Daily US grain report: markets jolted by Trump subsidy plan

US grain futures prices were mixed to weaker in overnight trading, on corrective pullbacks from recent solid gains that pushed corn and wheat markets to three-month highs earlier this week.

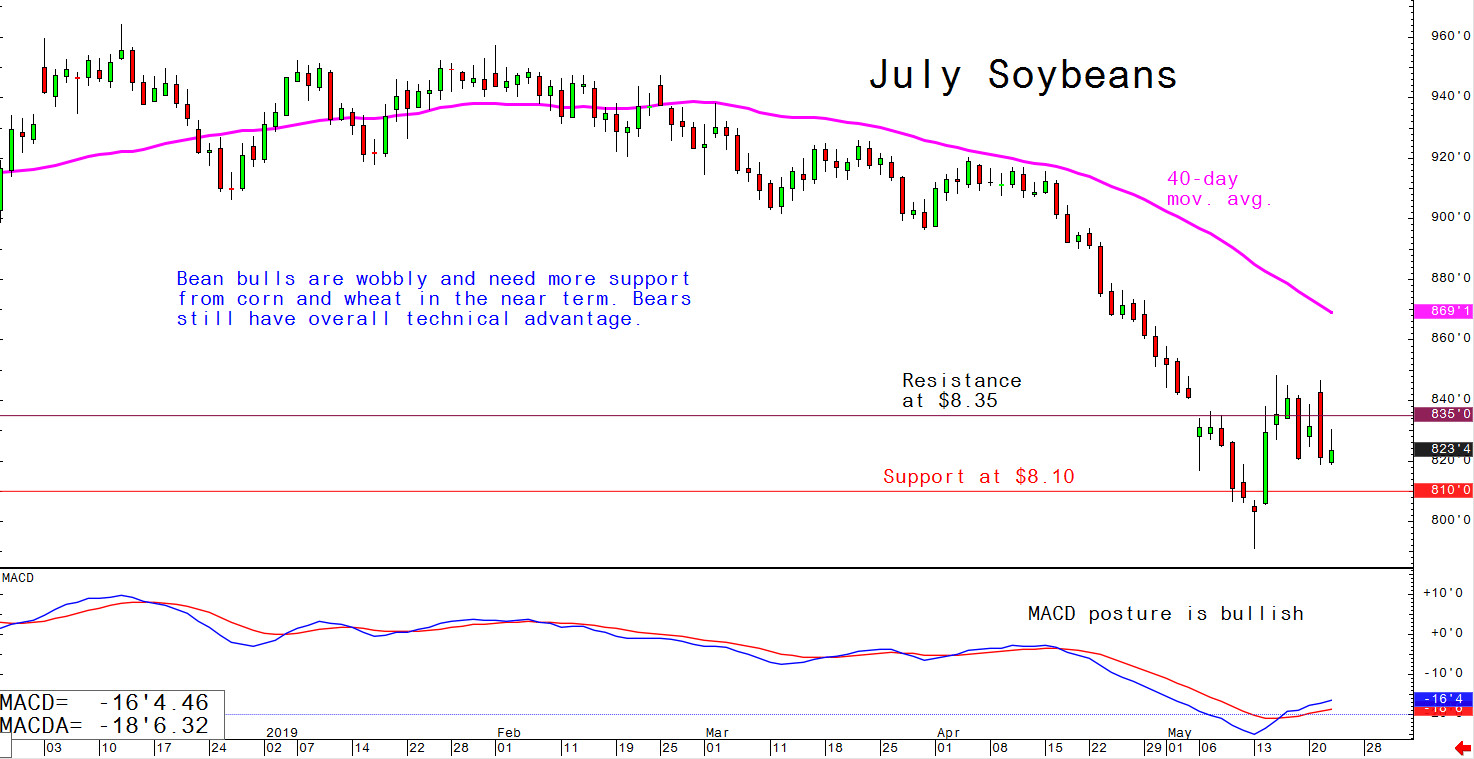

© Jim Wyckoff

The soybean futures market is rattled at mid-week after a Bloomberg news report on 21 May 2019 said the Trump administration is considering, in light of the US-China trade war that has hurt US ag markets, an aid plan for US farmers that includes a $2.00-per-bushel government payment for soybean growers. If realised, this plan would very likely mean US farmers would plant as many soybean acres as they can, even if it’s very late in the planting season. Still, given the soybean market’s only moderate selling pressure in light of what would be a very bearish development if realised, traders are sceptical of the subsidy being fully implemented.

Weather in the US Midwest remains soggy, which continues to limit US corn and soybean seeding progress. Lower production levels for corn and soybeans are now a real possibility this year due to the late planting.

Wheat futures will continue in a follower’s role. If soybeans and corn continue to rally, wheat will, too.