Jim Long Pork Commentary: USDA December 1st Hogs and Pigs Report

Last week the USDA released the December 1st Hogs and Pigs Report.

Our Observations:

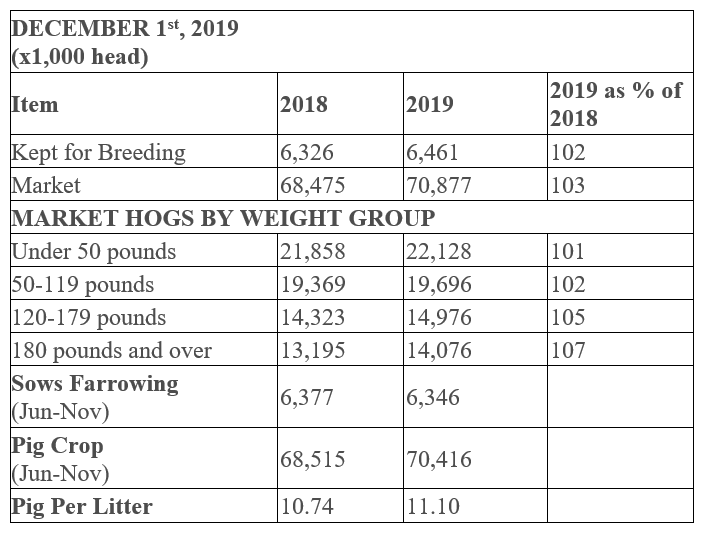

- Breeding Herd is up 135,000 from a year ago, a significant increase. It is up 30,000 since September 1st.

- Market Hog numbers up 2.4 million or about 100,000 a week. Interesting under 50 lb. up 1 percent. Falls into comment this past week that buyers scrambling to find small pigs to buy.

- Sows farrowing over the last six months the same as a year ago, this despite 2 percent more sows in inventory.

- We expect a lower farrowing rate mainly due to the Chlamydia non-estrus issues one genetic company is having with gilts. The same company in its yearly financial statement reports results were being impacted due to compensation charges related to the problem. Probably means if you bought pigs including Chlamydia (non-estrus) its best to be looking for compensation if you not already have. It also goes to show that gene-editing genomes still doesn’t replace basic swine health management and biosecurity to reach optimum production.

- The Pig Crop Jun-Nov was up 1.9 million all due to greater litter size up over a ¼ pig per litter.

Summary:

More Pigs. It appears to us the market expected this type of increase. We expect the market to handle this increase in inventory with the expected increase in exports due to ASF in 2020. Current lean hog futures, Corn and Soymeal futures indicate an average profit of $30 U.S. per head in 2020. If so, a good year. When current loses in the $10-15 range per head, can’t come soon enough.

Other:

- Small pig market heating up. Cash early weans last week according to U.S.D.A averaged $55.86 up $21 from 3 weeks ago.

- February lean hog futures are over 70¢ lb. Current 53-54 percent lean hogs 58¢ lb. Need to see strong price increase after January 1 to get to 70¢. We expect we will.

ASF China is in mainstream media. Lots of articles everywhere, if it’s like PED when there becomes perceived pork shortage that’s when prices take off. Need non-ag. money to come into market to drive futures higher. The shortage of pork in Asia (China) is real. It’s not if, but when the “Dog hits the end of the chain” and our hog prices surge.