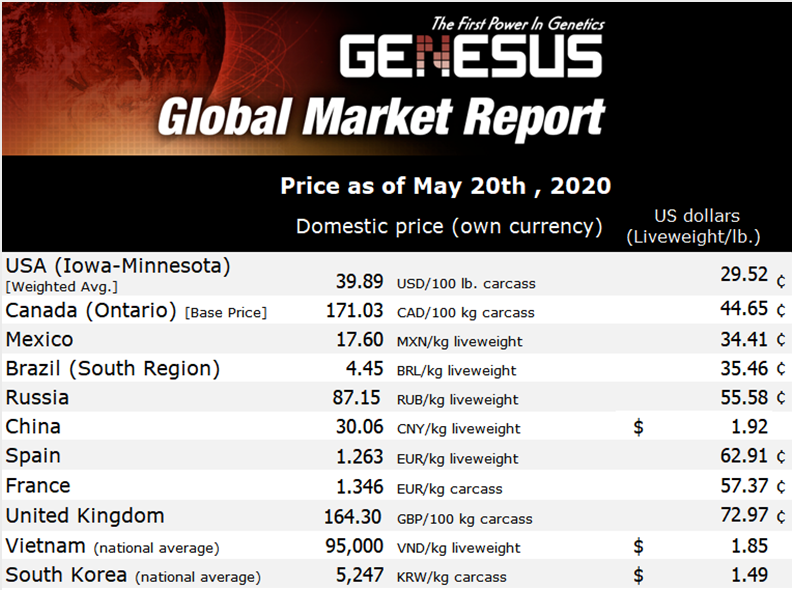

Genesus Global Market Report: Europe and Spain, May 2020

In my last report eight weeks ago, we were one week into the state of health alert in Spain, today we are still there, but little by little easing the restrictions and trying to go back into making "a normal life." The situation is difficult and complicated in our pig sector, although looking at the rest of the industries, we are perhaps in one of the best possible scenarios.

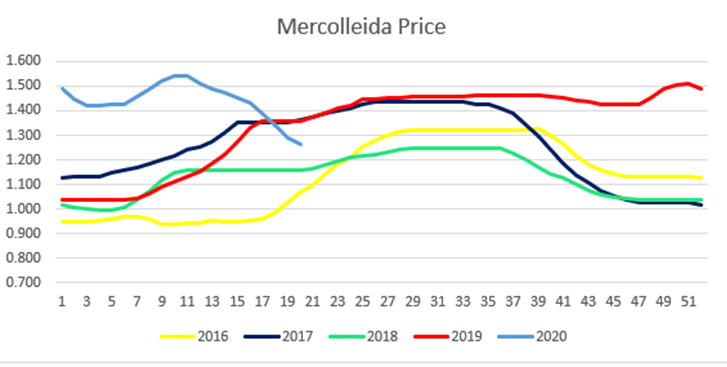

When the state of alarm began, the price of Mercolleida was €1.54 / kg live weight and the feeder pig was €70.50 /head. Today we are at € 1,263 / kg live weight for market hogs and feeder pigs priced at € 35/head. That is to say, the price has dropped in two months € 0.277, which represents 18 percent and the 20 kg pig has dropped by € 29.5, which represents a drop of 58 percent.

We cannot ignore the fact that we started from a remarkably high price, the situation is complicated but not disastrous for the vast majority. Even so, the producer who bought piglets above €100 (Mercolleida price plus the premium), will lose money.

The market weight increased; it is at 117.11 kg compared to 112.53 kg a year ago (90.90 kg compared to 87.34 kg carcass weight). This increase in weight obviously helps in lowering the price, but what has influenced was the international export market price. More precisely, the trade situation between China and USA, and closer to home, some issues in Germany and France with packing plants because of Covid-19.

In Spain, the activity of the packing plants has been affected by COVID 19 as well, but with tremendous effort and particularly good management, most have been able to move production forward. Production has slowed down, implementing safety measures, social distancing, and increased work shifts, but there are no packing plants to completely shut down so far.

To this extraordinary situation, we must add the normal abundant production months of the year considering Easter and May´s holidays. At this time of year, a year ago the packing plants increased their activity to absorb this surplus. This year they have not canceled incoming scheduled trucks, but they do not accept extra hogs. This has also influenced the drop in prices at a time of year in which we normally see a rise.

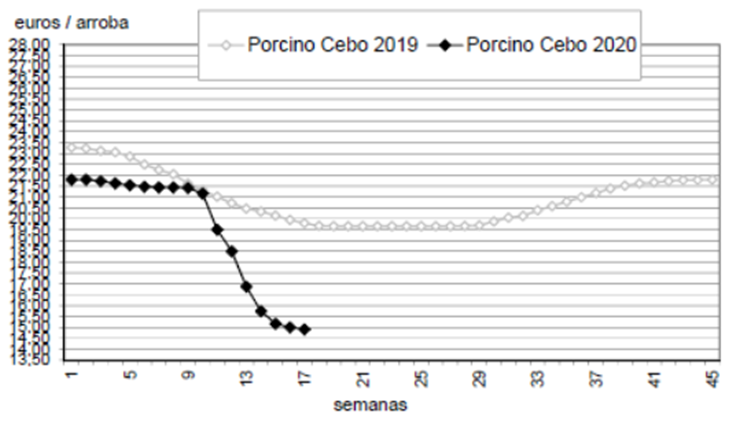

Those who have been most affected, and this crisis has caught them by surprise, have been the ones in the sector of Iberian Ham production. When its main marketing channel closed (hotels, restaurants, and coffee shops) and gatherings restricted, it has collapsed.

Iberian pig production represents 13.5 percent of total production. The sale price in the week of March 23 was at € 1,808/kg liveweight and eight weeks later is at € 1,231/kg liveweight, falling below white-pig price level of € 1,263 / kg. A drop of 32 percent in just 8 weeks. As a reference, the average production cost according to SIP Consultors in 2019 was 1.51€/kg liveweight pig produced for Iberian production compared to 1.07€ for white-pig production.

Question is: have we hit rock bottom or is this situation going to get worse? There is a lot of uncertainty.

With the arrival of summer, hog growth will be affected and therefore supply will decrease. In a normal year, this season, demand rises as well given the wave of tourists. This year much depends on whether the HORECA channel (Hospitality industry) will begin to open. While the “barbecue” season is here, tourism clearly will not level the years before.

Good management over the export market can make the difference between whether we have hit bottom, or the prices will continue to fall.

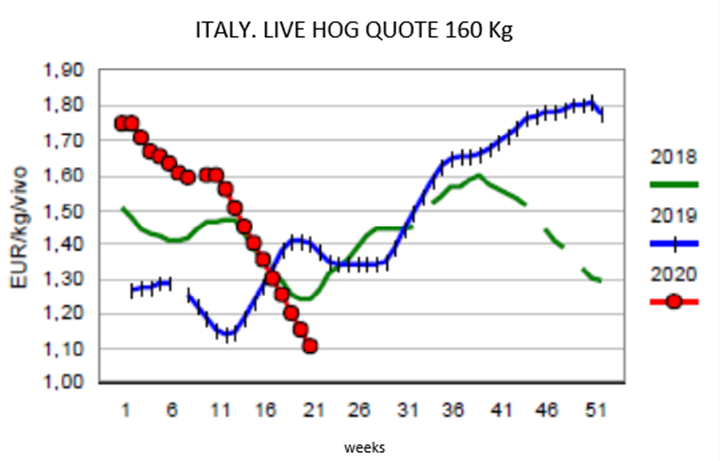

Italian market

Italy in 2020 started it with a record price for the last three years, hovering around €1.80 / kg of liveweight. Because of COVID 19, the decrease has been tremendous, setting the price last week at € 1,152 / kg for the Jamón de Parma (Parma ham) circuit and € 1,054 / kg for animals outside Parma circuit.

Almost all Italian market hog production is at 160-180 kg liveweight and destined for cured ham. Most demand comes from the HORECA channel. Like in Spain, closure of this channel negatively affected demand. In addition, health regulations against Covid19, prevents packing plants to function at full capacity. Farmers are losing money, while the processing plants margins have increased. The average cost of production for a market hog is estimated to be between €1.55-€1.60 kg liveweight.

Delays in processing have pushed hog weights to record levels, last week 176.6 kg! Supply is outpacing demand by 15-20 percent.

There is uncertainty on the market, although some more optimistic consider that in three, four weeks there will be a change towards a more positive outlook.