Genesus Global Market Report: South-East Asia - March 2020

Thailand: Falling pork demand, but pig price rises

As Thais are avoiding gathering in public places to save themselves for the coronavirus, demand for pork is falling due to massive closures of restaurants and food services across Thailand. Even so, pig prices in Thailand are jumping and have reached an average of USD 2.32/kg. This is a 20 percent increase over the past four weeks.

Contributing to the pig price hike in Thailand is a jump in live pig exports to Cambodia. The Thai Swine Raisers Association said the export rose to 30 percent from February to 6,500 pigs/day in the second week of March. The export of live pigs to Cambodia accounts for about 14 percent of the daily pig production in Thailand or 46,000 pigs/day.

Growing demand for live pigs in Cambodia reflects a severe shortage in the country and also its neighboring Vietnam, which is also taking live pigs from Cambodia

Besides, chilled and frozen pork exports are also increasing. In January, Thailand earned USD 6.3 million from pork exports or a 250 percent increase year-on-year. Of this, 97 percent of pork was shipped to Hong Kong valued at USD 6 million. This is an 1188 percent increase in value year-on-year.

As a result, the price of live pigs in Thailand tends to be higher.

Drought to drive pig price.

Summer is approaching in Thailand and will be lasting from March to May or longer. As such, the looming drought is expected to drive pig price further as farmers are being forced to spend an additional one US dollar per head or more in sourcing water from outside the farm.

According to Surachai Sutthitam, President of the Thai Swine Raisers Association, the cost of good quality water such as underground water is as high as USD 5-10/cubic meter.

Besides higher water costs, the farmers will have to spend an additional USD 0.16 /pig for improving biosecurity as ASF is spreading in neighboring countries.

Vietnam – Pig Prices rising again

Currently, liveweight price in Vietnam is on the rise.

- The price in North is 83,000 – 90,000 VND/kg (USD 3.56 - USD 3.86 per kg) - highest in Vietnam;

- Centre regions between 72,000 – 87,000VND/kg (USD 3.10 - USD 3.74 per kg);

- South regions between 78,000 – 85,000 VND/kg (USD 3.35 - USD 3.65 per kg).

According to Mr Cuong, MARD, in Vietnam, 70 percent of the meat consumed is pork. This is why pork is very important and he asks the pork-producing companies to reduce the price to 70,000 VND/kg live weight (USD 3.00 per kg liveweight) as this should lead to a more stable pork market. Current production cost/market hog is estimated at 40,000-45,000 VND / kg. (USD 1.72 per kg)

According to MARD, Vietnam's pig inventory as of March 10, 2020, is 24 million heads - a 26 percent decrease compared to the previous year (31 million heads in December 2019).

As of the end of February, imports of pork and pork products reached 13,816 tons, accounting for 21 percent of total meat imports, up 150 percent over the same period in 2019. Major pork importers are:

- Canada (accounting for 33 percent),

- Germany (25 percent),

- Brazil (16 percent),

- Poland (16 percent),

- United States (8 percent)

If domestic producers are not willing to cooperate, the Government will increase pork imports. Discussions on the subject have already been initiated with the largest Russian pig producer, Miratorg Group.

Philippines

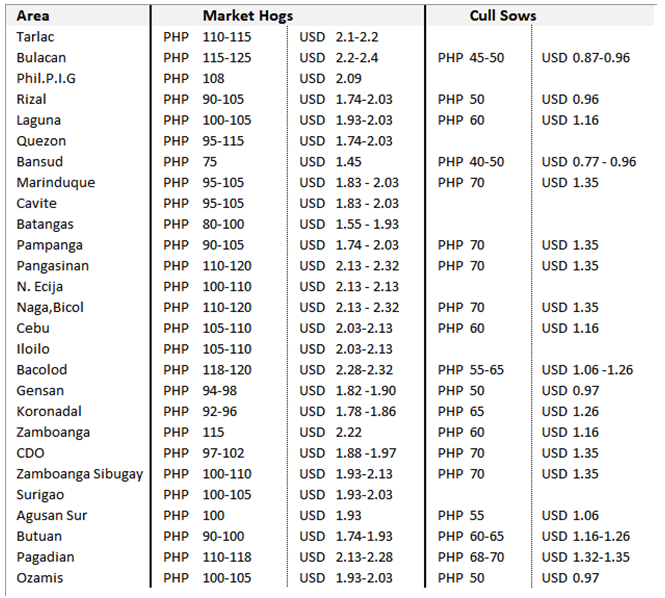

Pork Producers Weekly Prices as of March 10, 2020 (NET Price per kg liveweight)

The current pig price average in the Philippines is 13.9 percent lower when compared to last year

The first-ever recorded ASF incident was in Aug 2019. The government only made the press release making it official in October.

Badly hit are corporate farms in Central Luzon. FIve big corporate farms stated they've suffered a total loss of about 25,000 sow capacity. Of course, it is the backyard farms that are believed to have seriously decreased in population.

Recorded live pig weight also decreased by 9.8 percent - 597.51 thousand metric tons in 2020 compared to last year’s 662.73 thousand metric tons. Central Luzon, where corporate farms are located, has had the highest decline in live pig weight production, a 38.1 percent decrease compared to last year’s data.

Summary

Besides ASF, we now have Covid-19. We are seeing many of the industry's regular exhibitions and events canceled or postponed. Please consider the impact on staffing your farm and think about contingency plans to coup with the staff shortages in your business.

My recent S.E. Asian business trip had to be cut short, due to the multiple travel restrictions. In the short term, we will need to rely on social media and tools such as Skype, What’s App and FaceTime to hold our business meetings from our homes and offices.

We look forward to vaccines being produced for these two diseases as quickly as is possible. In the meantime follow the latest Government advice in your area.