Daily US grain report: steady-firm as traders mull latest US-China trade development

US grain futures prices were steady to firmer overnight; corn is near steady, soybeans are up around half a cent and wheat six to eight cents higher.There are new developments in the US-China trade war. Just ahead of the late-week meeting between US President Trump and Chinese President Xi in Japan at the G20 confab, Xi has reportedly told Trump he’s ready to settle the trade war, but has laid out several conditions that Trump may not accept, including lifting sanctions on China telecommunications giant Huawei.

So far today markets have not reacted much to this news, as traders are not sure if this is a positive or a negative for reaching a final deal. The outcome of the US-China summit meeting is still very uncertain and could have major implications for the grain market.

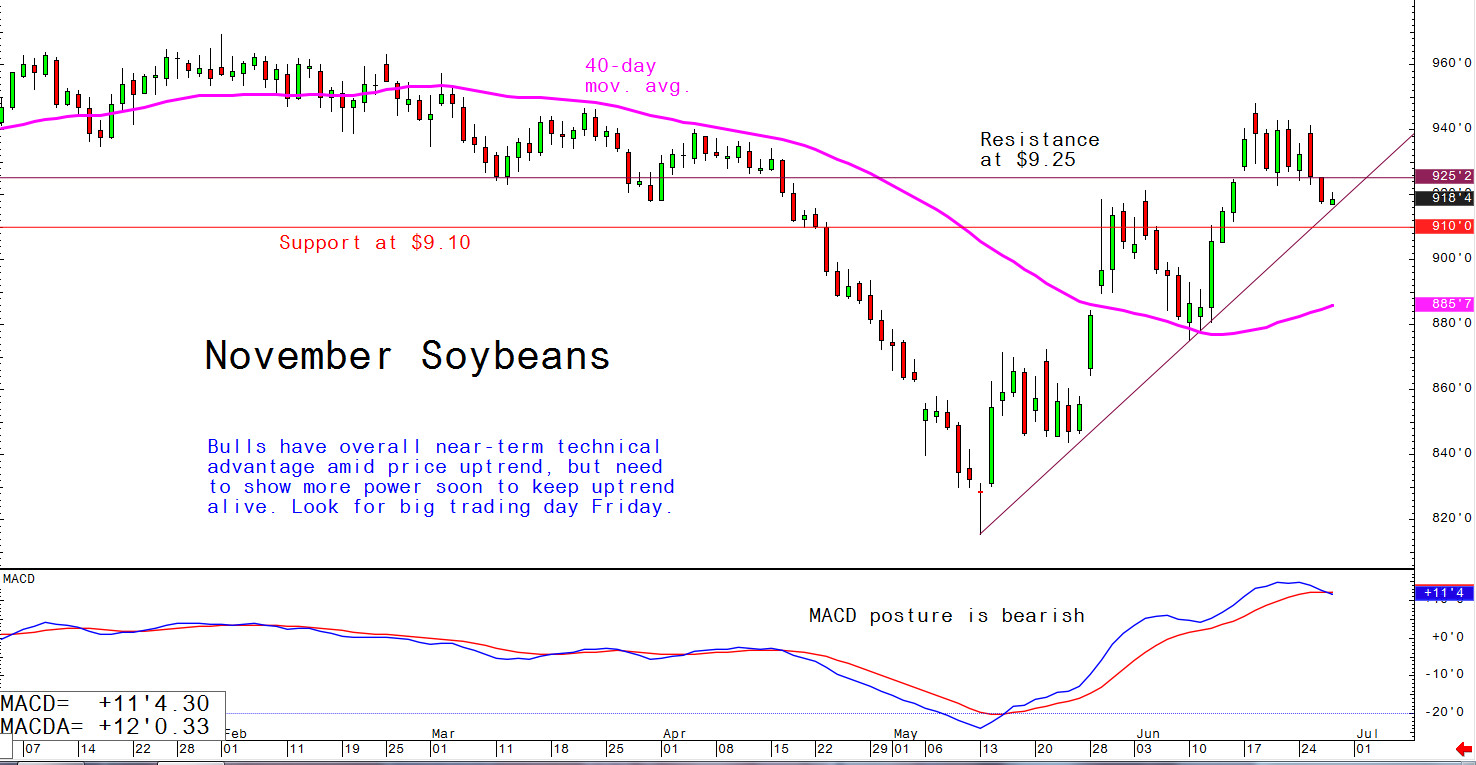

© Jim Wyckoff

© Jim Wyckoff

The grain markets are likely to be squelched Thursday, just ahead of the release Friday morning (28 June) of updated US acreage and quarterly grain stocks reports from the Agriculture Department.

Forecasts for US corn seedings are for around 86.5 million acres compared to 92.792 million acres in the March USDA forecast.

Soybean plantings are forecast at around 84.5 million acres compared to 84.617 million acres in USDA’s March forecast.

All wheat seedings are forecast around 45.5 million acres compared to 45.754 million acres in USDA’s March estimate.

Friday’s acreage report will be one of the most important grain market reports of the year, due to the uncertainty surrounding it.

Traders will closely examine weekly USDA export sales data out Thursday morning (27 June). Recently, worldwide demand for US grains has been less than stellar.

US Corn Belt weather has turned a bit bearish for corn and soybeans now. Some drier conditions later this week will benefit the crops.