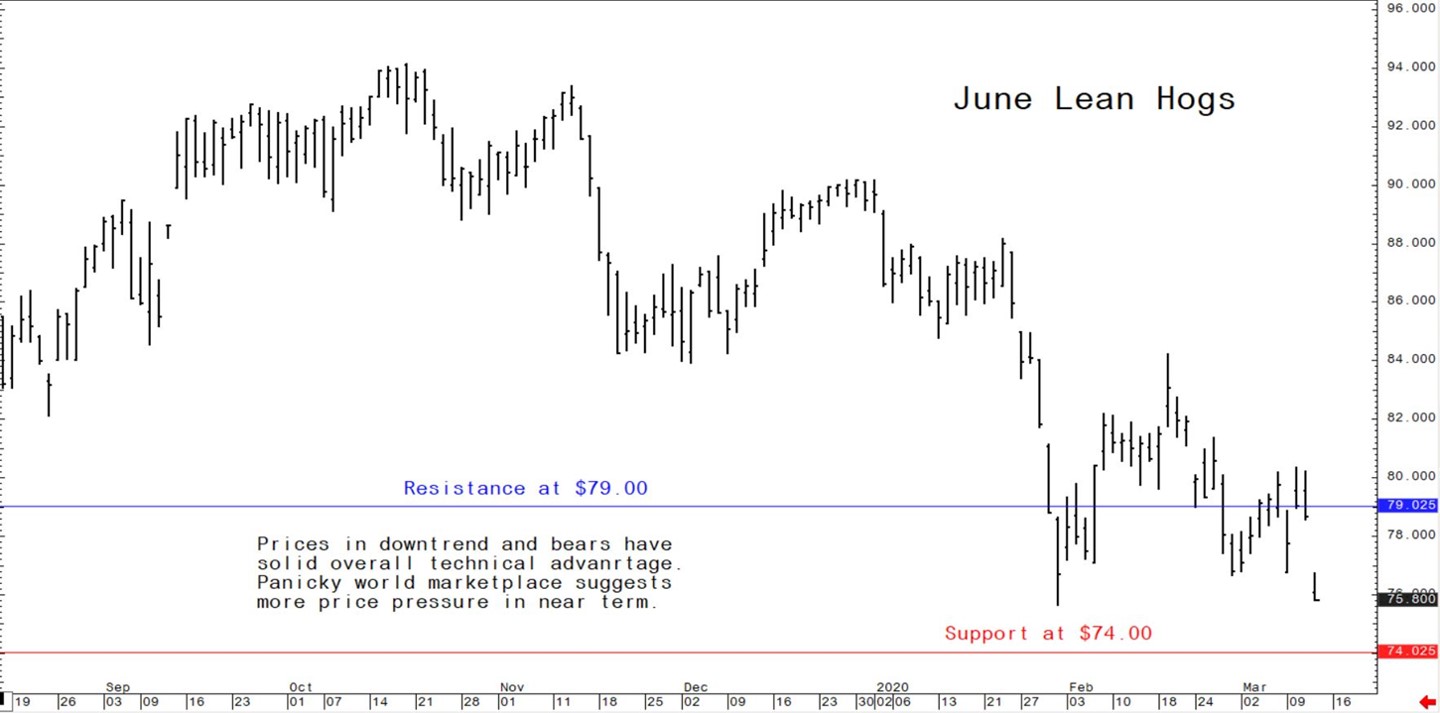

Hog prices pressured amid coronavirus markets panic

The US hog futures market continues to suffer, along with most other ag futures markets, from the escalating coronavirus outbreak and its negative impacts on the global economy.It’s increasingly likely the global economy will slip into recession in 2020. The question is, for how long? Do not look for this situation to stabilise anytime soon. That’s bearish for hogs and most other agricultural markets. When the Covid-19 panic subsides, from a markets perspective, then the hog market will likely start to trend higher.

The next week’s likely high-low price trading ranges

June lean hog futures: $75.62 to $80.35, and with a downside bias.

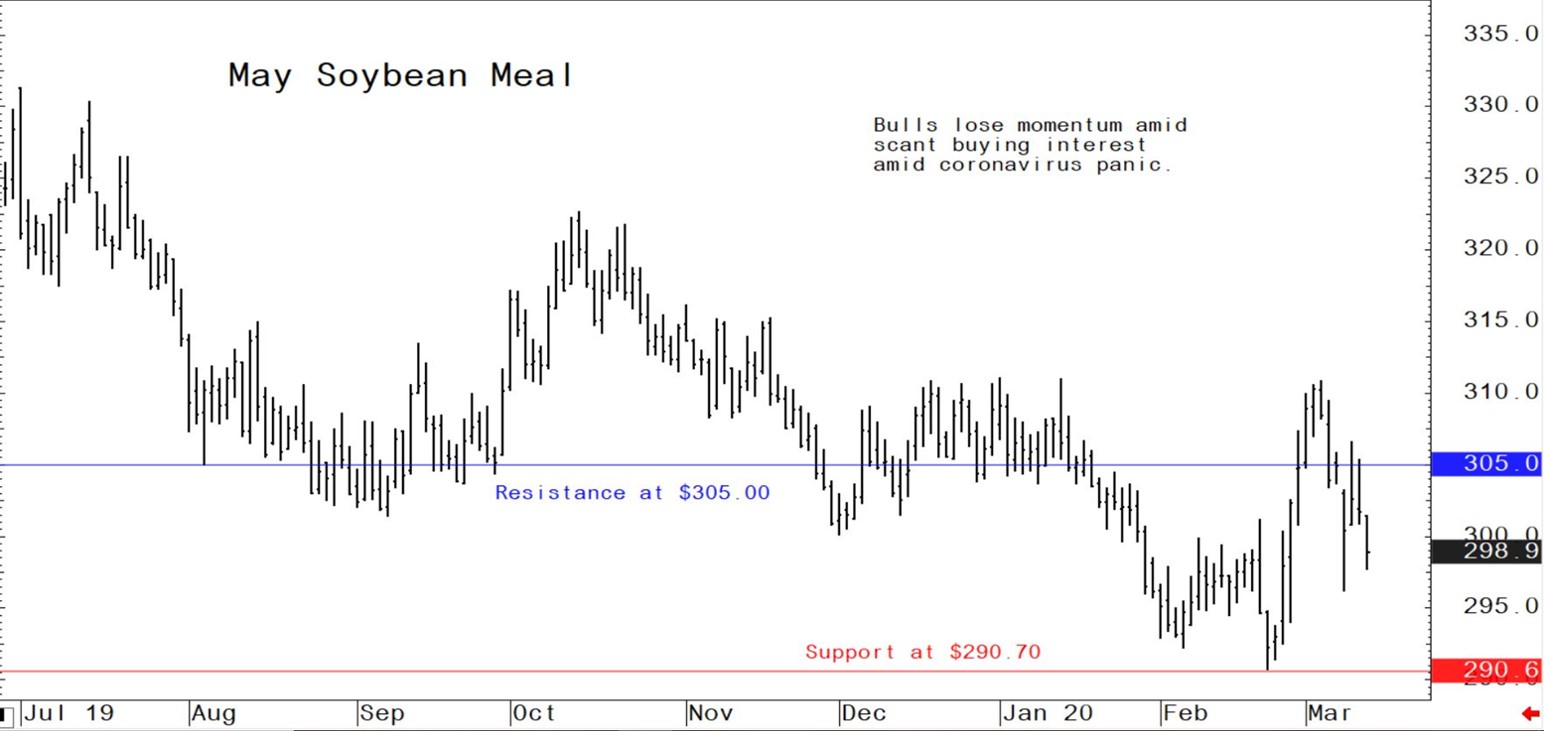

May soybean meal futures: $290.70 to $305.00, and with a downside bias.

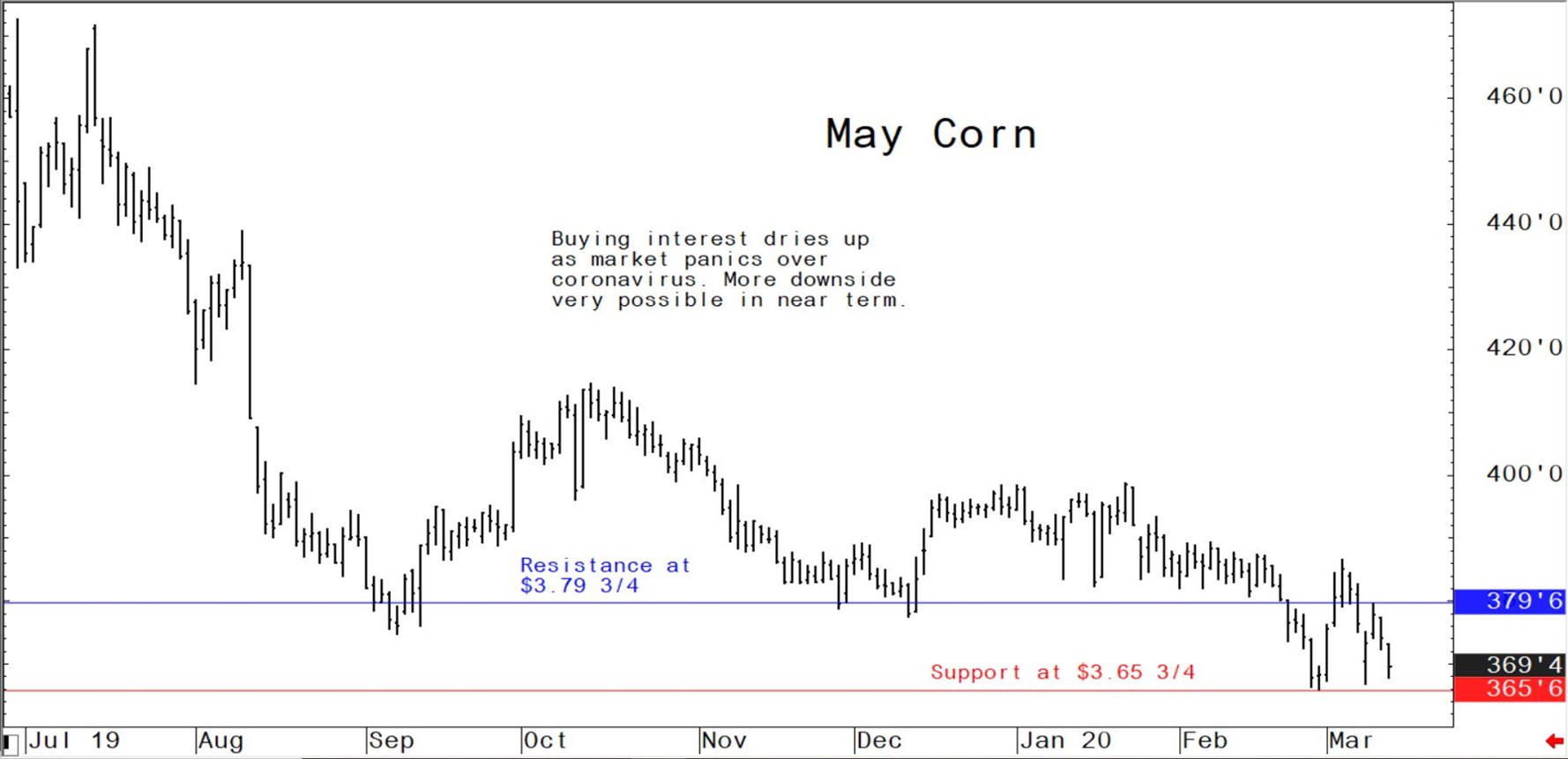

May corn futures: $3.60 to $3.75, and a downside bias.

Latest US Department of Agriculture (USDA) reports

Weekly US pork export sales plunge

The weekly USDA export sales report showed US net pork sales reductions of 26,600 metric tons (MT) - a marketing-year low and down noticeably from the previous week and the prior 4-week average. Increases primarily for Canada (6,700 MT), Mexico (5,800 MT), Japan (4,200 MT), Australia (700 MT), and Colombia (600 MT), were more than offset by reductions primarily for China (45,200 MT). Exports of 44,500 MT--a marketing-year high - were up 2 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to China (16,100 MT), Mexico (10,700 MT), Japan (5,300 MT), South Korea (4,100 MT), and Canada (2,600 MT).

USDA forecasts record EU pork production in 2020

USDA has forecast the European Union will produce a new pork volume record in 2020. While the EU swine sector was ready for record export demand for pork in 2018, shipments only picked up in 2019. This surge in demand resulted in strong recovery of pork and piglet prices and led to a larger breeding herd at the start of 2020. While record piglet production is not projected in 2020, when combined with a further increase in slaughter weights, pork production is forecast to reach the highest level officially reported. Domestic consumption is still falling in most EU Member States, most notably in Germany, leaving nearly four million metric tons (mmt), carcass weight equivalent (CWE), of pork available for exports.

Accordingly, more than 16 percent of domestic production will be exported to third countries, with China being the focus of EU pork producers. Despite the increase in export demand, pork production is anticipated to be cut in Germany, France, Bulgaria, and Hungary. Based on new investments, Spain is expected to surpass Germany as the leading pork producer in the EU.

In 2019, pig slaughter fell more significantly than anticipated. A substantial revision has been made by Post to the total slaughter number in 2019. Last year, the sum of official and backyard slaughter declined by 1.2 percent. It was previously anticipated that slaughter would recover during the last quarter, but this didn’t happen. The ending inventories of 2019 were close to the USDA official forecast. Based on the slaughter figure and the December census, adjustments have been made to production and loss. Based on the better market conditions for piglets in 2019, compared to 2018, loss is reduced to 2.3 percent, which results in a production level of 265 million piglets.

In response to the Chinese demand for pork, the EU sow herd expanded in 2019. Reviewing the balance of 2018 and 2019, it can be concluded that in 2018 the sector had piglets available, but the demand was not there. While in 2019 demand for piglets picked up (but only after the breeding herd was cut by 380,000 sows). This shortage is expressed in piglet prices. Between the low point at the end of 2018 until the date of publication of this report, piglet prices tripled (see graph below). The spread of African swine fever (ASF) in China since the summer of 2018 boosted demand for EU pork and, in turn, demand for piglets for fattening.

Based on the exceptionally good market conditions for the swine breeding sector in 2019, the EU sow herd expanded by 216,000 head. The Eurostat census of December 2018 and 2019 show that the sow herd increased most significantly in the Netherlands and Spain. The most significant reduction was reported for the German, French, Bulgarian, and Hungarian sow herds.