Fresh demand for grains from China means favourable position for US pork

The agricultural market bulls saw a glimmer of hope this week when reports started surfacing that China will increase its commitment to purchases US commodities as part of the Phase 1 trade deal.Reports said China is soon to buy 10 million metric tonnes (MMT) of soybeans and 20 MMT of corn for its stockpiles, in order to avert supply-chain disruptions from the COVID-19 pandemic and honour the trade deal with the US China had committed to ramp up purchases of US agricultural products in a trade agreement with signed in January. Thursday USDA announced daily export sales of 272,000 MT of US soybeans for delivery to China during the 2019-20 marketing year. That follows Wednesday’s announcement of the sale of 198,000 MT of old-crop soybeans to China. This is also good news for the pork industry as China works to resupply its swine herd.

Wednesday’s USDA Cold Storage meat report showed a larger month-to-month drawdown in frozen US pork stocks than is typically seen, confirming talk about strong US pork exports last month.

The 800-pound bearish gorilla in the pork industry is the efforts to keep packing plants and kill lines operating at full speed. Tyson Foods shuttered its large plant in Iowa plant Wednesday and announced it would close an Indiana plant to test workers for the COVID-19 virus.

The next week’s likely high-low price trading ranges

June lean hog futures: $45.00 to $50.00, and with an upside bias.

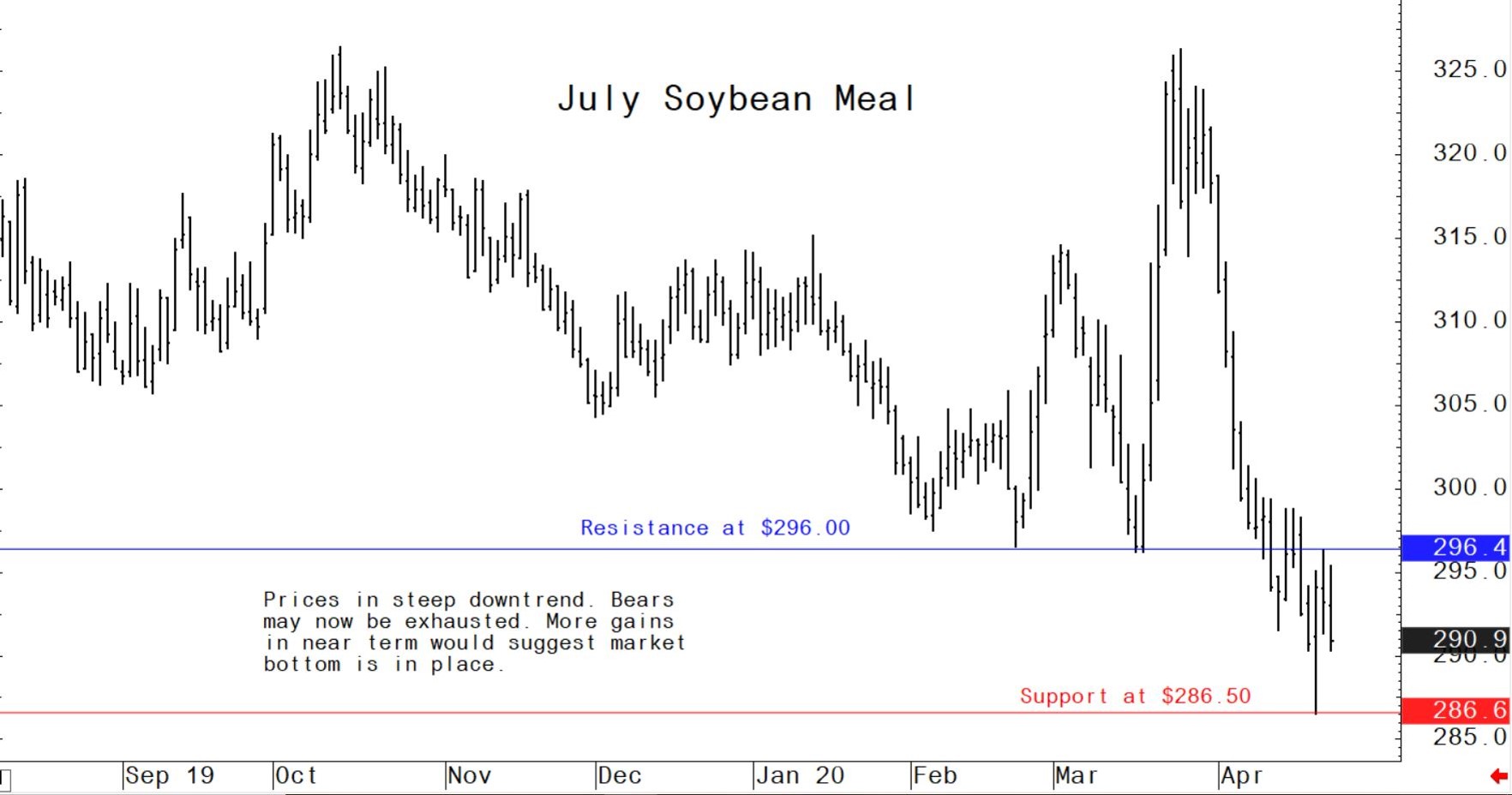

July soybean meal futures: $286.50 to $300.00, and with a sideways bias.

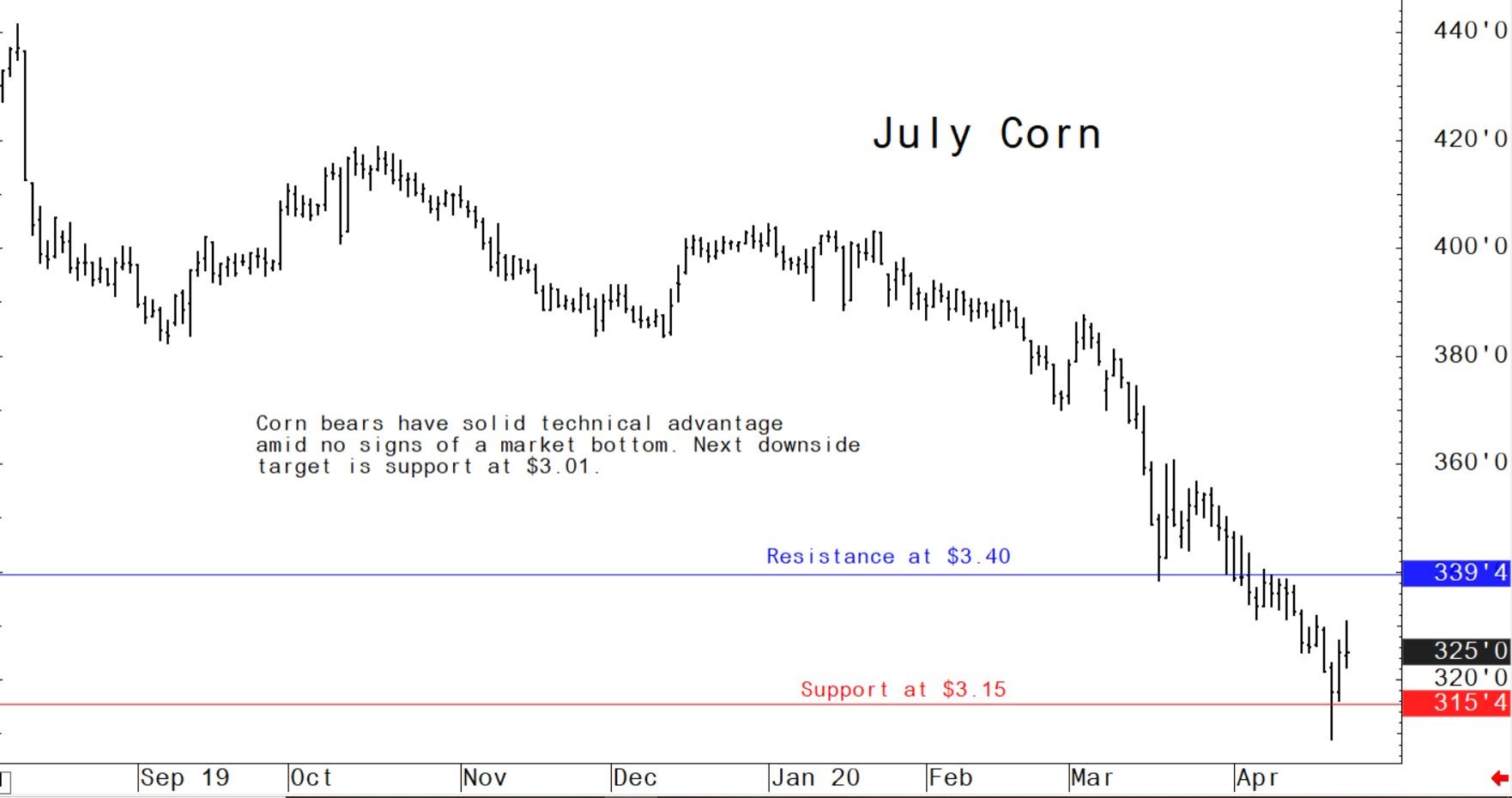

July corn futures: $3.15 to $3.35, and a sideways.

US pork export sales back off a bit but still outshine beef sales

The weekly USDA export sales report showed US pork net sales of 39,800 metric tonnes (MT) reported for 2020 were down 13 percent from the previous week and 11 percent from the prior four-week average. Increases primarily for Mexico (13,700 MT), China (9,700 MT), Japan (4,400 MT), South Korea (3,400 MT), and Canada (2,500 MT), were offset by reductions for Austria (100 MT). Exports of 40,900 MT were up 12 percent from the previous week, but unchanged from the prior four-week average. The destinations were primarily to China (18,400 MT), Mexico (9,200 MT), Japan (4,100 MT), South Korea (2,700 MT), and Canada (2,100 MT).

USDA livestock and products semi-annual report for China: swine herd increasing

African swine fever (ASF) has devastated China’s swine industry since August 2018. Despite low official reported cases of ASF and robust recovery efforts in the second half of 2019, overall swine production and slaughter will remain depressed in 2020.

Further complicating matters is the coronavirus outbreak in China, but it is likely that there will be sufficient market incentive and political stimulus to push forward with recovery efforts. As a result, the 2020 ending hog inventory is expected to increase slightly from 2019 as the decline bottoms out.

With low pork production in 2020 resulting in high pork prices, many Chinese consumers will seek out beef as an alternative protein. While elevated beef prices will spur some larger facilities to increase cattle production, most smaller facilities will be cautious in the face of uncertain pork prices and rising input costs. Overall, cattle ending inventories are expected to remain basically flat through 2020. The majority of increased beef demand will be satisfied by imports.

Hog and sow inventory are both starting at low levels, having fallen 27 and 30 percent respectively from 2019’s starting inventory. Due to robust restocking efforts in 2020 and fewer losses to ASF, the decline in herd inventory will reverse and year end 2020 inventories are forecast to grow by 9 percent.

Total hogs slaughtered and pork production in 2020 are both estimated to fall further by 24 percent and 20 percent, respectively, from the previous year. Pork Consumption: High prices will force many Chinese consumers to seek out substitute proteins or decrease net meat consumption. The Chinese government will continue to use multiple market and policy interventions in an attempt to stabilise prices.

As the pork supply remains tight through 2020, pork imports will increase to a record 3.9 MMT. However, China’s pork supply gap vastly outstrips available global supply, resulting in persistent high prices.

The signing and implementation of the US-China Economic and Trade Agreement (ETA) will open the doors for increased imports of US pork and beef, including processed meat products. Also, tariff exclusions for US meat imports will spur additional purchases in 2020.

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff