Genesus Global Market Report: Mexico - July 2019

The lower corn harvests in the US and the African swine fever that China suffers will raise the prices of beef, pork and chicken in Mexico, and the first adjustments already began to be felt with pork, according with producers and market analysts.

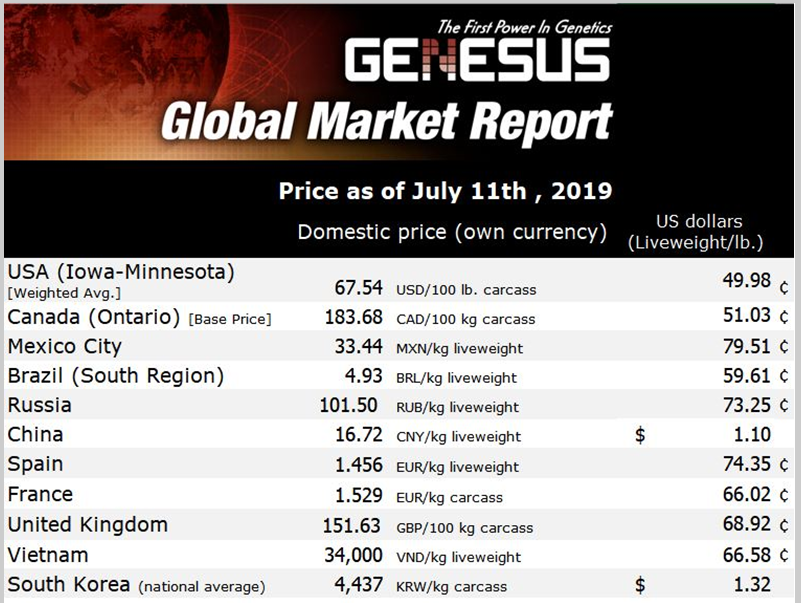

Mexico imports 40 percent of its pork consumption and from April to May the price of imported pork from the US and Canada increased 12.8 and 8.1 percent respectively, due mainly to African swine fever (ASF) in China.

The increases derive from the rise that began to register since the beginning of March the futures of the pig before the possibility that China loses 25 percent of its production because of the ASF. The Asian country produces half of the pig worldwide.

On 16 April, pork futures for delivery in August, without considering other costs (ie logistics costs, insurance and other expenses), reached their highest level since October 2014 and 33 percent higher than on the same date of the 2018, according to the Chicago Stock Exchange.

Since May pork futures have fallen because of the rise of corn, as it is making more expensive the production of pork and other animal proteins. But they will rise again once there is less domestic production and once China runs out of inventories, which we estimate will happen around August.

The rise we saw in imported pork is only a brief reflection of what might happen if the loss of Chinese pork production is confirmed, and if so, this will pull, also, the price of chicken and beef for a substitution effect.

Along with this, also in May, corn futures began with an upward spiral caused by the lower harvests of this cereal in the US, the largest producer in the world and the main supplier in Mexico, with one third of its consumption (17 million tons).

The heavy rains occurred in some of the main maize states in the American Union affected the planting of that grain, so the USDA estimates that the production of corn for the 2019/2020 cycle would fall nine percent.

Derived from this, the corn futures to be liquidated in July register an increase of 18.8 percent since the end of April, which was the lowest level in the year.

ASF Mexico Report

The US, Canada and Mexico are uniting to keep African swine fever (ASF) out of North America’s borders.

“Sharing the long borders that we do both on the north and south, it’s important that we function together as one,” US Agriculture Secretary Sonny Perdue said at the USDA’s Agricultural Outlook Forum on Thursday, where he shared a stage with Canadian Agriculture Minister Lawrence MacAulay and Mexico’s Secretary of Agriculture Victor Villalobos Arambula.

The animal health guidelines of Mexico have explained that the really important actions at these points of entry into the country are those of inspection and surveillance, which they claim are carried out permanently.

They added that in total, all the airports have 112 pairs of dogs and more than a thousand specialised technicians, in charge of preventing the introduction into Mexico of any swine product or infected residue; all the measures, he specified, are not only oriented to the PPA, but to any virus that poses a health threat.

The fact

Until 30 June, the elimination of 26.8 tons of food waste was reported in ships and planes and the destruction of 2,792.5 kilograms of food, waste and confiscated products in 93,428 bags and suitcases, thanks to the review of 79,132 passengers from of 848 flights.

Free Trade Agreement update

On 20 May, the 20 percent retaliatory obligation on generally US pork entering Mexico was expelled as the US, Mexico and Canada achieved a concurrence on steel and aluminium duties. While the arrival to obligation free status is relied upon to fuel a bounce back in pork fares to Mexico, it came past the point where it is possible to have much effect on May results as fares fell 26 percent from a year prior in volume to 52,555 mt and 15 percent in incentive to $98.4 million. For January through May, fares to Mexico were down 19 percent in volume (284,946 mt) and 27 percent in worth ($454.9 million).

Source: Grupo Consultor de Mercados Agrícolas (GCMA) Mexico.