Jim Long Pork Commentary: US-Canada pork producers suffering the burdens of trade war

The way things are going for us US-Canada pork producers it is time to look for optimistic quotes."I am an optimist. It does not seem too much use being anything else."

-Winston Churchill-

The grim facts are that the US pork industry has had tariffs last Friday increased on pork to China. Canada is in even worse shape: Canada can’t ship any pork to China.

The pork industries of both countries are taking the brunt of the trade war. USA-Canada sells next to nothing but ag-products to China. Consequently as one of the few products China buys from USA-Canada ag takes it on the chin. There is little else the Chinese can retaliate against, but ag.

An optimistic tone was set by a large commodity house on Friday.

"As such China can put more tariffs on US pork, as it indicated this morning- adding another 10 percent - but it will still need the pork, but that will push other customers that had been buying from those sources to the United States - effectively reshuffling the trade, but not reducing it.”

"The optimist looks at the horizon and sees an opportunity, the pessimist peers into the distance and fears the problem."

-William Arthur Ward-

As reported in Fortune magazine

“We currently estimate 40 percent of the herd has already been lost, and more than 50 percent of the herd could be eliminated by year end. The loss would account for more pigs than are raised in an entire year by the EU and US"

“I am not sure how much serious the trade war will get, my expectation is that China will continue to buy US pork” said McCracken.

“There is currently not enough pork (or other protein) available in the rest of the world to fully meet China’s protein needs. We expect US pork, beef, and poultry to help fill the void until China can rebuild its internal supplies.”

"Belief in the power of optimism rests on a simple idea; by looking at the future, we can hang tough and do our best in the present."

-Gabriele Oettingen-

The gravity of Chinese pig losses can be seen in the policies that came from the Chinese government last week!

- Accelerating the distribution of subsidies for compulsory culling.

- Local governments should cancel any restrictions that may go beyond the current laws.

- Abolish the 15 mu (2.5 acres) maximum land restriction to encourage large scale production

- Strengthen animal epidemic prevention systems and disease control.

- Increase local pork reserves ensuring affordable pork to the citizens and increase social security benefits so as to ensure the basic livelihood of the people in need.

It’s obvious the Chinese government a year after the initial ASF break sees the gravity of the issue. The massive decrease in China's pork production is truly reflected in the price of market hogs.

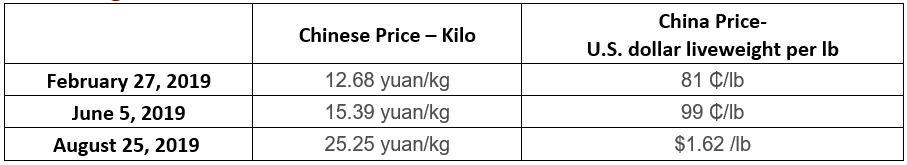

Last week the average price in China was 25.25 yuan/kg ($1.62 US liveweight lb.). This is an increase of 1.36 yuan/kg (9.6₵ US lb) from the week before.

Price increase reflects the supply and demand. The cratering of Chinese pork supply can be seen by the trajectory of China's hog price. It’s doubled in price since February.

The highest price last week was in Guangdong at 29>64 yuan/KG ($1.79 US/ lb. liveweight). We expect China's hog price will continue to increase and the pressure to increase meat protein from everywhere in the world will magnify.

China Imported 62 percent more pork January-June compared to the year before. It’s obvious the 62 percent increase was before China's hog price took off. The need for more meat protein has now intensified.

"The farmer has to be an optimist or he wouldn’t be farmer"

-Will Rogers-

After we wrote this week’s commentary we got the good news that US and Japan have made a trade agreement. It’s a win for US pork

“We look forward to rapid implementation of the agreement as international competitors are taking US pork market share through more favourable access.” - David Herring; President of the National Pork Producers Council.

Dr Dermot Hayes an economist of Iowa State University, estimates exports to Japan will grow from $1.6 billion to $2.2 billion in the future.”