Genesus Global Market Report: Mexico, February 2020

Pork production was up 6 percent through November 2019, as gains in the breeding herd, productivity and a 2 percent year over year increase in weights offset losses resulting from herd health challenges.

Producers responded to the expansion in packing capacity, growing the herd (particularly in the north). We expect an ongoing expansion of the herd in 2020, with pork production estimated to be up another 7 percent.

After flat imports in 2019, Rabobank expects a 4.4 percent decline in Mexican pork imports in 2020, to 1.12m metric tons. Higher pork prices, a weaker economy, and larger domestic production, all work to limit projected per capita pork consumption in the coming year.

Strong global demand has resulted in a nearly 40 percent year over year increase in ham values, which, along with a relatively weak Mexican peso, will limit import demand. At the same time, local pork production is projected to rise by 7 percent year over year in 2020, which should help satisfy domestic demand.

Pork imports were up 11 percent year over year in Q3 2019 but fell 6.6 percent in October, as high prices began to negatively impact demand. Imports from Canada remained strong through October (up 17 percent YOY), whereas the US continued to struggle (down 3 percent YTD from a year ago). Even so, the US continues to dominate Mexico’s import market, with an 85 percent share of trade.

The US has been slow to recoup exports to Mexico following the removal of tariffs in Q2 2019 and may continue to struggle in 2020. Imports totaled 725,000 metric tons (CWE) YTD, just 0.9 percent behind the same period last year. We expect slightly stronger imports to end the year, with total imports in line with year-ago levels. We expect slightly lower imports in 2020, due to higher pork costs and larger domestic supplies.

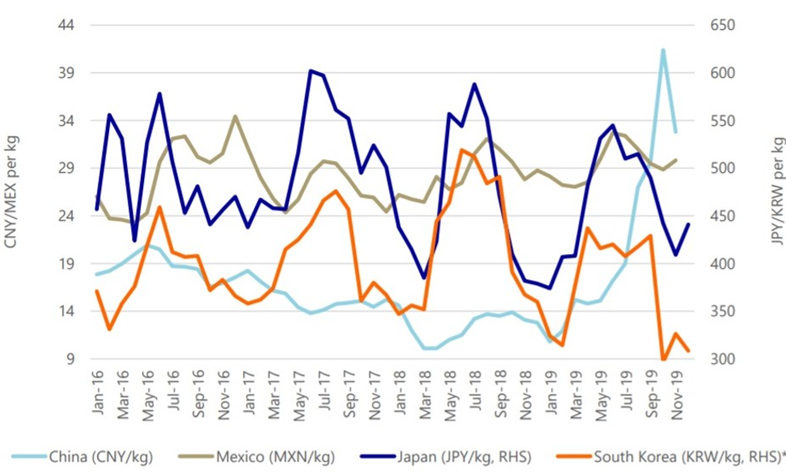

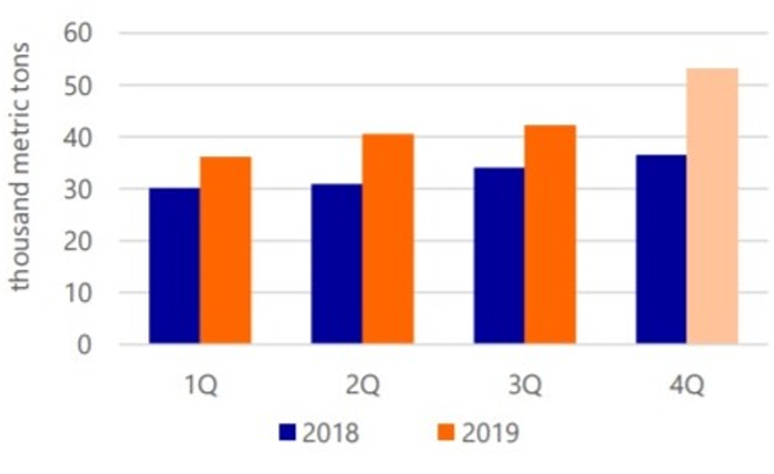

Export markets remain exceptionally strong (up 28 percent through October), driven by triple-digit growth in shipments to Canada, China, and Singapore. Japan remains the largest export market (72 percent of total), with Q3 2019 exports up 22 percent year over year and up 25 percent year over year in October.

Exports to China surpassed 13,000 metric tons by October, up from only 1,500 metric tons in 2018. China has now overtaken the US as Mexico’s second-largest export market by volume but trails in total value.

Sharp declines in year over year exports to South Korea and the US in October (both down 25%) reflect excess supply in those markets, along with weaker pork demand in South Korea following the discovery of ASF.

For 2019, it was projected a 30 percent increase in exports vs. year-ago levels (see figure below). In 2020, we expect another 12 percent increase in exports from Mexico on the back of continued strength in exports to China and Japan.

On the other hand, the Ministry of Agriculture and Rural Development is working on the opening of Vietnam and the Philippines markets for the export of beef and pork. Vietnam has reported interest in scheduling packing plants inspection by its technicians in the coming months.

Another protocol that has made progress is the export of pork offal (variety meats) to China, for which, the authorities of the Asian country have recently inspected various TIF-accredited establishments. Federally Inspected Type (TIF) quality mark, are slaughter, processing, packing and cold storage plants that are regulated, inspected and supervised by the country’s National Service of Health, Food Safety and Food Quality (SENASICA), part of the Ministry of Agriculture, Livestock, Rural Development, Fisheries and Food (SAGARPA) and deemed to be in compliance with international standards.

Also, on pork exporting, negotiations with Taiwan are moving forward since Senasica solved and sent evidence of the recommendations made by Taiwanese technicians, during the audit they made to TIF establishments, in order to recognize the surveillance and inspection of the Mexican veterinarian system.

In summary of the Mexican pig market update, we see that the country's large swine companies are expanding and getting ready by relying on science-based genetics with a great impact on global pork markets to compete internationally in these demanding high meat quality marketplaces.

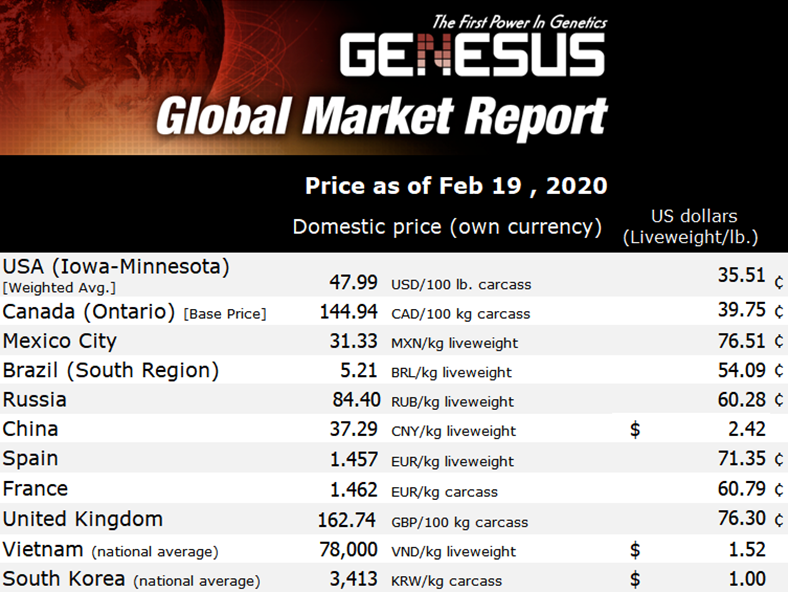

Liveweight prices continue to be strong in Mexico with normal variations by regions. Mexico City and Central Mexico's average price is currently 31.90 MXN/kg (approx. $0.78 US/lb) while in Sonora liveweight price is around 27 MXN/kg ($0.59 US/lb). Having said that Mexican producers are making over $30US/market-hog profit.