Genesus Global Market Report: Canada, June 2020

Eight weeks ago, I suggested the Canadian pork industry was a mess. I was hoping now (eight weeks later) to be able to alter my prognosis. Unfortunately, all I could add now is, it’s a hot mess.

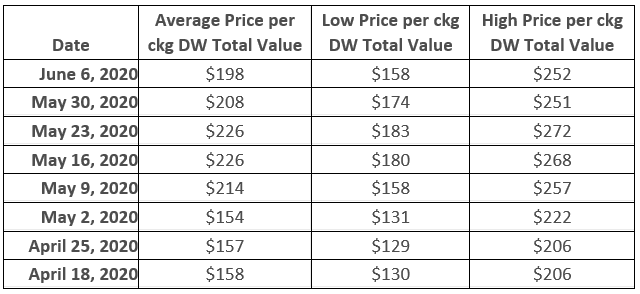

Below is a table from Ontario Pork’s weekly reporting of the average, low and high total return to producers per 100 kilograms dressed weight.

As you can see it truly is a Tale of Two Cities (or rather two producers). The spread is $75+ per hog, stretching to $100 per hog. Such that you have producers going broke with a crowd around (along with some being challenged to move their hogs at whatever price). While other producers have arguably rarely had it so good. Most of this wide discrepancy comes by whether, like Conestoga producers, you’re priced off the meat or like some other producers you have a contract that at least includes some percentage of the cutout. Although the spread between cutout and cash hogs is narrowing, we have gone through a period of an unprecedented spread, leading to huge price discrepancies.

On a brighter note due to some heroic efforts of front-line workers, packers, and others (particularly in Quebec) the backlog of hogs from COVID-19, while not eliminated, has been greatly reduced. Such that to the best of my knowledge few if any hogs have ultimately been euthanized. My apologies (and sympathies) to any producers who have in fact in Canada had to euthanize hogs. Although seemingly minimal to the industry, certainly not minimal to any producer so affected.

Further in these chaotic times reports of SEW/feeder pigs moving from Manitoba to Ontario. Seemingly some opportunistic buying. “Five-dollar pigs, how can I lose”. Unfortunately, we have had other occasions of “let me count the ways”. At the same time, these pigs are being passed by Olymel market hogs from Ontario heading west as far as Olymel’s plant in Red Deer, Alberta. Hard to imagine there would be change on sixty dollars per head freight. Would seem to make little to no sense but given present packer margins apparently it does.

Got to the point where one wouldn’t be surprised to see the sunrise in the west, as we see the strong possibility of fourth-quarter hog prices being better than second quarter. What’s normal???

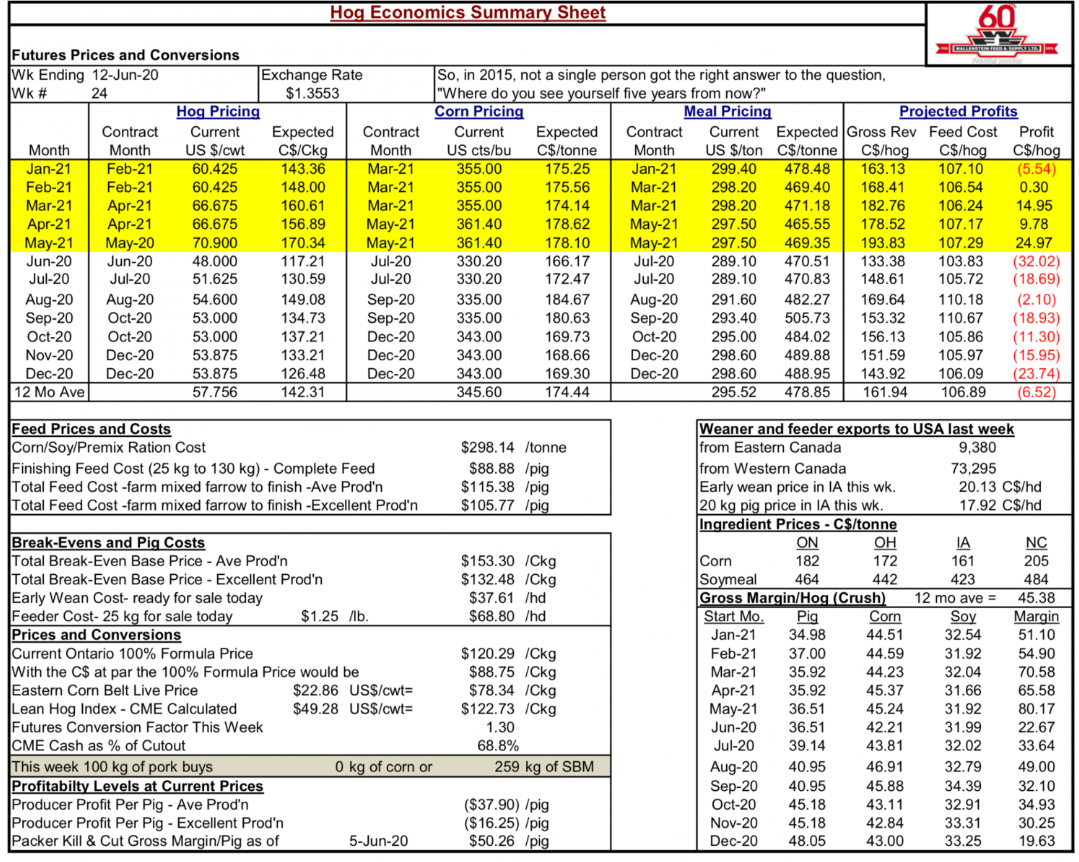

Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet shows little in the way of encouragement from eight weeks ago, profitability going from per pig with average production loss of (-$44.43) to loss per pig with an average production of (-$37.90). A $6.53 per pig increase in revenues that for some at least only says “you’re not bleeding as fast”. Then with the next twelve-month projection moving from (-$17.61) to (-$6.52). Arguably moving in the right direction but the promise to just lose less money hardly something to get enthused about.

Let’s hope the cavalry shows up with next week’s USDA June Hog & Pig Report or there’s going to be a line up on liquidation.