Genesus Global Market Report: EU and Spain, July 2020

We are coming out of the health alert trying to get back to normal, but we are far now from what we understood as "normal life" a year ago. The price of pork has been falling since the state of alarm was declared until four weeks ago, losing 14.7 percent of its value. Then price started to recover until last week.

Various events in the EU have caused this trend to change. On the one hand, the closure of the largest processing plant in Germany/Europe, Tonnies-Rheda, three weeks ago; and on the other hand, the suspension of exports to China from various European slaughterhouses: 3 Dutch, 1 German and 1 British.

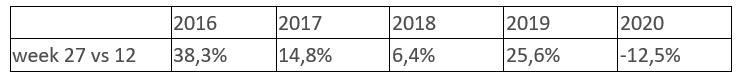

These events have placed live selling price at 12.5 percent lower than in the week of March 16 (week 12), while in the same period last year we were at 25.6 percent increase.

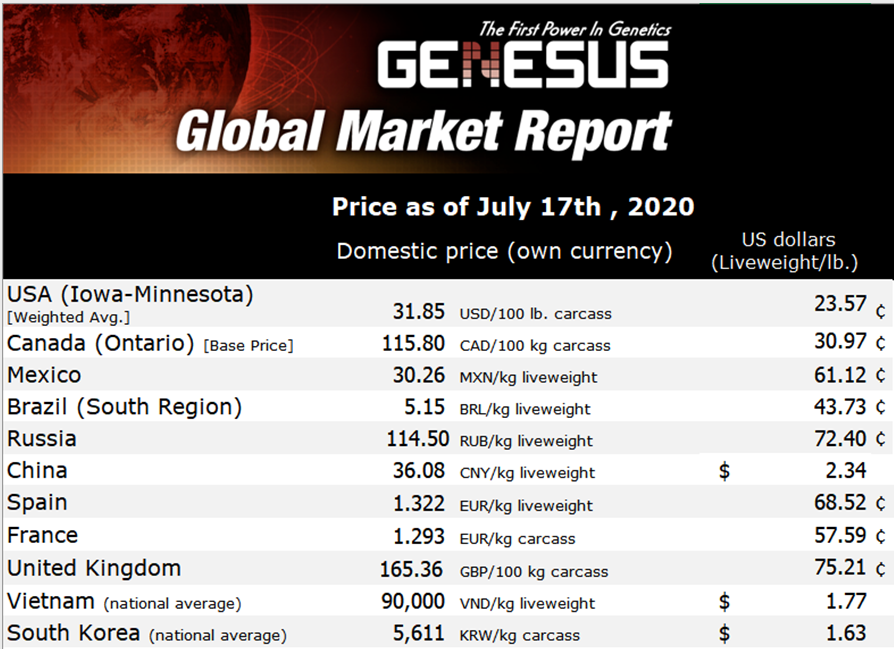

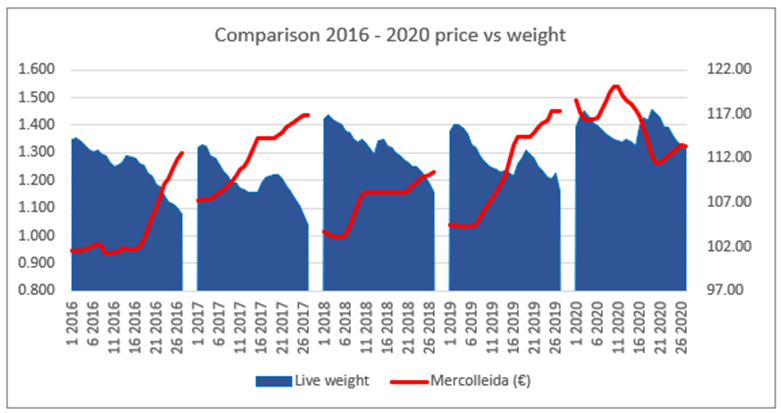

Market hog price for this week is 1.322 euros/kg live weight, compared to 1.451 euros/kg live weight a year ago. With a weight of 111.98 kg (87.19 kg carcass) compared to 107.48 kg (83.80 kg carcass) then. Weights, although falling due to the summer heat, are still well above previous years.

This situation has also dragged the piglet market, having more supply of animals that can now be fattened and/or slaughtered in northern Europe, which sets the price of a 20kg piglet at 24.5 euros.

All this can be summed up as:

- As of now fewer and lighter pigs in Spain (summer seasonal)

- Some packing plants in Europe cannot export to China results in excess meat

- Lower domestic demand

There is an imbalance between supply and demand in the EU, which has led to a very turbulent situation with great uncertainty. This obviously has repercussions on the Spanish market, and even though here there is a certain balance between supply and demand, the price of meat is falling.

The Spanish packing plants that can still export to China, although slower due to the measures implemented by Covid-19, are taking advantage of the gap left by the other packing plants in Europe and reaching 37 percent of total Spanish exports. These exports are what are sustaining the market, both in quantity and price.

In 2019, China was the main non-EU destination for the Spanish pig sector, absorbing 27.2 percent of exports in volume (663,892 tonnes) and 23.0 percent in value (1,441 million euros).

However, the packing plants unauthorized to export to China are suffering the pressure of excess meat. They cannot lower their production because they have fixed costs to bear. In addition, domestic consumption, with the decline in tourism, has been greatly reduced.

Finally, there is the Iberian pork sector, this was first to collapse with prices well below cost, and than started to recover slowly. Now the Iberian pig sales at 1.48 - 1.60 euros/kg live (estimated cost of production 1.55 - 1.60 kg).

There are three different markets within the same industry in Spain, connected to each other but with very different results.

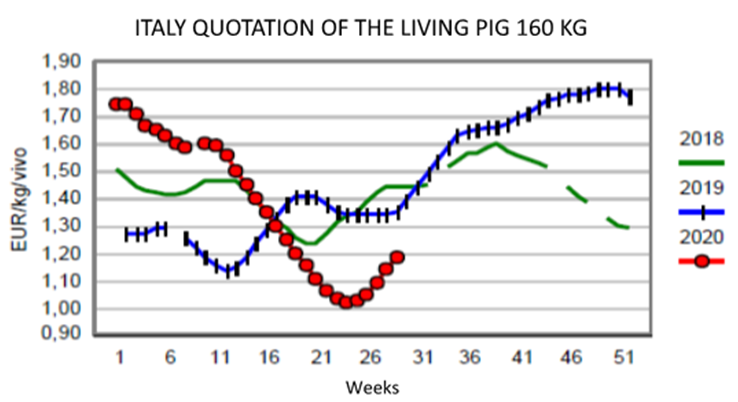

Italian Market

In the Italian market, contrary to the problems in northern Europe, the relationship between demand and supply has not changed and consequently, the price has been rising since mid-June. Price is 1.18-1.19 euros/kg live with average weight dropping to 173.5 kg compared with 176.6 kg two months ago.

All the market indicators show a continued rise in prices.