Grim reality of severe global economic recession slams meat industry

The mood of the global marketplace turned more sombre this week, following a grim assessment Tuesday afternoon by US President Trump regarding the COVID-19 outbreak.Over the next two weeks things are going to get “really bad,” he said. Few buyers are stepping in to participate on the long side of any commodity futures markets under these circumstances, including livestock futures markets.

In the US, reports of heavier sow liquidation signal even tougher times could lie ahead. Average hog weights in the central US fell 0.8 lbs the week ending 28 March, to 285.4 lbs, which is 0.7 lbs under year-ago levels. US packer profit margins have fallen to just $16.10 a head as of Wednesday - nearly a $24 plunge from a week earlier. There are reports of heavy sow liquidation, with producers paying $5 a head to take baby pigs.

One positive in examining the US lean hog futures market: The recent large losses are a “washout” type price move that history shows tends to put in market bottoms - and sooner rather than an extended period of time when new price lows are being scored.

The next week’s likely high-low price trading ranges

June lean hog futures: $55.00 to $60.00, and with a sideways-lower bias.

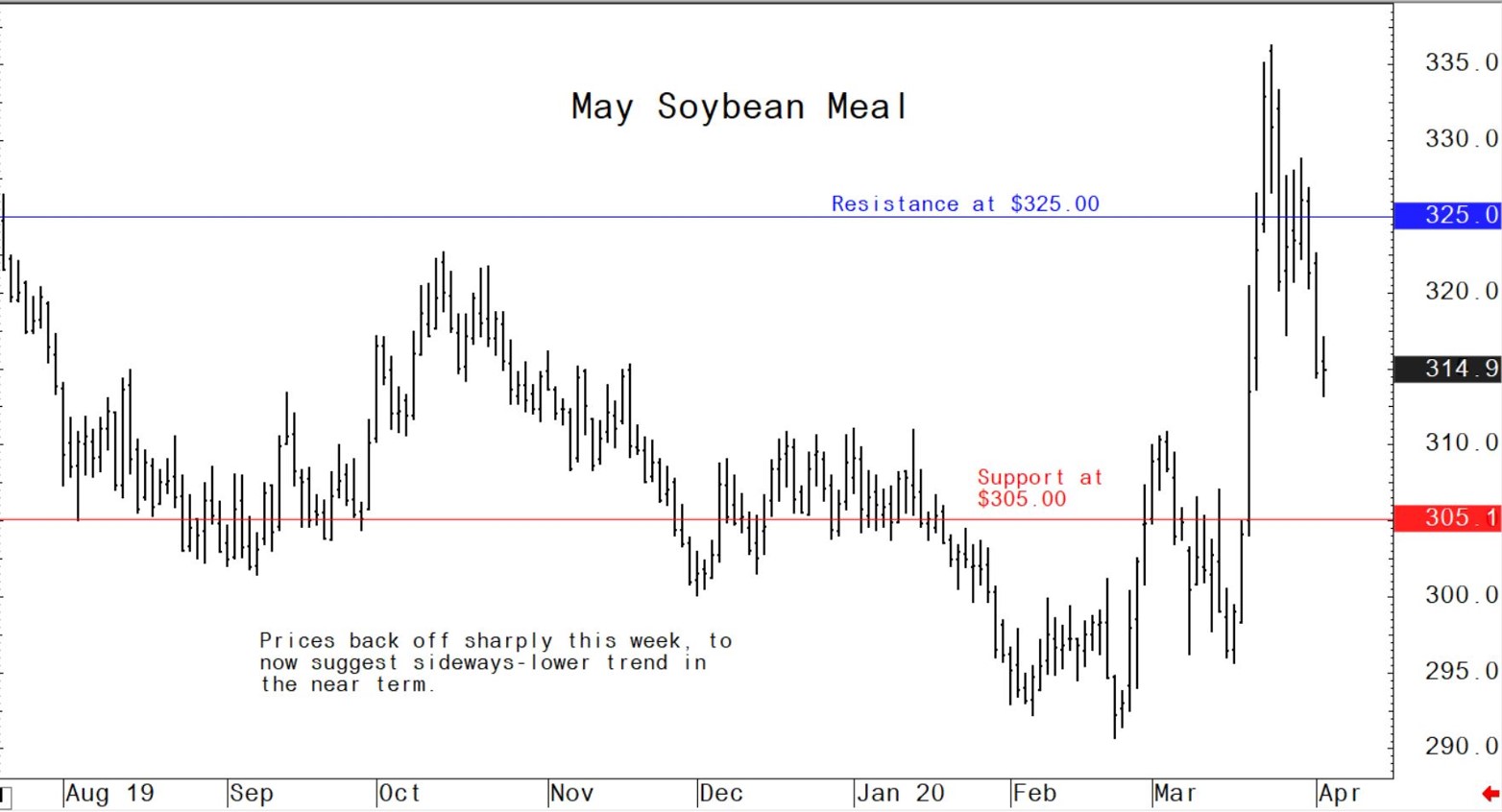

May soybean meal futures: $305.00 to $320.00, and with a sideways-lower bias.

May corn futures: $3.30 to $3.45, and a sideways-lower bias.

US pork export sales remain a bright spot in beleaguered industry

The weekly USDA export sales report showed US pork net sales of 38,200 metric tons (MT) reported for the 2020 marketing year - down 1 percent from the previous week, but up 88 percent from the prior four-week average. Increases were primarily for China (18,900 MT), Mexico (8,500 MT), Japan (4,000 MT), South Korea (2,200 MT), and Canada (1,600 MT). Exports of 40,200 MT were down 17 percent from the previous week and 11 percent from the prior 4-week average. The destinations were primarily to China (16,200 MT), Mexico (9,400 MT), Japan (5,100 MT), South Korea (2,700 MT), and Canada (2,200MT).

Market watchers focus on manufacturing, processing plants amid COVID-19

Poultry and meat processing plants are some of the workplaces where tensions between workers and employers are rising amid the COVID-19 situation, according to a report in the Wall Street Journal. Workers at meat plants, in particular, are concerned about their proximity to other workers. Some plants have spaced workers farther apart and staggered shift starts and break times. Tyson and others have begun offering employees masks and gloves and taking their temperatures, the report said. Tyson Foods said a small number of workers have tested positive and they have set in place efforts to address situations where employees may have had contact with an infected worker. However, the concern is not over transmission of the virus through food, but from worker to worker.

China imports more than 4,000 breeding pigs

More than 4,000 high-quality French breeding pigs have arrived in China so far this year, in what is expected to be the first of many such imports needed to rebuild the Chinese hog herd, reports this week said. Around half of China’s hog herd was wiped out by African swine fever. The Chinese government has been working on various programmes to encourage herd rebuilding, with some provinces offering import subsidies of around 2,000 yuan ($282) per pig. China’s customs office is working to resume imports of live pigs from the United States. Coronavirus restrictions could disrupt any shipments near-term, however.

© Jim Wyckoff

© Jim Wyckoff