Light at the end of the tunnel for the US hog market?

Hog prices have reached levels of value and there is now speculation that demand for food won’t be curbed as much as feared.This week’s sharp downside price action in lean hog futures is very likely a “washout” type move that puts in major market bottoms. Indeed, for many agricultural markets that have been beaten down so badly recently, this week’s price action may well have experienced the worst of the coronavirus-induced global economic crisis.

Hog prices have reached levels of value and there is now speculation that demand for food won’t be curbed as much as feared, which is encouraging some short covering and new commercial buying in futures markets. The key is finishing this week on a stronger note Friday.

US consumer demand for pork remains strong and if that holds it should also help to keep prices supported. It can be argued that the lean hog futures market has priced in a worst-case economic collapse. Still, meat cases are sparsely stocked and awaiting delivery trucks.

The possibility of coronavirus impacting work at hog processing plants continues to keep the market on edge, as the need for staple food supplies is high and market-ready hog supplies are abundant.

Reports this week said China will auction another 20,000 MT of pork from its frozen state reserves on March 20. It is doing so to stabilise pork supplies and tame inflation in the wake of African swine fever followed by the coronavirus.

The next week’s likely high-low price trading ranges

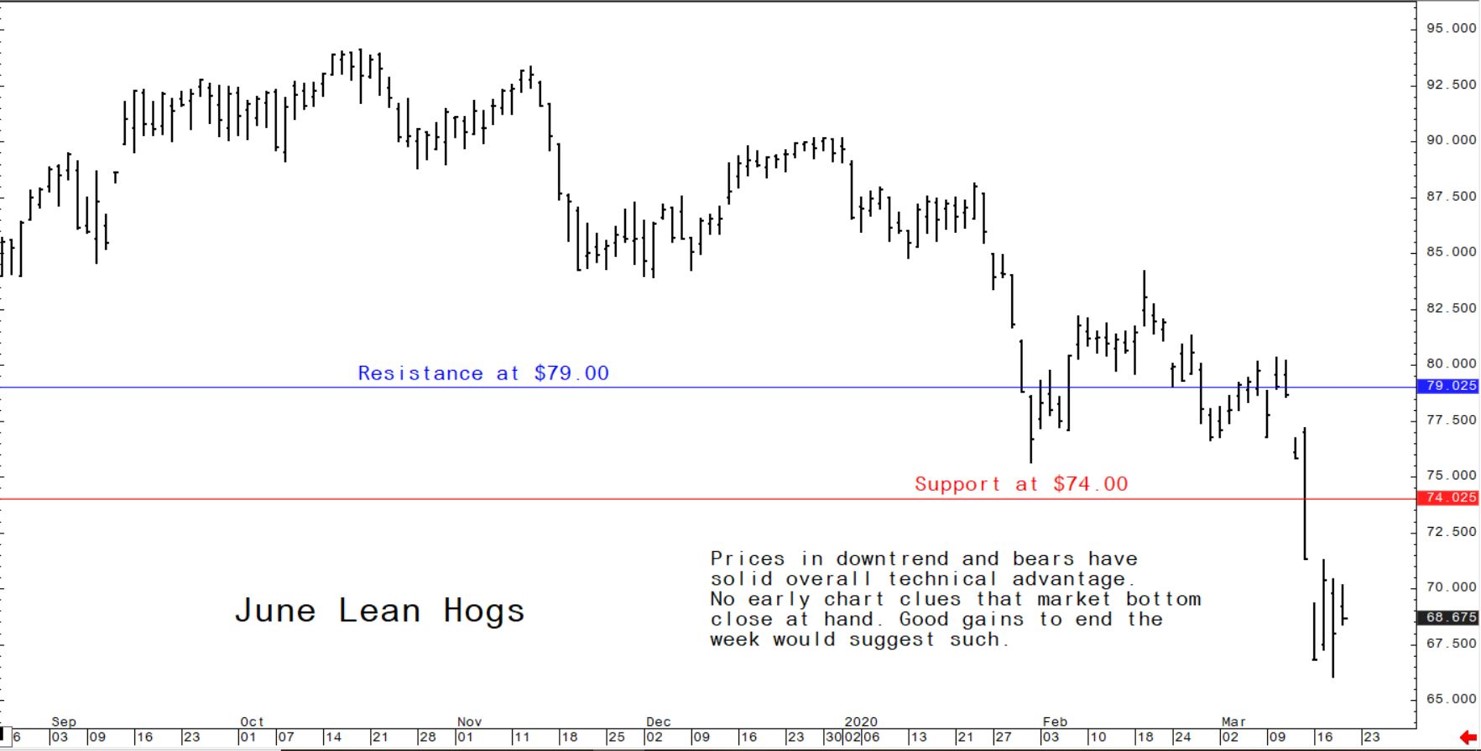

June lean hog futures: $66.00 to $72.50, and with an upside bias.

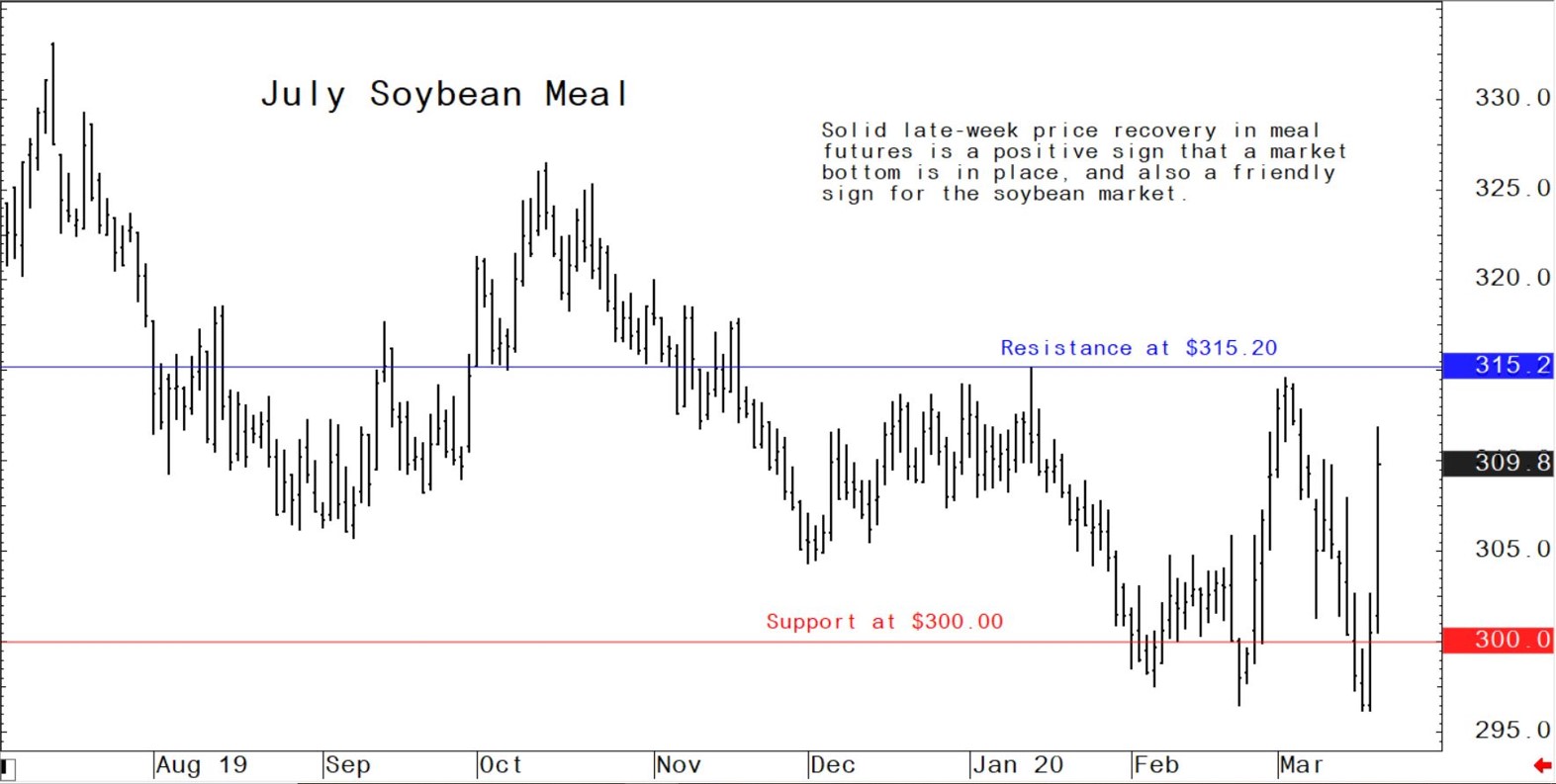

May soybean meal futures: $310.00 to $325.00, and with an upside bias.

May corn futures: $3.32 to $3.55, and an upside bias.

Latest US Department of Agriculture (USDA) reports, and other news

Weekly US pork exports show strong recovery

This week’s UDA export sales report showed net US sales of 35,700 metric tons (MT) reported for 2020 - up noticeably from the previous week’s net reductions and from the prior four-week average. Increases were primarily for China (15,700 MT), Mexico (8,600 MT), Japan (3,900 MT), South Korea (2,300 MT), and Chile (1,200 MT). Exports of 43,000 MT were down four percent from the previous week, but unchanged from the prior four-week average. The destinations were primarily to China (15,600 MT), Mexico (10,400 MT), Japan (5,500 MT), South Korea (4,200 MT), and Canada (3,100 MT).

US-China relations becoming more strained?

A noted China watcher commented this week that a telephone call between US Secretary of State Mike Pompeo and China’s Director of the Office of Foreign Affairs of the Communist Party, Yang Jiechi, went very badly. President Trump has recently called the coronavirus outbreak the “Chinese virus".

Said the China watcher: “I cannot think of a more dangerous time in the US-China relationship in the last 40 years, and the carnage from the coronavirus has barely begun in the US.”

The watcher is worried that as the coronavirus takes its toll on the US economy and its population, US citizens and government will increasingly blame China and its initial perceived slack efforts to contain the contagion. If true, such would not bode well at all for increased US agricultural exports to China, including pork.