and DFD meat and excessive drip loss. Genetics plays a significant part in meat quality as does management of the pig in the day before slaughter and the carcass in the hours after slaughter. Both PSE and DFD significantly affect meat eating quality.

Chicken is relatively low cost and very consistent in quality. Buy a Chicken and you are mostly guaranteed the taste and texture. There are a limited number of cuts (breast, legs and wings). There is little risk of being disappointed, the chicken industry has nailed consistency! For the consumer, chicken is an easy choice.

Go into many retail stores or meat markets in Russia and go to the pork counter. There you will see unrecognisable piles of pig meat, with different prices on it. What is the consumer buying? How can they recognise? If they have a good eating experience how can they buy the same thing again? If they have a bad experience, how do they avoid making the same mistake...simple, go to the chicken counter!

We have made the consumers decision to buy pig meat very difficult and made the decision to buy chicken very easy!

The next place we need to look is on our pig farms and slaughter plants. The variation in type and size of pig both on-farm and on the hook is incredible. I have visited pig farms and have been in pens of pigs where the number of genotypes in a single pen is well into double figures. How can we possibly even start to offer a consistent product to consumers?

Pig farmers decisions to buy this or that genetics are based upon what the cost is, how many piglets the gilt will produce, what the FCR will be or what the killing out percentage will be. There is never a single thought on what the final product will be like, will consumers want to buy it, how much will they pay for it, how much will they buy?

Can you imagine the car industry working in the same way? Designing a car based upon the cost to buy the seats, or how many wheels it should have. You would end up with the pork counter car…. A muddle of unrecognisable parts… No, car manufacturers start with designing the final product, the traits that will get buyers, and also calculating what buyers will pay. Once that is done they then decide how to produce it at the lowest cost and with a manufacturing process that guarantees every car (of the same model) is the same.

The Genesus breeding system is very simple. Pedigree Yorkshire X Landrace to produce F1 sows and a Pedigree Duroc boar. Consistent, every pig the same!

A synthetic or hybrid boar is already a mix of breeds. In any mix it is not possible to predict how genes will combine. Straight away inconsistency. Add sire line trials of multiple pure and synthetics boars, more inconsistency.

Maybe when looking at pork consumption figures we should blame ourselves. We produce what we want and then expect the consumer to buy it. The consumer is telling us that this is not what they want.