COVID-19 pandemic continues to inflict heavy toll on US hog and feed industries

Pork producers, like most other agricultural sectors, are trying to figure out how to stay afloat, financially, during this most difficult period - holding out hope that world economies will begin to ramp up activity as soon as next week.The COVID-19 pandemic that has severely damaged the global economy continues to inflict a very heavy toll on US and European agriculture. Pork producers are in dire need of government assistance.

The US government announced this week a $19 billion relief programme to help US farmers weather the impact of the coronavirus – including food buys for poor Americans and $16 billion in direct payments.

It was initially announced that the Government would purchase milk and meat products as part of a $15.5 billion initial aid package to US farmers hurt badly by the COVID-19 pandemic. USDA Secretary Sonny Perdue said, “We want to purchase as much of this milk, or other protein products, hams and pork products, and move them into where they can be utilised in our food banks, or possibly even into international humanitarian aid.”

More US meat-packing plants were closed or saw significantly reduced production this week, as workers in those plants have tested positive for COVID-19.

Pork and cattle producers are weighing their options on feed rations. Some are thinking of putting their animals on maintenance or low-weight-gain rations to try to wait out the worst of the pandemic that has so severely depressed pork and beef prices.

The key US data point of the week Thursday saw the weekly jobless claims report come in at up 5.2 million claims in the latest week. The pandemic that has seen over 20 million American workers lose their jobs up to this point. In another potentially ominous development for North America and Europe, reports say Chinese consumers coming out of the coronavirus lockdown that lasted several weeks are not in a spending mood. This contradicts notions that once the lockdowns are lifted, holed-up European and North American consumers will coming out swinging regarding spending at retail outlets, including restaurants.

There’s an old saying that it’s always the darkest before dawn. I hope I can bring you more positive news in next week’s report.

The next week’s likely high-low price trading ranges

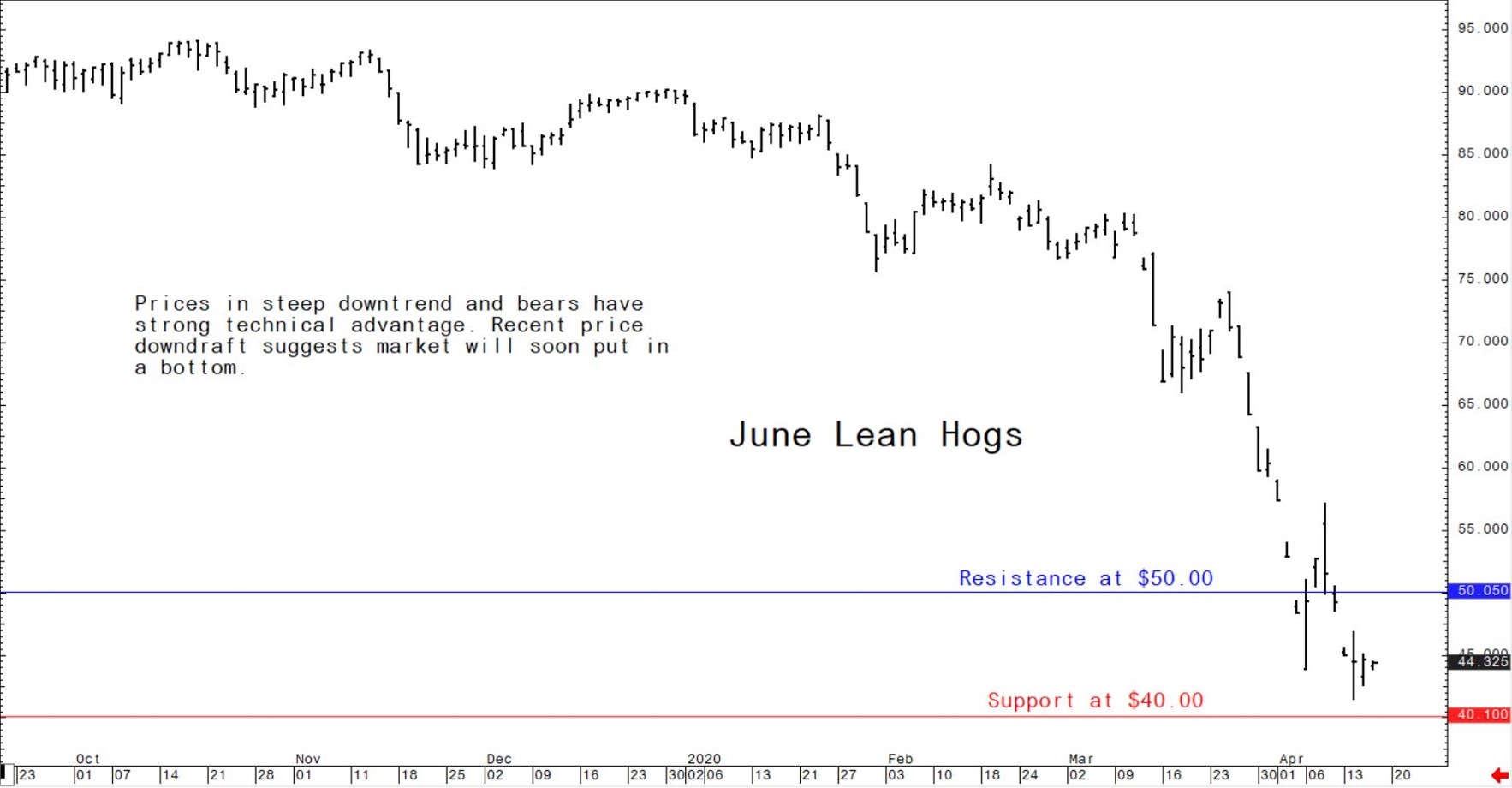

June lean hog futures: $40.00 to $50.00, and with a sideways-lower bias.

May soybean meal futures: $280.00 to $300.00, and with a sideways bias.

May corn futures: $3.15 to $3.35, and a lower bias.

US pork export sales a bright spot in battered industry

US weekly pork net sales of 45,700 metric tons (MT) reported for 2020 were down 18 percent from the previous week, but up 9 percent from the prior 4-week average. Increases were primarily for China (16,400 MT), Mexico (13,000 MT), South Korea (4,500 MT), Japan (4,300 MT), and Canada (3,000 MT). Exports of 36,600 MT were down 4 percent from the previous week and 14 percent from the prior 4-week average. The destinations were primarily to China (18,400 MT), Mexico (4,900 MT), Japan (4,500 MT), South Korea (2,800 MT), and Canada (1,700 MT).

Recent price downdraft suggests market will soon put in a bottom. © Jim Wyckoff

Next downside target is support at $3.01. © Jim Wyckoff

More gains in near term would suggest market bottom is in place. © Jim Wyckoff