Genesus Global Market Report China - March 2019

During a recent visit of customers and clients in China we offer the following observations:

Sow numbers

Everywhere we go we are hearing of producers who have made the decision to depopulate certain facilities as they deal with the ASF issue. The question is how many sows have been taken out of production and shipped to the market? We are being told sow numbers are down an estimated 20% across the country since the start of these measures to battle the disease.

Biosecurity

We have noticed heightened biosecurity measures are being adopted by producers, feed manufacturers, and others throughout the pork industry today in China. It seems everyone is taking biosecurity procedures very seriously these days as a result of the spread of ASF and the affect the disease has had upon the Industry and markets.

Recently we visited the offices of an established Feed manufacturer and encountered first hand a number of newly adopted Bio-security measures required of all visitors to enter the premises. All producers and companies we visited reported being very busy tightening up and adopting new bio-security measures as well.

It seems biosecurity is the main focus and the priority at the moment over everything else in China. One producer told us of establishing a very elaborate biosecurity system with established zones throughout their facilities with washing, disinfecting and heating stations at all transfer points for pigs and people. We applaud these Industry leaders and the measures they are undertaking to protect not only their own businesses, but the greater Pork Industry within China.

Recently we visited the offices of an established Feed manufacturer and encountered first hand a number of newly adopted Bio-security measures required of all visitors to enter the premises. All producers and companies we visited reported being very busy tightening up and adopting new bio-security measures as well.

It seems Bio-security is the main focus and the priority at the moment over everything else in China. One producer told us of establishing a very elaborate biosecurity system with established zones throughout their facilities with washing, disinfecting and heating stations at all transfer points for pigs and people. We applaud these Industry leaders and the measures they are undertaking to protect not only their own businesses, but the greater Pork Industry within China.

Stock prices

It seems stock prices of China’s leading Pork Producing companies are soaring as ASF continues to disrupt the pork business. Bloomberg just announced that Muyuan Foodstuff Company is now the best performing stock on the MSCI Asia Pacific Index this year. Stock prices of many of these companies have been climbing by the 10 percent daily limit lately and closing at record highs.

Expectations of higher pork prices due to the reduction of herds in affected areas and lower supply are driving the surge. The government is pledging its support to companies like Muyuan who are planning to invest in new slaughtering facilities. These new government policies are aimed at reducing the negative impact of restrictions upon transportation of live animals. Again we applaud Beijing and the support of the government upon this important Industry.

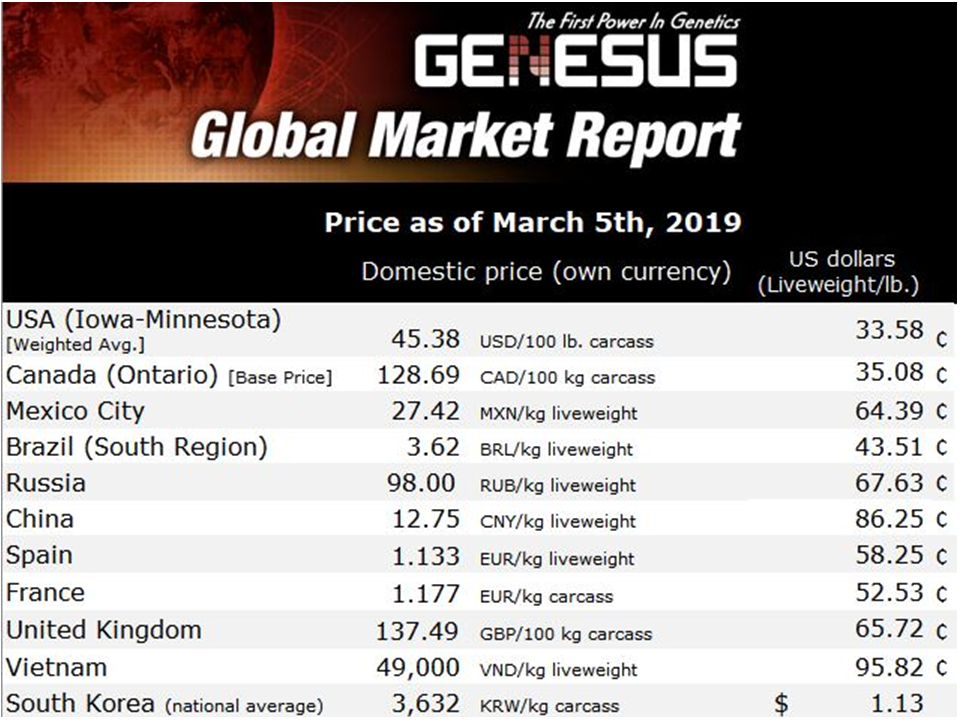

Current pig prices in China

No doubt the effect of ASF and the resulting increased numbers of animals going to slaughter has many slaughterhouses running at full capacity. Thus, as result we see lower prices in virtually every market region since the first of the year. For example, the market price in Shanghai is now $0.88/lb., down from $1.01/lb. Pig prices in Fujian Province are $1.08/lb., down from $1.32/lb., just 60 days ago.

It appears the variation of pig prices within regional markets is now beginning to stabilise as we don’t see the huge swings in price we once did. For example, we noted pig prices back in January in Sichuan Province varying from $1.15/lb., to $1.48/lb. Today prices range from $0.93/lb., to $0.96/lb. We now see similar reductions in the range of pig prices in the other major regions of China as well.

Market outlook

No doubt much higher pig prices (perhaps even all-time highs) are on the horizon for producers in China as result of these conditions. We wish our friends, colleagues and clients all the best as they deal with these issues