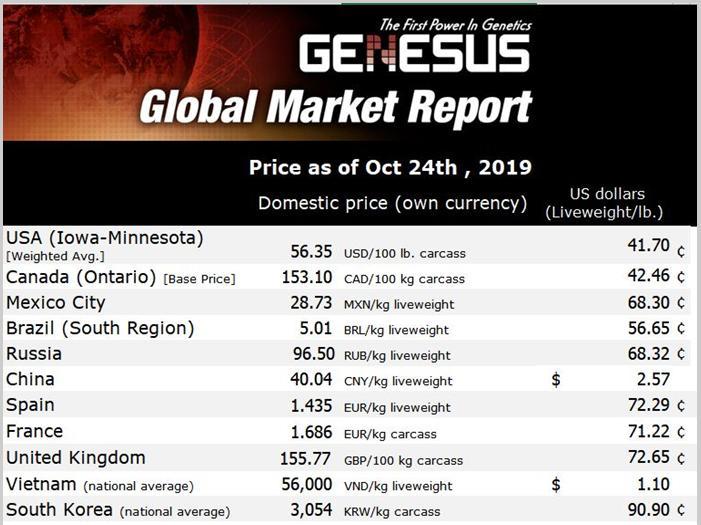

Genesus Global Market Report: USA - October 2019

Everyone knows the ASF situation so I will talk about currency and its effect on commodities.

I asked Bob Lingenfelter to help me with this commentary as we talk daily about markets and I like the prospective he brings to the table and would like to share his thoughts with mine.

Many years ago, to expedite transactions, we developed currency. Originally, the dollar bills we started using were backed by gold, a commodity. While Nixon was president, He removed US from the gold standard and every commodity had a value related to the dollar. He also got the world to value oil in the dollar, a deal worked out by Kissinger with OPEC.

In order to maintain a steady asset value, as said assets increased, the number of dollars in circulation would need to increase. The example I have used to express this would to have you imagine that originally, there would be 10 households, each with a value of $100, as these households grew, your family grew, and let say you now have 100 households, if you did not expand the currency, each household would now be worth only $10. That kind of asset depreciation would severely slow economic development, so, you would need more currency to maintain asset valuation.

That is a little of what you are seeing today. As the Fed started to withdraw their stimulation, pull money out of the system, the dollars needed to keep the economy running are becoming harder to find.

With Trump having the economy running in high gear, more assets being produced, the value of said asset is having a hard time maintain its value. That is a little of what you have seen in this last month, the repo rate, that is what is charged for turning unused cash into the Treasury department, mostly for hours, not days or weeks went to 10%.

That had the Fed step in and start putting more cash into the system. That is what I am trying to show below with where the current value of the dollar is, and just how much each dollar contract would buy in hogs, cattle, corn, and beans today as compared to what said contract would buy when there were plenty of dollars around and the commodity was a little short.

Today, it is said that there is a dollar shortage. That may very well be why hogs have not been able to move much higher even with strong demand showing up. I asked my Grandfather what corn was worth during the ‘30’s, he said $0.10/bu., I said how could that be, we were in the dust bowl and production was way down, he told me that was all the money there was!

Below is Dollar value versus corn, hogs, and cattle value today versus when said commodities topped. Give one an idea of just what the value of the buck can do to the value of said commodity.

Dollar value 10/21/19

40,000# hog contract x 0.6805 Dec current value = $27,220. Today

40,000# $1.33 July ‘14 December value = $53,200

Dollars contract value today = $97,000. One dollar contract buys 3.56 contracts of hogs

Dollars value on 07/14 = $81,523. One dollar contract buys 1.53 contracts of hogs

40,000# cattle contract, Dec. ‘19, $110.95 = $44,380

40,000# cattle contract, Nov. ‘14, $171.65 = $68,660

Dollars contract value today = $97,000. One dollar contract = 2.19 cattle contracts

Dollar value on Nov. ‘14 = $88,410. One contract buys 1.29 contracts

5,000bu corn, December contract @ $3.87 current value =$19,350

5,000bu corn, December contract on 08/12 @ $8.43 = $42,150

Dollars contract value today = $97,000. One contract buys 5.01 Dec. corn contracts

Dollars value on 08/12 = $81,210. One contract buys 1.93 contracts of corn