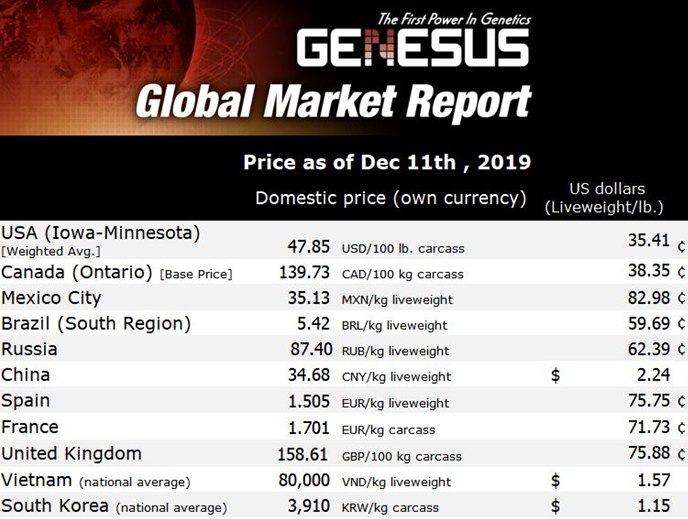

Genesus Global Market Report: China - December 2019

If you are a pork producer or allied industry supplier doing business in China, 2019 was a year you might rather like to forget.

2019 Year in review and outlook for the future in China.

However, the unfortunate outbreak of ASF may have created a silver lining with significant opportunities in the future of the pork industry.

As we are traveling in China and meeting with producers, it seems many have new plans for growth and significant expansion in 2020. The optimism and resilience of Pork Production companies in China is quite impressive. Many in other countries may have likely exited the industry after such an experience.

Just one year ago the outbreak was spreading thru the Northeast and central provinces of China with no end in sight. Nor could anyone realize at that time the full extent of the losses yet to come. By February and March, long lines of trucks waiting to deliver pigs to the slaughter plants were a common sight as producers began liquidating herds. Producers were forced to make the difficult decision of selling their sows while they could to avoid losses.

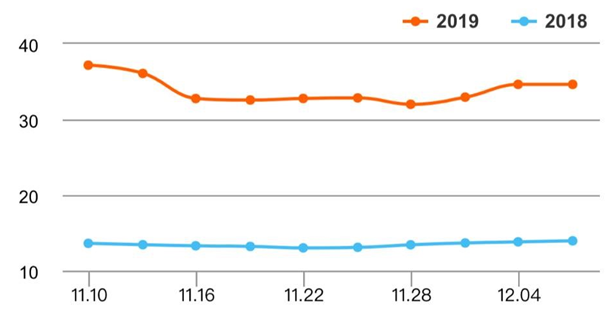

A strange phenomena was developing amid reports of wide spread production losses, but at the same time pig prices remained flat. The surge of pigs to slaughter created an oversupply of pork meat at the marketplace.

Over the summer months, the outbreak continued its devastating spread thru the southern provinces. Everyone suffered from the losses whether a pig producer, feed manufacturer or allied industry supplier. However, the stock prices of publicly traded pork production companies were setting record highs almost on a daily basis.

It wasn’t until the 3rd quarter of 2019 did the flow of pigs to the slaughter began to dwindle and the live hog price begin its upward spike to an all-time high of 42 RMB/kg ($2.70/lb.) in August. With the huge shortfall of breeding pigs, large scale companies began keeping back commercial Gilts from the finishing floors for future use in their breeding herds.

New policies were put in place to stop the production losses before the end of the year and stabilize the supply of pork in the marketplace. China began importing record quantities of Pork meat from other countries to fill the void caused by its losses of production.

At the end of the 2019, the pig price seems to have stabilized at about 32-34 RMB/kg and anticipated to drop some more after Chinese New Year. So looking forward into 2020 and beyond what can one expect the Swine Industry in China to look like?

The ministry of agriculture and rural areas issued a three-year action plan with 18 task to ensure the pig production capacity to return to normal in 2021. The government support will include subsidies for the construction of large-scale pig’s farms.

Vertically integrated companies will play a prominent role in the rebuilding of the pork production system in China. It seems each of these companies has a new plan with increased production goals. No doubt the government subsidies will be a big benefit for those who are able to access them.

The unfortunate outbreak of ASF is forcing change that will encourage companies to construct modern designed facilities with new technologies and locate these farms in better bio-secure areas. Thus, consolidation of the industry will be accelerated.

However, the one central component needed for the rebuilding of the Swine Industry in China is Quality Genetics to resupply the breeding farms. There is a huge shortfall of breeding pigs in China and it will take many years to replace all the GGP animals lost during the year of 2019. Saving back gilts from commercial production is a short term fix and not part of a successful long term strategic plan.

Thus, the need for imported GGP breeding pigs is historical but the limited supply existing around the globe is virtually the same. Denmark, France and the UK will not be able to supply the numbers needed to fill the void and the US has no active protocol.

Genesus has the World’s largest Registered Purebred GGP Nucleus Herd and largest quantities of DLY available to resupply China’s breeding herds. Furthermore, Genesus is committed to the China market and continues to expand its Global Nucleus base within China to better serve its needs.

We believe it is in China’s own best interests to import GGP pigs needed to resupply its own breeding herds and rebuild its own production systems. The cost to import Swine Genetics and build up its own self-sufficiency is but a fraction of cost to import the billions of dollars of Pork meat indefinitely.