US pork and grain markets hit year marketing highs

Global economic recession or even depression that is likely in the coming months is keeping the world’s meat markets in a downward spiral.The COVID-19 pandemic has shut down parts of the US meat industry. Plants across the US are reducing production or have completely shut down as coronavirus cases spread from cities to rural locations. At least three people who worked at plants owned by top US meat packer Tyson Foods and a local unit of Brazil’s JBS were reported to have died from the pandemic. Companies including Cargill, Sanderson Farms and Perdue Farms have also reported coronavirus infections of their employees.

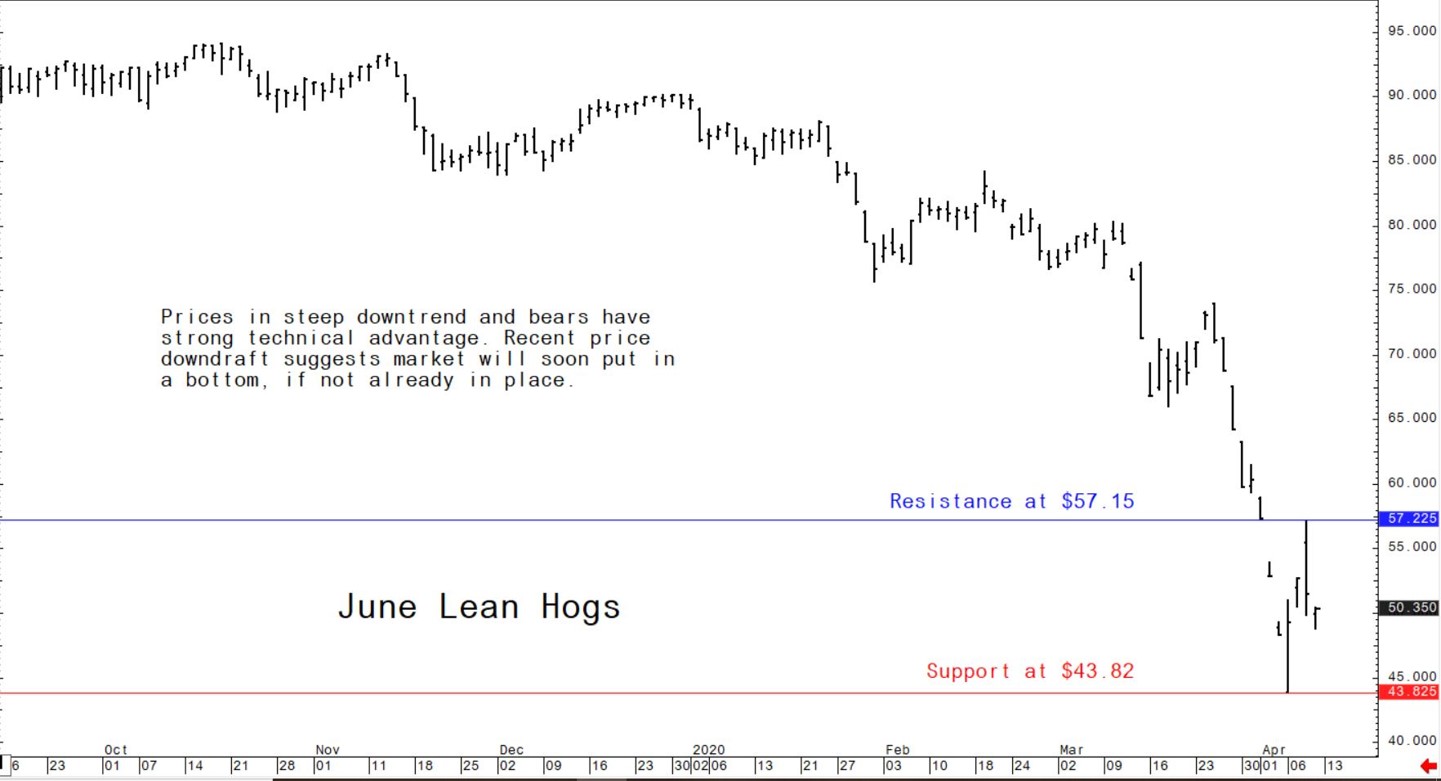

US pork prices continued to fall this week. Volatile trading is seen in lean hog futures, with prices seeing big moves both on the upside and downside. The meat processing cuts due to COVID-19 are renewing concern about bulging US pork supplies. Pork movement has picked up in the US, but it took a big drop in prices for that to occur and prices have shown little sign of bottoming.

A positive this week is that the rate of new infections in the US and Europe has slowed. Global stock markets have rebounded recently, including US stock indexes that have now started near-term price uptrends, to suggest that market bottoms are in place. There is now growing speculation that the US economy will restart on May 1 - at least a partial reopening. All of this is good news for the beleaguered pork industry. Also, as the worst of the COVID-19 passes and as temperatures warm up, the barbecuing season will be at hand, with consumers eager to put some tasty pork on their grills. There is light at the end of this dark tunnel.

The next week’s likely high-low price trading ranges

June lean hog futures: $43.82 to $57.15, and with a sideways bias.

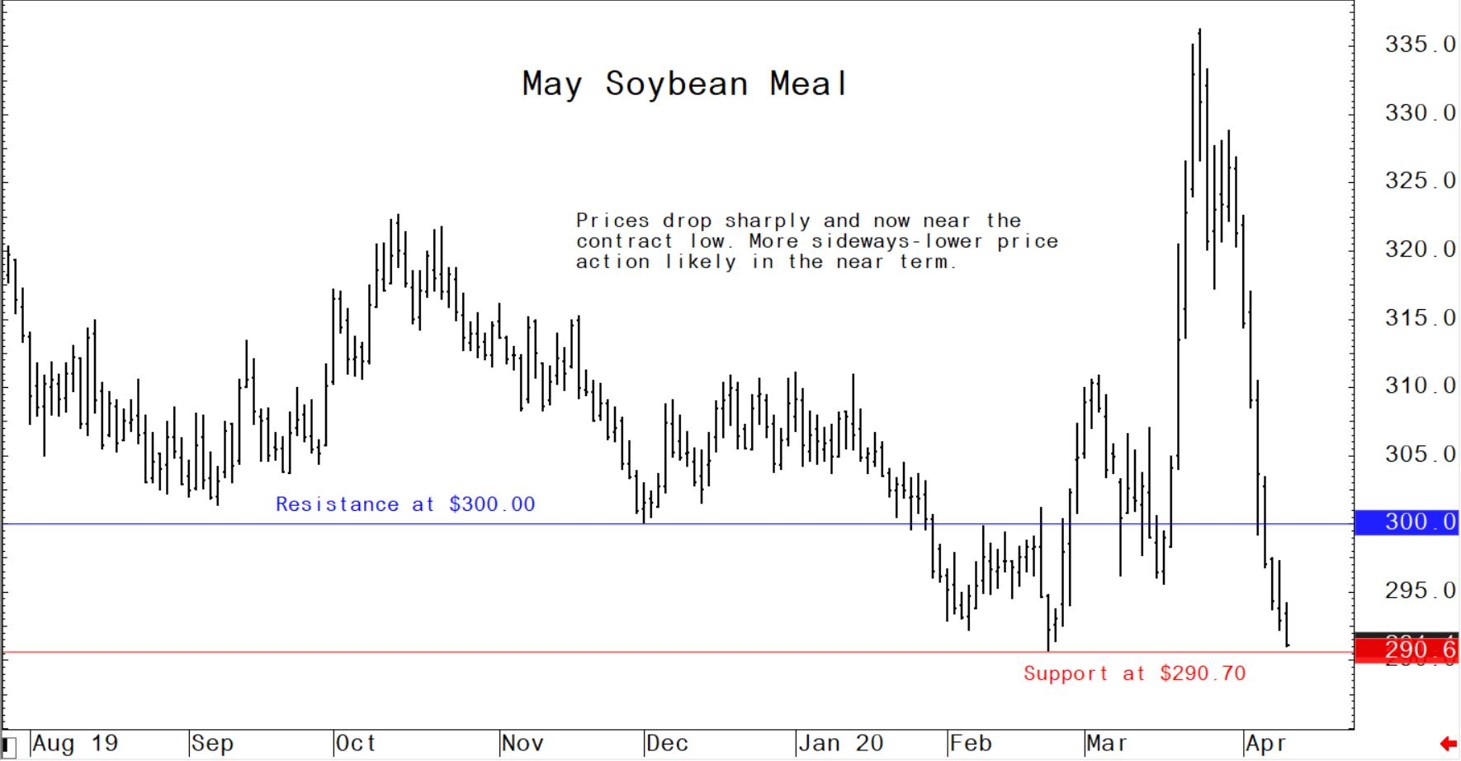

May soybean meal futures: $280.00 to $300.00, and with a lower bias.

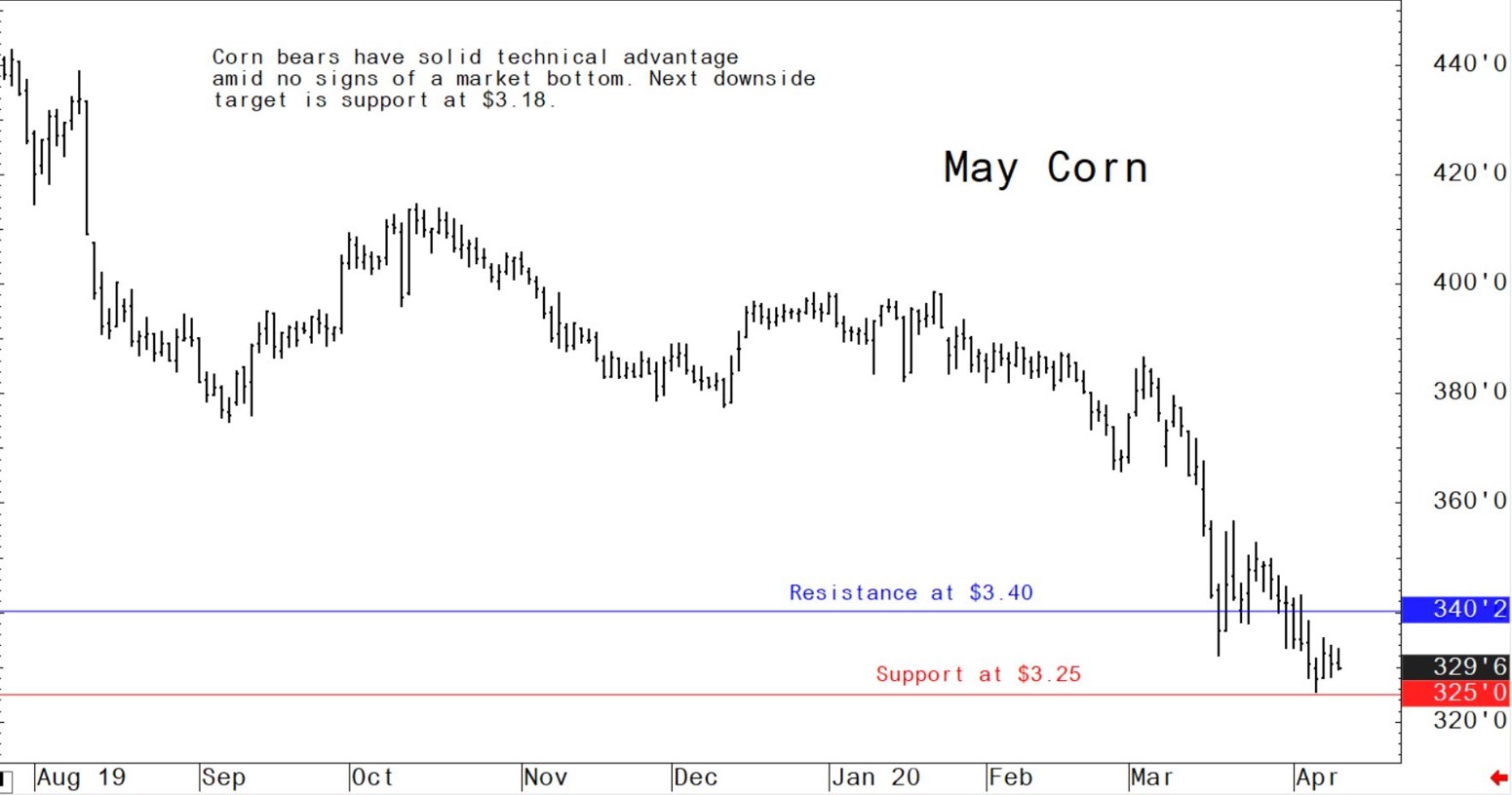

May corn futures: $3.25 to $3.40, and a sideways-lower bias.

US pork export sales remain solid

The USDA on Thursday in its weekly export sales report showed US pork net sales of 55,900 metric tons (MT) reported for 2020 - a marketing-year high - were up 47 percent from the previous week and up noticeably from the prior four-week average. Increases primarily for China (38,700 MT), Mexico (6,600 MT), Japan (3,900 MT), South Korea (2,300 MT), and Australia (2,300 MT), were offset by reductions for Canada (900 MT) and Nicaragua (400 MT). Exports of 38,300 MT were down 5 percent from the previous week and 13 percent from the prior four-week average. The destinations were primarily to China (16,300 MT), Mexico (8,500 MT), Japan (4,900 MT), South Korea (2,700 MT), and Canada (2,200 MT).

© Jim Wyckoff

US corn net export sales of 1,848,900 MT for 2019/2020 - a marketing-year high - were up 72 percent from the previous week and 41 percent from the prior four-week average. Increases primarily for Japan (702,600 MT, including 130,800 MT switched from unknown destinations and decreases of 6,500 MT), South Korea (331,900 MT, including 86,000 MT switched from unknown destinations and decreases of 4,300 MT), Mexico (179,600 MT, including decreases of 1,700 MT), Saudi Arabia (139,100 MT, including 135,000 MT switched from unknown destinations), and Israel (65,000 MT), were offset by reductions for Nicaragua (200 MT). For 2020/2021, net sales of 608,800 MT were for China (504,000 MT), Mexico (99,5000 MT), unknown destinations (4,000 MT), and Guatemala (1,300 MT). Exports of 1,290,300 MT - a marketing-year high - were up 3 percent from the previous week and 31 percent from the prior four-week average. The destinations were primarily to Japan (377,800 MT), Mexico (315,300 MT), South Korea (154,000 MT), Saudi Arabia (139,100 MT), and Taiwan (77,900 MT).

US soybean cake and meal: Net sales of 193,300 MT for 2019/2020 were up 55 percent from the previous week and 23 percent from the prior four-week average. Increases primarily for Canada (54,300 MT), Guatemala (52,100 MT, including 5,000 MT switched from El Salvador and decreases of 1,000 MT), Mexico (20,700 MT), Morocco (17,000 MT), and the Dominican Republic (16,700 MT), were offset by reductions for El Salvador (5,000 MT), Colombia (2,200 MT), and Ecuador (1,300 MT). Exports of 273,100 MT were down 16 percent from the previous week, and 9 percent from the prior 4-week average. The destinations were primarily to Mexico (49,100 MT), the Philippines (44,600 MT), Canada (42,300 MT), Colombia (36,900 MT), and Ecuador (21,800 MT).

© Jim Wyckoff

© Jim Wyckoff