Genesus Global Market Report: Spain - March 2020

We are in a full crisis of COVID-19 in Spain, in Europe, and in the world. The ever-changing situation by the second makes it difficult, if not impossible, to see what is going to happen next.

Hog market in Spain

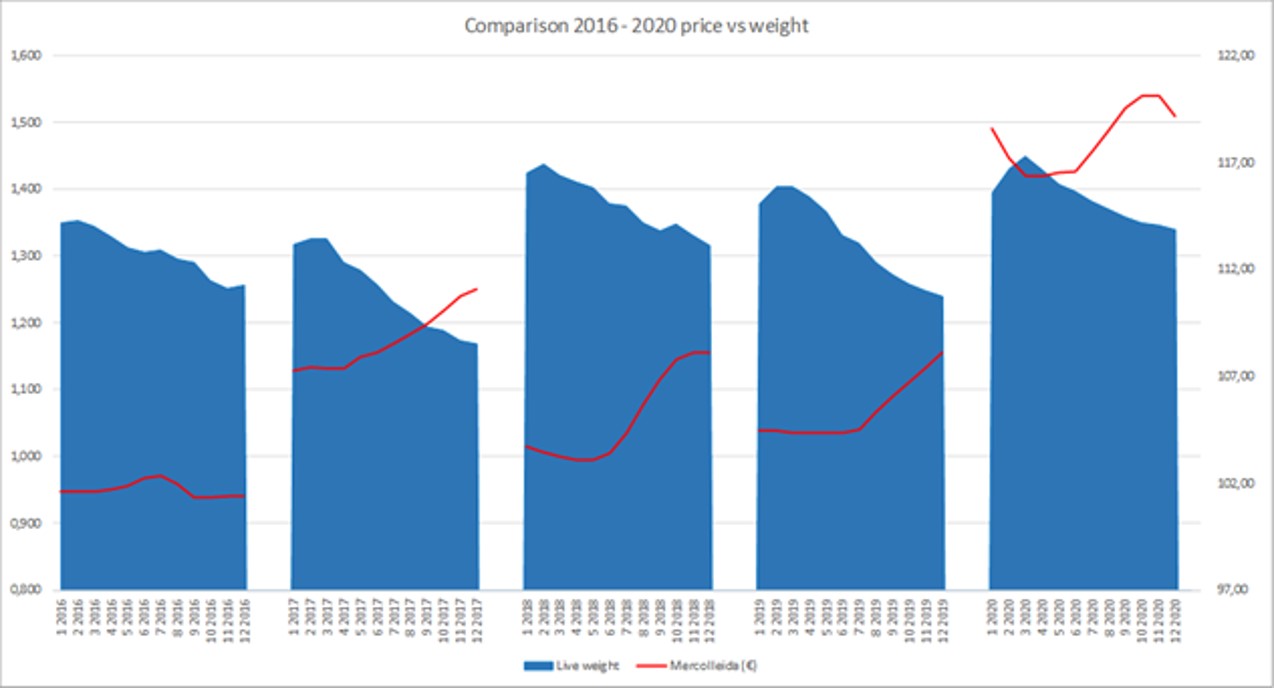

Spain reached the highest price in its history last week, €1,540 / kg live weight (US 77.27/lb) with an average weight of 114.06 kg live (251.45 lbs) or 89.41 kg carcass (197.11 lbs) compared to €1,133 / kg live weight (US 56.81¢/lb) and 110.99 kg (244.69 lbs) or 86.32 kg carcass (190.28 lbs) from a year ago.

The 20 kg (45 lb) piglets are at €70.50 ($77.74 US) compared to €49 ($54.03). Adding the premium, last week we saw feeder pigs sold between €103 and €109 ($114 and $120 US.

Everyone is asking what the price for market pigs must be for producers to remain profitable – €1.60 or €1.70/ kg live weight (US 80.50¢ or 85.50 ¢/lb)? I don't remember ever seeing prices like these ever since the mad cow crisis in 2001.

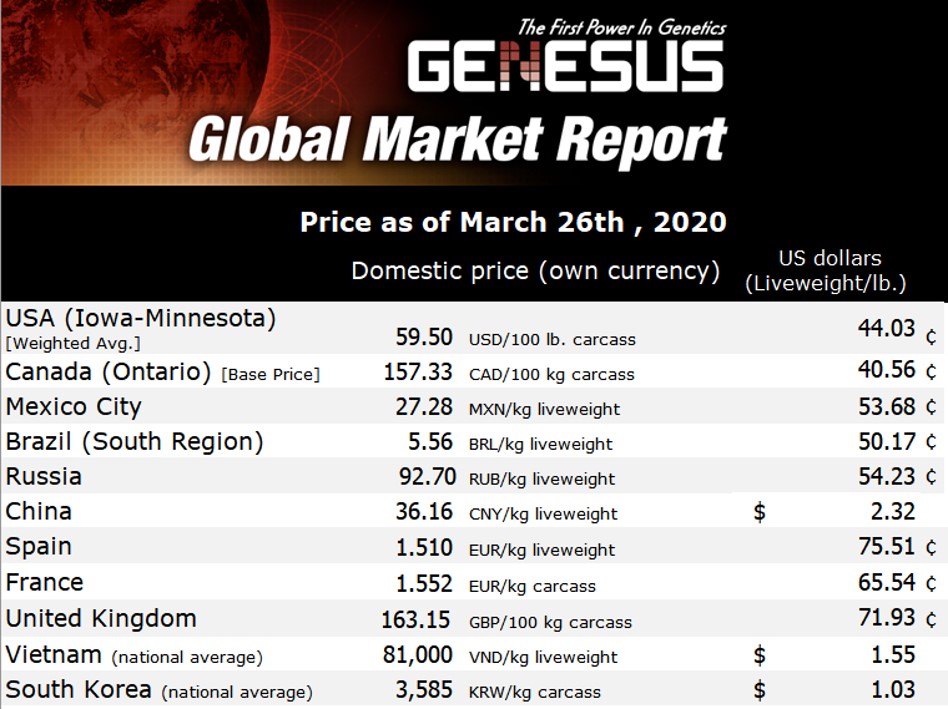

This week the prices have dropped a little to €1.51 / kg live weight (US 75.51¢/lb) for market pigs and €64.50 ( $71.23 US) for a feeder pig, before premiums. Even so, Spain’s hog market reached the highest levels of the century.

Supply and demand were more or less controlled; with both high weights, and continual prices increase.

The year 2019 according to SIP Consultors data

- Average Mercolleida €1.34 / kg live (US 66.16¢/lb), with a discount of EUR 4.8 ¢ per kg (2.35¢/lb). Real sale price €1,292 / kg (US 63.32¢/lb).

- Average sales weight 111 kg live (245 lbs).

- Average production cost €1.07 / kg (US 52.44¢/lb).

- Average profit per processed hog €24 ( $26.50 US).

A logical pattern of the market situation, created by ASF in China, production in Spain and Europe, and the expansions of processing plants. A logic pattern that can be disturbed by the COVID-19 surprise factor that has put us all in "quarantine".

Currently, the entire chain is running more or less smoothly. It is frozen, waiting for the containers to arrive from China to be filled and resume export.

We see high peaks in demand for fresh, frozen, processed meat in food stores. But this has a limit and this high demand will stabilise. What we don’t know is what will happen with external demand: Europe, China.

There is so much uncertainty! Until now the producer and the packing plants were doing well. Those who were suffering were the processing industries that had an expensive raw material and that could not rebound on their product.

For now:

- Farms can continue working.

- Packing plants can continue working.

- Piglets can keep moving.

What we heard from the experts, opinions that I share, there are concerns related to:

- Logistics.

- Farms and packing plants personal.

- Exports – for example, Italy demands meat, but who to transport it.

- Hospitality consumption: restaurants, bars, and hotels are closed. A part of domestic consumption is thanks to tourists, who no one knows when they will return.

This year was seen as a continuation of 2019 that was exceptional, but what will happen from now on? I think it is impossible to predict. Hopefully, until my next report due in May, we will have seen the light at the end of the tunnel, and everyone's life will go back to normal.