Surge in Chinese imports pushes global pig prices higher

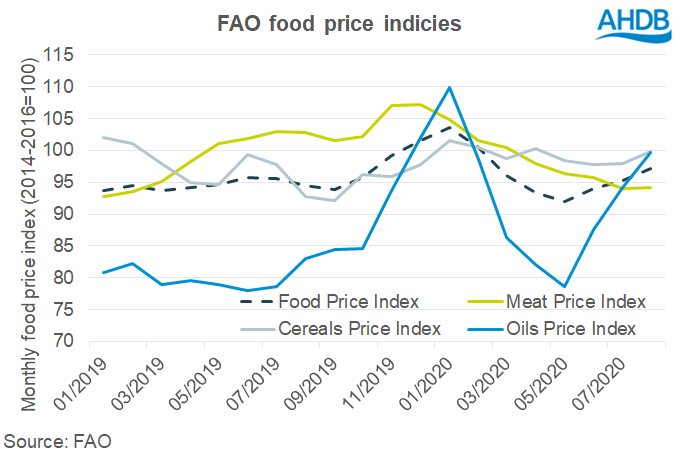

Bethan Wilkins, AHDB senior analyst for red meat, explains recent trends in the FAO Meat Price Index.Last week, we showed how global pork prices, represented by average export prices from the key global suppliers, were declining for the first half of the year. This week, we look at how this relates to recent trends in the FAO Meat Price Index, which offers insight into how global export prices have developed in July and August.

The FAO Meat Price Index for the most recent months is derived from a mixture of projected and observed prices, as most actual prices are not available at the time it is published. While this means the figure is subject to revision, it also gives a more up to date indication of global price trends.

The FAO Meat Price Index averaged 93.2 points in August, almost unchanged from the July value. Within this, quotations for beef, poultry and sheep meat declined. By contrast, pig meat prices rose after four months of consecutive declines. The Meat Price Index is now 8.6 points lower than in August 2019 and 10.7 points lower than early this year.

According to the FAO, the recent rise in pig meat prices is explained by a surge in Chinese imports (which reached 548,000 tonnes in July, another record high). Meanwhile, global supplies tightened somewhat due to lighter slaughter weights, coupled with prolonged plant shutdowns in some producing regions.

In contrast, the FAO Food Price Index averaged 97.1 in August 2020, nearly 2 points above its July value and 3 points more than in August 2019. The Food Price Index has risen back near to levels seen in February and has been driven up by the weaker US dollar, which provided support to international prices of most agricultural commodities. Price increases were most pronounced for sugar and vegetable oils, though cereal prices have also firmed, albeit more modestly.