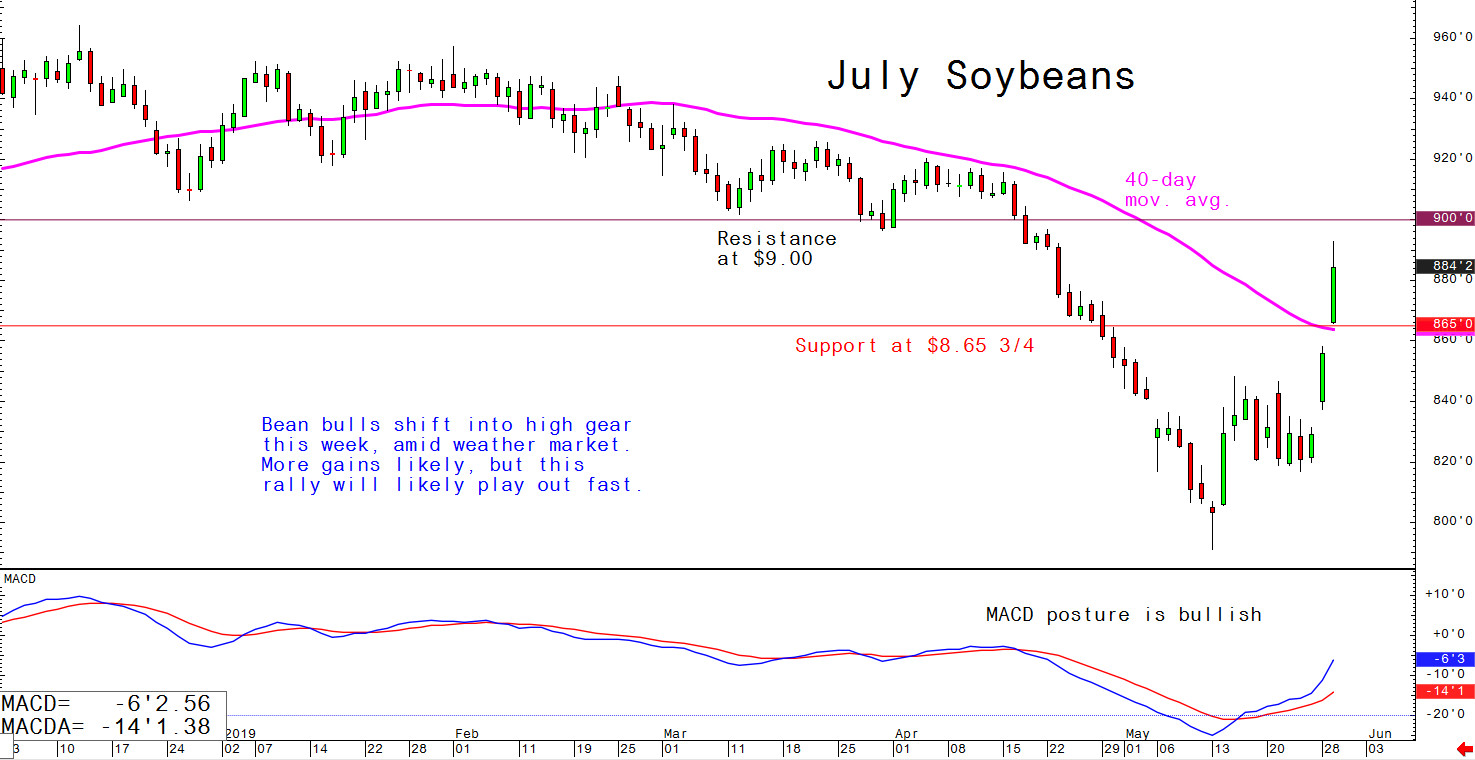

Daily US grain report: grain futures markets on fire, but for how long?

US grain futures prices were sharply higher again in overnight trading, with corn hitting another nearly 12-month high and wheat another three-month high.Soybeans are now on board with the rally and hit a five-week high overnight. Just this week, soybeans have gained over 50 cents, while corn is up nearly 40 cents and wheat is up nearly 30 cents in two days.

It’s a full-blown weather market in the grains, and it’s not even June yet. Very wet US Midwest weather, and more rain in the forecast in the next week, will keep many US farmers out of their fields and continue to keep the seeding of corn at a pace that is the slowest in recent history.

Bulls in solid control. More upside likely, but accompanied by very high volatility. It could be the market tops out this week, at least for the near term. Weather markets many times play out quickly. © Jim Wyckoff

Weekly government crop progress reports out Tuesday (28 May) showed US corn planting at 58 percent, which is below the average trade estimate of 63 planted at this time of year percent. The five-year average is 90 percent planted. US soybeans were reported at 29 percent planted. Traders expected 31 percent planted. The five-year average is 66 percent planted. Spring wheat was 84 percent planted vs the 83 percent estimate and 91 percent average. Winter wheat crop conditions ratings also declined in Tuesday’s reports, further supporting the wheat market.

Importantly for traders to realise is that parabolic price moves in the grains during weather markets tend to put in peaks much sooner than most would reckon. Too, price tops in weather markets usually occur well before the full extent of crop damage ever comes to fruition. Thus, look for price tops in the grain futures to occur sooner rather than later – and probably much sooner, for this weather market scare.

Remember that the rest of the summer could spark other weather market rallies.

Bean bulls shift into high gear this week, amid weather market. More gains likely, but this rally will likely play out fast. © Jim Wyckoff