Uncertainty over coronavirus puts selling pressure on US hog markets

The global hog markets got another dose of bearish news late this week, as the coronavirus on Thursday was reported to be escalating in its rate of new illnesses in China.Some medical experts are now saying China under-reported the coronavirus cases in the country. World Health Organization officials have now warned the outbreak "could still go in any direction." Markets do not like uncertainty. Look for the hog futures market to continue to see selling pressure from this situation, as the once again wonder about a worst-case scenario playing out, including less demand for pork coming from the world’s most populous nation.

Some analysts believe China will restructure its meat production and distribution system, shifting away from smaller producers and toward large-scale operations in the wake of the coronavirus outbreak, African swine fever and avian flu.

On the positive side, many market watchers say it is still very likely China will need to boost imports of pork to reduce shortages and alleviate high prices that are currently near the 2019 record highs. Reports say China has delayed the implementation of new hog-breeding facilities. Supply chain disruptions in Asia have started to impact the movement of the meat and other food products to Chinese consumers. Many believe Chinese officials by the end of the first quarter will ask the US to delay promised purchases of US agricultural products as part of the US/China “Phase 1” trade deal.

Rabobank analysts are now reportedly forecasting China’s pork production to fall 20 percent from 2019 levels this year; the firm had previously called for a 15 percent decline. “Given the sizeable supply shortage, pork prices (in China) are expected to have even greater volatility than in 2019," the report said, adding strong Chinese pork imports are expected in the second half of 2020.

The next week’s likely high-low price trading ranges

April lean hog futures: $60.00 to $66.85, and with a downside bias.

March soybean meal futures: $286.40 to $297.00, and with a sideways bias.

March soybean futures: $8.78 to $9.00 and with an upside bias.

March corn futures: $3.75 1/4 to $3.88, and sideways bias.

Latest US Department of Agriculture (USDA) reports

Weekly export sale report for the week ending 6 February.

US PORK: Net sales of 28,600 MT for 2020 were primarily for Mexico (6,800 MT), Japan (4,400 MT), China (3,700 MT), South Korea (3,600 MT), and Canada (3,100 MT). Exports of 42,900 MT were primarily to Mexico (13,100 MT), China (13,000 MT), Japan (6,000 MT), South Korea (3,600 MT), and Canada (2,200 MT).

Monthly support and demand report (WASDE)

This week’s USDA monthly supply and demand report saw the agency raise its US pork export forecast for 2020 by 275 million pounds, but it made no reference to increased demand from China. USDA said it expects “robust global demand” for US pork. Still, US hog futures traders remain focused in part on the continued high hog slaughter levels so far this year. US hog kills are up 6.3 percent so far this year. However, slaughter rates should start to recede soon.

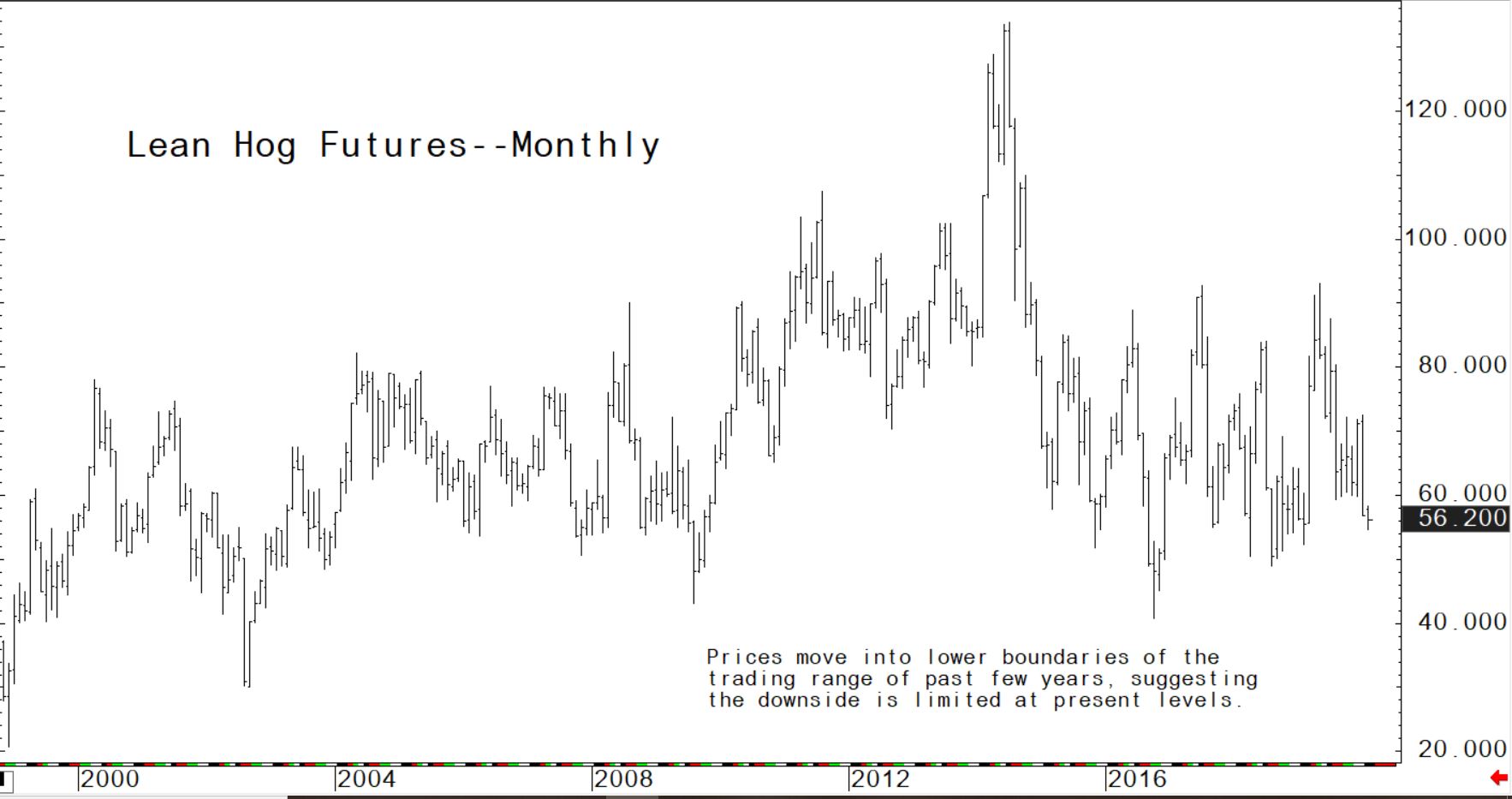

Now, no early clues that market bottom close at hand. © Jim Wyckoff

© Jim Wyckoff