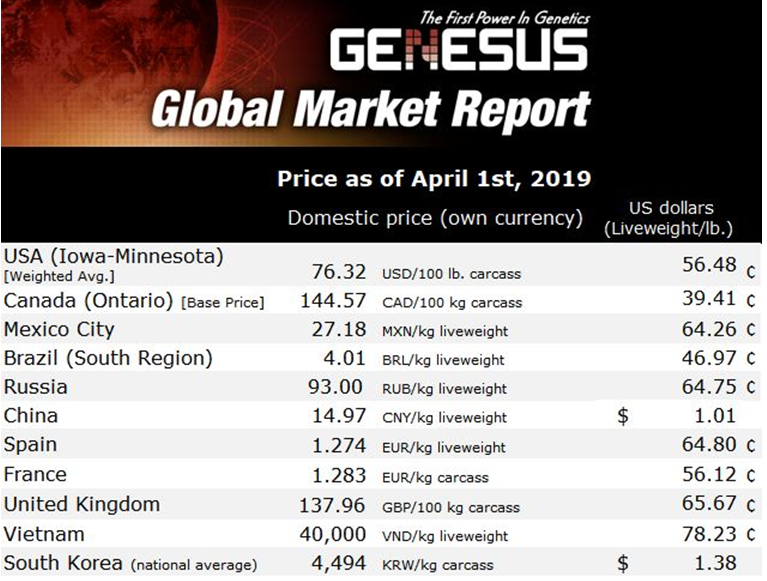

Genesus Global Market Report: Mexico pork market - May 2019

Genesus' Ibero-American business development manager Fernando Ortiz assesses the current and future state of the Mexican pork market.

Overview of Mexico

Mexico is situated in the southern portion of North America and is surrounded to the south and west by the Pacific Ocean and the Gulf of Mexico in the east. Mexico’s diverse landscape of mountains, deserts, and jungles covers over 770,000 square miles and has a population nearing 130 million. Mexico is the fifth largest country in the Americas and is the most populous Spanish-speaking country in the world. Mexico is comprised of 31 states with Mexico City, its most populous city, as the nation’s capital.

Domestic self-sufficiency for Mexico’s pork production is approximately 58 percent. Historically, the lack of infrastructure, animal disease, and reliance on grain imports has hindered increased production. However, the pork sector has seen expansion and vertical integration in recent years with commercial company investment. Domestic production is supported by an increasing demand for animal protein, improved genetics, and increased biosecurity.

In 2017, Mexico remained the second largest consumer market in Latin America behind Brazil. Consumer expenditure per capita totalled $6,248 in 2017, and this expenditure is expected to grow by 1.8 percent in 2018. Consumers are becoming more knowledgeable about the products they buy and are looking for high-quality protein products at a reasonable price. Pork exports to Mexico have continued to rise even as tariffs and trade tensions have challenged the market.

Since mid-2018, most US pork entering Mexico has faced a 20 percent retaliatory duty imposed in response to US tariffs on steel and aluminium imports. This turn of events ended six consecutive years of record export volumes to Mexico, and early 2019 is showing no signs of relief. Pork exports haven't fared as well in 2019, with first quarter volume down 13 percent year-over-year to 177,420 mt, while value declined 29 percent to $261.9 million. While the US is still Mexico’s primary supplier of imported pork, Canada, Chile and the European Union are gradually gaining market share and Mexico’s domestic pork production is also trending higher. The 20 percent duty on pork is really hitting US producers. In 2017, US pork export value reached $1.51 billion (up 12 percent), the second highest on record behind 2014 levels ($1.56 billion). Mexico’s per capita pork consumption has grown by nearly one-third over the last ten years and now sits at just over 39 pounds.

Mexico’s Pork Industry Forecast

Pork Production - in 2019 pork production in Mexico is forecast at 1.36 million MT based on increasing consumer demand stable feed prices, and the modernisation efforts of the Mexican industry. The production estimate for 2018 increased to 1.32 million MT.

Pork Consumption – for 2019 the consumption forecast is increased to 2.4 million MT, as demand for pork is expected to continue because of lower prices and consumer preference.

Pork Trade Import – Pork import for 2019 are forecast at 1.25 million MT. Nonetheless, Mexico exhibits a strong demand for US hams and in 2017 set a volume record for pork and pork variety meat exports for the sixth consecutive year at over 1.7 billion pounds (up 10 percent year-over-year).

Pork Export - in 2019 are expected to increase and are estimated at 205,000 MT. The 2018 value was increased to 195,000 MT based on official trade data. Japan is the main destination for almost 75 percent of Mexico’s pork exports, with Mexico shipping almost 90 MT of fresh, chilled, and frozen pork to Japan between January and November 2018. Mexico also shipped sizeable amounts of pork to the United States (13.8 MT) and South Korea (13.1 MT) and posted notable export increases to China and Chile during the same period.

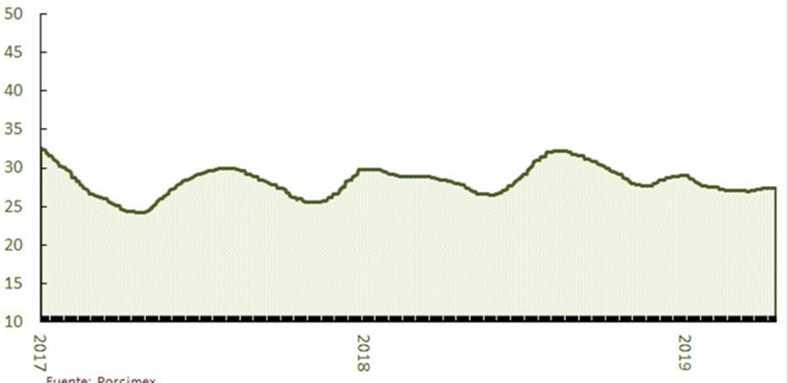

Domestic Price – There has not been significant changes on market hog prices in Mexico over the last quarter, compared with other countries as a repercussion of the ASF pandemonium in China. The price has remained relatively stable, but it is expected that in the coming weeks it will start to increase. The average price for the year so far is of 27.48 MX pesos/kg (65 ₡/lb) liveweight compared with 29.13 MX pesos (2018) (69₡/lb).

Overview of Mexico

Mexico is situated in the southern portion of North America and is surrounded to the south and west by the Pacific Ocean and the Gulf of Mexico in the east. Mexico’s diverse landscape of mountains, deserts, and jungles covers over 770,000 square miles and has a population nearing 130 million. Mexico is the fifth largest country in the Americas and is the most populous Spanish-speaking country in the world. Mexico is comprised of 31 states with Mexico City, its most populous city, as the nation’s capital.

Domestic self-sufficiency for Mexico’s pork production is approximately 58 percent. Historically, the lack of infrastructure, animal disease, and reliance on grain imports has hindered increased production. However, the pork sector has seen expansion and vertical integration in recent years with commercial company investment. Domestic production is supported by an increasing demand for animal protein, improved genetics, and increased biosecurity.

In 2017, Mexico remained the second largest consumer market in Latin America behind Brazil. Consumer expenditure per capita totalled $6,248 in 2017, and this expenditure is expected to grow by 1.8 percent in 2018. Consumers are becoming more knowledgeable about the products they buy and are looking for high-quality protein products at a reasonable price. Pork exports to Mexico have continued to rise even as tariffs and trade tensions have challenged the market.

Since mid-2018, most U.S. pork entering Mexico has faced a 20 percent retaliatory duty imposed in response to U.S. tariffs on steel and aluminium imports. This turn of events ended six consecutive years of record export volumes to Mexico, and early 2019 is showing no signs of relief. Pork exports haven't fared as well in 2019, with first quarter volume down 13 percent year-over-year to 177,420 mt, while value declined 29 percent to $261.9 million. While the US is still Mexico’s primary supplier of imported pork, Canada, Chile and the European Union are gradually gaining market share and Mexico’s domestic pork production is also trending higher. The 20 percent duty on pork is really hitting US producers. In 2017, US pork export value reached $1.51 billion (up 12 percent), the second highest on record behind 2014 levels ($1.56 billion). Mexico’s per capita pork consumption has grown by nearly one-third over the last ten years and now sits at just over 39 pounds.

Mexico’s Pork Industry Forecast

Pork Production - in 2019 pork production in Mexico is forecast at 1.36 million MT based on increasing consumer demand stable feed prices, and the modernisation efforts of the Mexican industry. The production estimate for 2018 increased to 1.32 million MT.

Pork Consumption – for 2019 the consumption forecast is increased to 2.4 million MT, as demand for pork is expected to continue because of lower prices and consumer preference.

Pork Trade Import – Pork import for 2019 are forecast at 1.25 million MT. Nonetheless, Mexico exhibits a strong demand for U.S. hams and in 2017 set a volume record for pork and pork variety meat exports for the sixth consecutive year at over 1.7 billion pounds (up 10 percent year-over-year).

Pork Export - in 2019 are expected to increase and are estimated at 205,000 MT. The 2018 value was increased to 195,000 MT based on official trade data. Japan is the main destination for almost 75 percent of Mexico’s pork exports, with Mexico shipping almost 90 MT of fresh, chilled, and frozen pork to Japan between January and November 2018. Mexico also shipped sizeable amounts of pork to the United States (13.8 MT) and South Korea (13.1 MT) and posted notable export increases to China and Chile during the same period.

Domestic Price – There has not been significant changes on market hog prices in Mexico over the last quarter, compared with other countries as a repercussion of the ASF pandemonium in China. The price has remained relatively stable, but it is expected that in the coming weeks it will start to increase. The average price for the year so far is of 27.48 MX pesos/kg (65 ₡/lb) liveweight compared with 29.13 MX pesos (2018) (69₡/lb).

Trends – The retaliatory tariffs on US pork are making the American pig meat sold across its southern border expensive enough to create new competition. Mexico has started to shop around new importing markets. Also, from Mexican industry people we have hear in some areas about American pork producers looking at moving to Mexico or trying to partnership with Mexican producers since Mexican operations are already world-class pork producers, so expansion is not unthinkable.

As for the new Trade Agreement, Jesús Seade, Mexico’s top North American negotiator, said recently about the steel and aluminium tariffs: “From the Mexican point of view, I can tell you we will never dream of completing the USMCA … if that problem has not been resolved”. The point is If the US pork producers don’t have zero tariff trade with Mexico and they stay at 20 percent, it is a great risk to lose the entire Mexican market over time.