Daily US grain report: markets pausing ahead of USDA report; traders watching Midwest weather patterns

US grain futures prices were mixed in overnight trading. Corn was down 1 to 2 cents, with soybeans and wheat near steady.Look for quieter trading action early Thursday, ahead of the late-morning release of the latest USDA supply and demand report. Trading action will pick up significantly after that. Traders surveyed by Reuters expect USDA to lower its US corn crop production estimate to 13.664 billion bushels from its June forecast of 13.680 billion bushels.

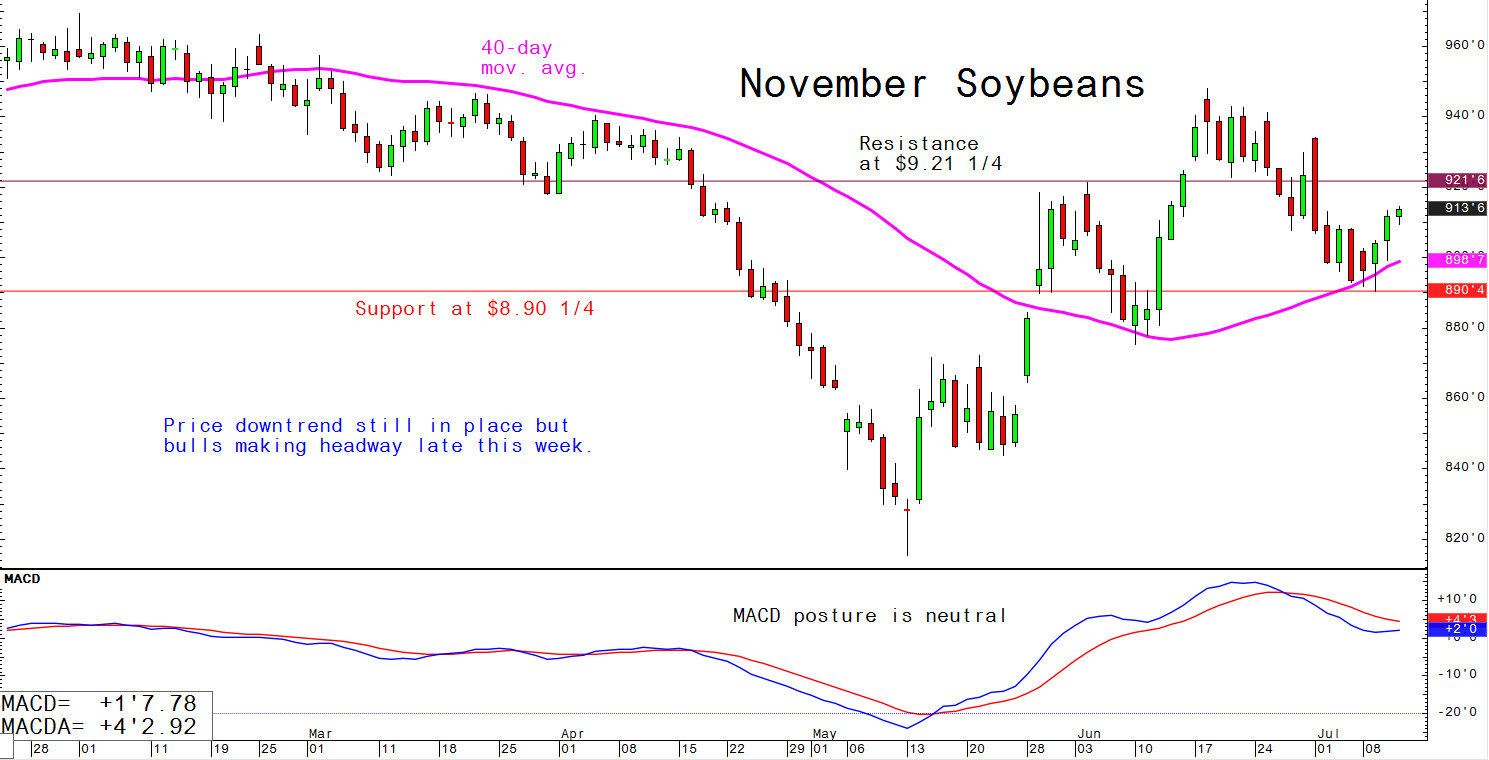

The agency is expected cut the size of this year's US soybean crop to 3.833 billion bushels from 4.150 billion bushels estimated in June, due to the smaller US acreage estimate USDA released in late June. There is some keener uncertainty regarding USDA's numbers for corn and soybeans in this report, given the historically late-planting of the crops and questions about the corn-soybean acreage mix.

For US all wheat carryover, the trade expects just over 1 billion bushels of stocks for both the current marketing year and the new marketing year.

© Jim Wyckoff

Warmer, drier weather in the Midwest recently has been bearish for the grain futures markets. Focus now is on a tropical storm brewing in the Gulf of Mexico that is likely to impact weather in the central US next week. Presently, ideas are mixed on whether the storm will bring needed rains to the eastern US Corn Belt. Come next Monday morning, if the Midwest weather forecasts are calling for hot and dry conditions, grain futures market bulls will come roaring back with a vengeance.

© Jim Wyckoff

Traders will also closely examine Thursday morning's weekly USDA export sales report, specifically looking for new business from China. China has promised to buy more US ag products but so far little business from that nation has showed up in USDA export sales reports.

One bullish underlying element for the US grain markets late this week is the easy-leaning Federal Reserve and the resulting weakening of the US dollar. More money in the US financial system likely means more demand for raw commodities, while the weaker greenback makes US commodities that are priced in dollars on the world markets cheaper to purchase in non-US currency.