Genesus Global Market Report Russia - April 2019

Still lots of profit to be made despite rising feed costs

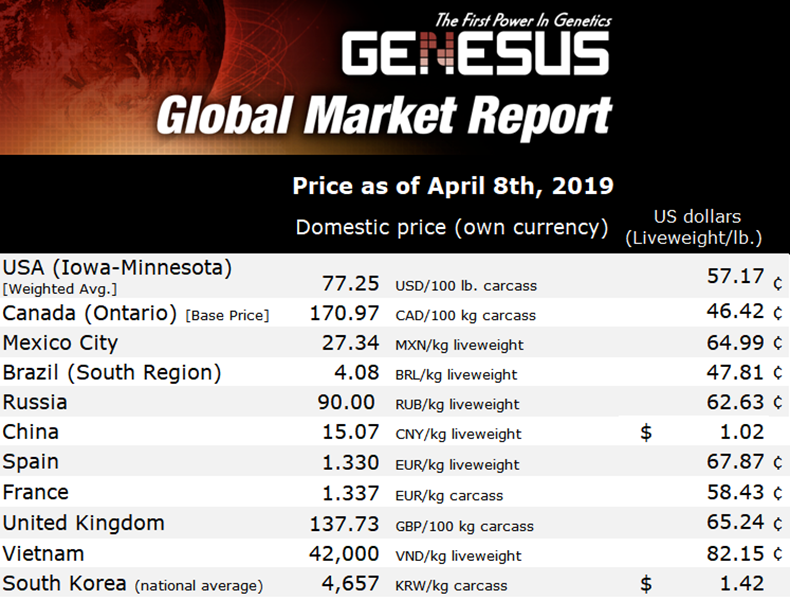

Current pig price is 90 Roubles per live kg ($1.38). This is lower than for some time and with rising feed prices profits are a little lower, but relative to what most of are used to still lots and lots of profit for Russian pig producers.

Major producers point of view is that price will continue to fall over the next few years as production increases. Expectations are that his will be about 5 percent per year. If this is correct then it will give producers time to gradually reduce cost of production.

This week, Russian Prime Minister announced a new policy that aims to get rid of no longer relevant Soviet administration. As someone who has spent a lot of time on Russian farms, I don’t think anyone realises quite how much completely pointless administration is done. I would estimate that between 80 percent and 90 percent has absolutely no value for managing pig production or accounting / controlling where the money is!

I have visited farms with administration cost of $7 to $9 per pig. This is an unbelievable 4 percent to 5 percent of cost. The worst thing of all is that even with all of this administration, there is no basic production or feed use data straight to hand. To look at something simple like feed intake can take 30 minutes of printing out feed delivery reports, then adding up by hand to get feed usage.

One Soviet relic, that requires urgent attention is the archaic grading system that is still used. It categorises pigs on backfat (and weight). Most important points are, Category 1 pigs are under 2cm back fat and under 100 kg liveweight at slaughter. Nobody can afford to produce Category 1 pigs. Cost is too high due to the very low sales weight.

Category 2 is from 2cm to 3cm and category 3 over 3 cm. There is a discount for Category 3 pigs. This varies between 2 Roubles and 8 Roubles per kg! This means a 95kg carcass at 3.1cm of backfat can be worth 760 Roubles ($11.69) less than a 95 kg carcass that is 3cm backfat. If ever there was a system that makes no sense, this is one of them!

Russians are looking closely at the situation in China and how that is affecting global pig price. At a time when global price is on the up, Russian is reducing. For sure the situation in China will mean little or no pigmeat being imported into Russia, which will have some effect on price.

There seems to be an assumption that it is the situation with ASF that stop Russia exporting. Europe has ASF, but ‘regionalisation by country’ allows export from ASF free areas. Looking at the size of Russia relative to Europe, it seems regionalising a very simple thing to do.

Classical Swine Fever Vaccine that is required by law for all pigs today. Many countries, including China will not accept meat from vaccinated pigs!

I have been asked on several occasions what the solution to this one is. If this is the issue then there really is only one solution. Change the law and stop vaccinating. One thing ASF has done in Russia is increased the level of Bio-security on farms, so risk today of any outbreak is very small indeed. If there did happen to be a local outbreak of CSF then pigs in the very local region can be mass vaccinated.

This week I travelled in Western Siberia. On a four and a half hour drive from a major city to a smaller regional town we passed field, after field, after field, after field, after field, after field of agricultural land. There is so much space to pig farms it is unbelievable. Also, small villages where I have absolutely no idea what people do to earn money, other than to grow their own food just to survive!

Russia is a country that for sure has the potential to produce a lot more food to feed the growing world population. Meat has to be produced somewhere. Despite seeing in the news, Europe has had record exports recently, this will be short lived. Due to new animal welfare and environmental law, Europe continues to lose sows. The latest country to adopt high welfare rules is Germany. Already sow herd has reduced by 10 percent with another 10 percent of farmers currently going out of production.

Every country that has ever put in place high welfare rules has lost 50 percent of its pig production. The reason is higher welfare standards increase cost of production. The majority of consumers do-not care and can-not afford to pay for these higher standards. Result, bankrupt farmers. Today the EU exports about 10 percent of its production. Today the EU has about 12 million sows. Germany was at around 2 million sows. Simple maths. 1 million less sows in Germany is about 10 percent less pigs in Europe. 10 percent less production will mean no meat to export. Of-course becoming a net importer will mean higher prices for the remaining European farmers….

More meat will have to be produced somewhere in the world. Seems to me Russia is a very obvious place. From what I have seen Russia can be a low-cost global producer. A change of focus to managing cost is all that is required. Half of Russia is also in Asia, the region of the world where demand for pork is increasing at the fastest rate.

In-stead of building expensive European style farms, Russia can build American style, which can be 15 percent to 20 percent lower cost. The climate in Russia is similar to Canada and Northern USA.

Reduce the administrative burden and there is another $5 to $8 cost saving.

Regionalise the country for health control, and update vaccination rules.

Become labour efficient. Looking at the number of people on Russian farms, and farm offices, the sow herd could double without hiring a single person!

A modern grading system that takes into account the meat quality required for the Asian market. Darker pork with high marbling!